These sibling companies are almost indelibly robed in our memories with Big, Multinational, Important, Central to the Economy.

A bit of perspective.

Forty years ago (January 1981—think Reagan/Thacher, the introduction of the original IBM PC, and the recent death of double-digit inflation at the merciless and brilliant hands of Paul Volcker), the S&P 500 was 29% made up of energy by market cap. In 2008 (the GFC), it was still 17% and oil was at $140/barrel. Today the smallest sector in the S&P @ 2.3% is: Energy.

The decline in energy can be seen by comparing the market cap of the seven largest oil companies to the market caps of Apple, Microsoft, or Amazon. Each of the three technology companies is now valued at more than $1 trillion; Apple is valued at more than $2 trillion. In contrast, the combined value of BP, Chevron, ENI, Equinor, ExxonMobil, Shell, and Total, the last of the “supermajors” formed at the turn of the century, is less than $700 billion.

—Philip Verleger, “I am a climate optimist,” Niskanen Center/September 2020.

And with Salesforce taking the place in the Dow of–you know what’s coming–Exxon itself just last month (after 92 years of Exxon being a DJIA component), the only traditional energy player left among the 30 stocks is Chevron.

Now, this is not a column about investment strategies, but can The Majors save themselves by pivoting to solar, wind, etc.?

They seem to be trying:

The European supermajors are trying to save themselves by abandoning oil. BP, Shell, and Total have all announced plans to expand their activities in renewable energy while cutting expenditures on oil. BP has gone further than Shell and Total, which both still see a role for natural gas. Investors have not been fooled.

BP is leading the way here. The company has announced a tenfold increase in its investment in low-carbon energy sources, reaching $5 billion per year by 2030, according to Reuters. The company also intends to achieve a twentyfold boost in renewable generating capacity.

–(Ibid.)

The day after this announcement, BP’s stock slid sharply, hitting a 25-year low. Then of course came word last week that California (11% of new car registrations in the US) was announcing a ban on the sale of new gasoline-powered cars and light trucks effective in just 15 years. The market (again) has internalized this knowledge:

Market cap Tesla: $361.7B

Market cap Exxon: $145.1B

Ratio: 2.49:1

What could have seemed a safer bet as a core practice area than oil and gas? Remember firms piling into Texas and Alberta? And it has long been a truism so unremarkable as to make one suspect one who voices it of being a simpleton that economic growth and energy demand are linked.

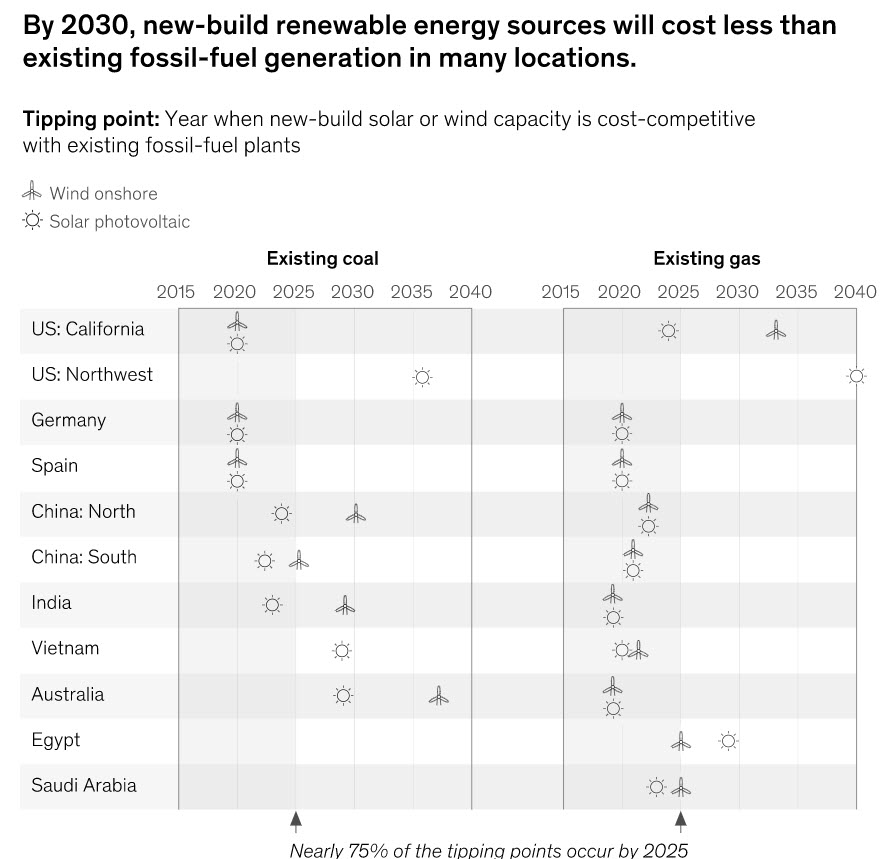

But per McKinsey, “past is not always prologue.” They foresee a decoupling driven by:

- A drastic decline in energy “intensity” of GDP as the global economy moves away from industrial to service functions.

- Growing energy efficiency, thanks to technology and changes in human behavior.

- A growing share of energy in the form of electrification, once a bogeyman but now the darling of efficiency fans.

- And of course the shift from fossil to renewable power.

Enough said.

Astute readers will recognize that this article is less about the dimensions of specific changes that may be afoot on the macro front and more about our theme from Day One of Adam Smith, Esq.: “Think” Or, as the Italians might put it, stai attento!

The world is full of highly qualified experts who get paid to prognosticate for a living, and you know where to find them. Take what you’ve read here as an invitation, or better yet an entreaty, to keep your eyes and ears open and your brain in critical-thinking mode. “Past is not prologue,” indeed.

Bruce: Just over a year ago, ASE ran a fascinating string of posts distinguishing “Maroons” from “Grays” in Lawland. Now we are considering what “Build Back Better” may mean. I wonder if building back better means the same thing to Grays as to Maroons (I doubt it), and whether thinking about where one’s firm lies in that conceptual space might be instructive in today’s circumstances. Perhaps we are entering a time in which the Splendid Grays will look especially strong?