An interlude providing some data on China.

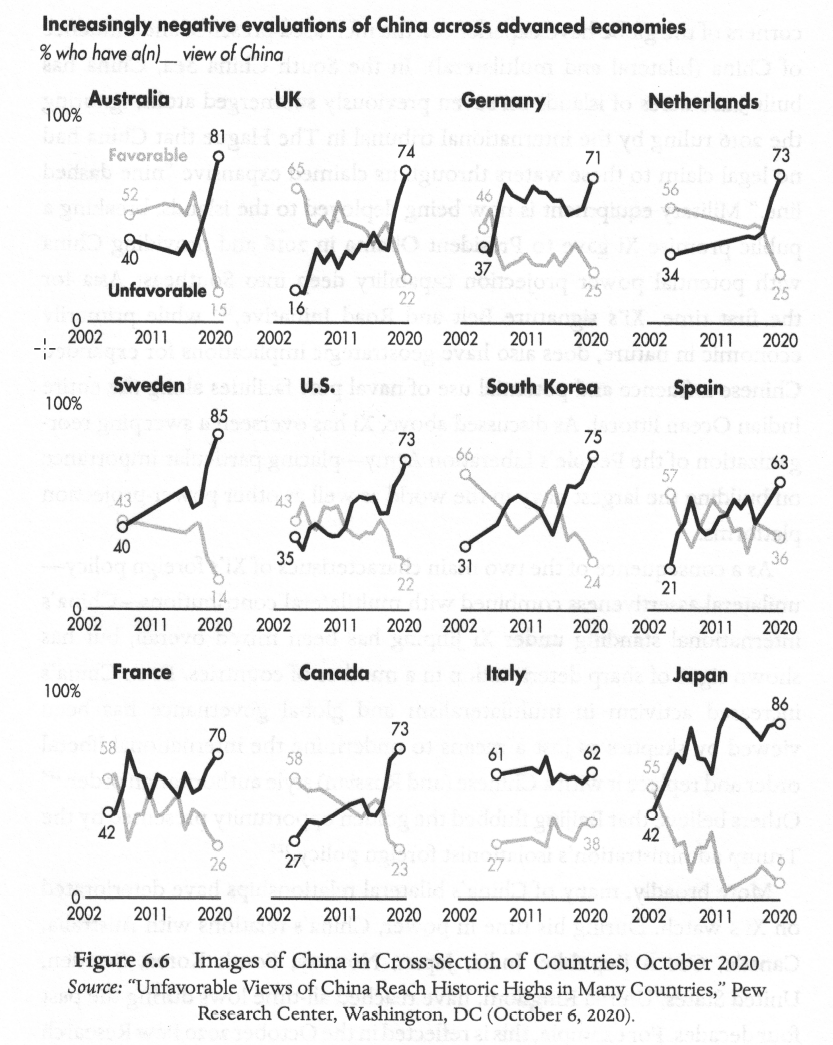

First, an extremely illuminating, and rather unexpected to me, sample of public polling across a dozen countries (“advanced economies”) showing the change in “unfavorable views of China” across the last 20 years. This image appears in Shambaugh’s book at p. 312 and is credited to the Pew Research Center (Washington, DC) as of October 6, 2020:

Provides a consistent pattern, eh what? Of particular interest to me–I wonder if you read the charts the same way–was that the growing negativity towards China predated Covid-19, and to my eye (OK, the data series may have ended too “early” to draw any definitive conclusions here) there is no change in the trend lines coincident with the arrival of that dratted pox. If this holds true as the data series continues into our futures, it would be a relief to see and a win for rationality.

Second, a few somewhat arbitrarily selected excerpts from Chapter 1 of Shambaugh, “On China’s Leaders and Leadership.” This comes from a section called “The Influences of Chinese Political Culture,” which correctly points out that while the CCP leaders are “communist (Marxist-Leninist) in their orientation,” “they are also Chinese leaders and are thus deeply shaped by historical and culture traditions of politics and rule” (emphasis original).

I leave it to you, dear Reader (as is our custom here) to draw your own conclusions, but here is a summarized, lightly edited/paraphrased, and shortened list of “a number of the most salient residual elements and built-in assumptions from Chinese historical political culture that have continued to influence post-1949 CCP leaders,” in Shambaugh’s view (pp. 12-13):

Leaders should inherently be benevolent, and set a moral example.

But coercion against usurpers is justified to maintain the sanctity of the regime.

The physical core of China is ethnically Han; other groups on the periphery or farther away are “outsiders” or “barbarians.”

Other powers are predatory and seek to take advantage of China; they are not to be trusted.

China is a great global power with over 3,000 years of history; restoring China’s global status as a respected great power is the primary mission of all Chinese leaders.

To the greatest extent possible, China must remain autonomous and self-reliant; (inter)depending on others is a recipe for manipulation.

Disorder is to be avoided at all costs and a premium is to be placed on stability.

Maintenance of “face” and avoiding embarrassment is essential not only within Chinese society but with foreigners; the appearance of confidence and grandeur are paramount.

The Chinese people are a “loose sheet of sand” who need to be led by the tutelage of enlightened elites.

This brings us to Xi Jinping.

Xi Jinping has put his stamp on the nation and the world as has no Chinese leader since Mao; his reign is “neo-totalitarian” and, using the full power of technology, rests on an unprecedented surveillance state. “He is fixated on power–his own and his country’s.” (p. 336). The process began with a sweeping purge of potential enemies, to the point (today) that the “sycophancy surrounding Xi has not been seen since the Mao era.” Xi is “an emperor-like figure” but he remains “divisive” within China particularly among many urbanites, intellectuals, and Party members resenting the state’s strict controls and “draconian repression.”

Nevertheless, he has “certainly been a transformational leader,” exerting an “extraordinary impact,” exuding personal confidence and an air of entitlement and destiny and, barring a sudden coup, is likely to remain in power for some time. Despite “ample precedent in Chinese politics” for a sudden purge from power, “autocrats the world over have demonstrated a stubborn tenacity for sustained rule through repression and populism.”

Thus must we leave this survey of nearly 75 years of Chinese CCP rule an unfinished story. As Shambaugh concludes (p. 339): “Time will tell with Xi Jinping.”

Two additional thoughts bearing no connection whatsoever to the book:

(1) Without fear of contradiction, we can assert that Xi Jinping is now “emperor” for life, or for as long as he cares to wear the mantle. Historically, this has been thoroughly the norm for leaders, but since about 1945, if not 1918, it has been the exception for leaders of globally consequential nations. We shall see whether the old model or the new is superior, or certainly how they interoperate simultaneously.

(2) The question at the forefront for financial markets, for some time now, has been whether China is “investable.” On the one hand, it’s the second largest economy in the world (by GDP) and unquestionably brings new meaning to the word “vibrant.” On the other hand, the CCP remains unquestioned arbiter of all that goes on in the nation, in terms of development, investment, trade, R&D, infrastructure, and you-name-it. If the plug could be pulled on (say) Evergrand in a heartbeat, what sane investor would risk their capital on opaque caprice?

Goldman Sachs published a monograph on this very topic just a few weeks ago. For those (including yours truly) interested in delving further into such topics, here’s the executive summary of the 36 page report:

As the Chinese government continues to carry out unprecedented regulatory tightening, what the new regulatory environment means for China’s growth, investment outlook and beyond is Top of Mind. We get perspectives from Primavera Capital’s Fred Hu, Oxford University’s George Magnus, Tsinghua University’s David Li and CSIS’s Jude Blanchette, and our own economists and strategists. Hu, Li and our analysts view these shifts as largely consistent with the goal of achieving sustainable and socially responsible growth, suggesting limited damage to China’s longer-term growth and investment prospects, despite the likelihood of continued market volatility and a growth drag over the shorter term. But Magnus and Blanchette see strong political motivations at work, especially in the run-up to next year’s important 20th Party Congress, and are more concerned about the longer-term growth and investing implications. That said, we find little evidence of spillover effects beyond China from these shifts so far, with EM assets remaining resilient, and expect this to largely continue.

It strikes me that the risks to heavyweight investors in China (blessedly not a problem I have to solve first-hand) is that the unknowns do not fall within any manageable or calculable boundaries. Let me explain: If you believe, as every sane or at least mainstream investor does these days, that the Fed is in the process of “tapering” and that sooner or later it will begin to raise rates, the unknowns are (a) when; (b) how much; and (c) how fast. There is zero risk that the Fed will announce that it’s abandoning all support for the US economy (say) or raising rates to 21.5% effective immediately. But the risks to investors in China are virtually boundless because the government can do whatever it wants whenever it wants. (See, e.g., the Didi IPO imbroglio.)

Caveat emptor, big time.

Separately, I will leave you with what I heard in the form of a very different view of what’s going on in HK which presents a vivid contrast of what we consume through the MSM. This from a long-time Anglo correspondent/friend who’s a partner at Name Brand Firm:

I have been grounded in HK since March 2020 at my duty station. I have just returned to the West Coast to attend a [meeting] and to see my wife and children. I will be flying back to HK [soon]. With great regret, I must report that the coverage by NYT and WSJ of HK has bordered on the irresponsible. Both have had headlines of “death knell of HK”. HK remains a global financial center with historic amounts of capital and investment pouring in and the global banks doubling their employment in HK. I wonder if these reporters will feel any embarrassment in 3 years when HK is an even stronger financial center than it is today. Forgive me, but these “news” articles have been the bane of businesses in HK, all of which are forging ahead at full speed, including the law firms.

This observation confirms my view of the MSM dating back to about my college or even high school days. To wit: “Everything you read in the WSJ, the NYT (etc.*) is the gospel truth with the rare exception of matters you know deeply and personally, which are flagrantly mischaracterized to the point of unrecognizability.”

This presents a nearly irreconcilable dilemma when reading the MSM, of course. As with investment portfolios, my imperfect but tolerable workaround is “diversification” [of sources]. The result remains innately dissatisfying.

______

* Additional media which could be listed according to taste would include the FT, the Economist, PBS, the BBC, Bloomberg, the Washington Post, CNN, and any other MainStream outlet whose reputation was not built first-foremost-and-always on being head-snappingly partisan about everything all the time and extremely so.