Last week I spent three full days in Bogota, meeting with firms and colleagues, giving a talk at the always-wonderful “Gun Club,” and generally trying to soak up as much market intelligence as I could.

Although I’ve been to Bogota several times–our Director for Latin America, Antonio Leal Holguin, is based there–it had been well over six months and even in that period of time the tenor of the prevalent form of conversation had migrated pronouncedly. In the foreground of most discussions new attention was given to lateral partner hiring and competition for (desirable) lateral partners. Naturally, some firms felt somewhat under siege while others felt they had won away key talent from competitors. Why this new focus of attention?

The remainder of this column is by me (Bruce) and Antonio.

First, I should say that many other topics also came up spontaneously: Growth (a perennial), compensation, succession planning, the pro’s and con’s of networks, foreign “best friends,” and outright acquisition by other firms with an international footprint, etc. These are almost never in perfect economic (or psychic) equilibrium, so I was not surprised by questions surrounding them: But it struck me that lateral partner movements were at least perceived to be a new source of anxiety and uncertainty.

Can one offer any intelligent generalizations on this topic?

We start from “we’ve seen this before.” Specifically, we’ve seen it in other markets traditionally populated by “Local Hero” law firms with deep roots in the community, the metropolitan area, or the region. These are highly respected firms that, in the vast majority of cases, have survived the transition from the first generation of founding leaders to the second generation of builder/managers, and perhaps beyond. They have demonstrated their worth in providing value-for-money, cost-effective and client-pleasing legal services. To all appearances, they are solidly positioned organizations with comfortable runways ahead of them.

And then. If the local market is economically dynamic and vibrant (Bogota surely is!), other firms “discover” it. This happened decades earlier in Sao Paulo, appears to be achieving lift-off in Santiago, and is a repeated pattern across North America in regions or metro areas as varied as western Canada, the US Pacific Northwest, Silicon Valley, Texas, San Diego, Phoenix, and the list goes on and on.

Can one offer useful generalizations about how this tends to work out?

Yes; and the Local Hero firms may not welcome what we’re about to report.

In our experience and as masterfully detailed by the always incisive Nicholas Bruch (of ALM Intelligence) last year in “Barbarians at the Gate: The Invasion of Regional Legal Markets and How Mid-Sized Firms Should Respond,” data from nearly the past two decades of NLJ 250 reports:

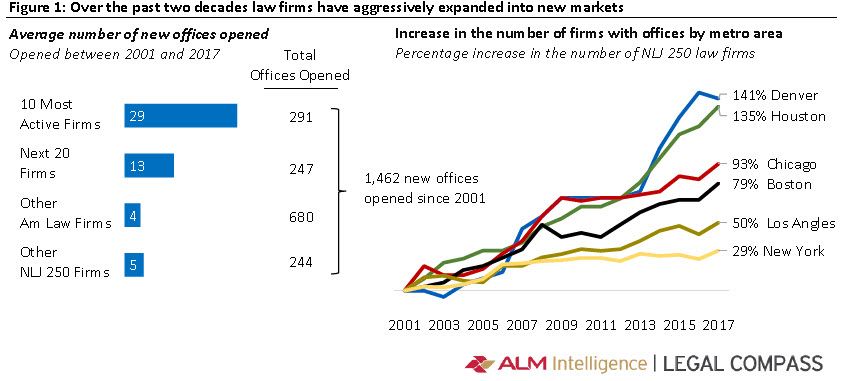

- Those 250 firms (the 250 largest US-headquartered law firms by lawyer headcount) “have nearly doubled their geographic coverage,” adding nearly 1,400 new offices.

- Of course, “this has created a group of law firms with vast scale and geographic reach,” but even more interesting for current purposes

- “Many regional legal markets have been transformed over the past decade. They have transitioned from localized markets, dominated by legacy firms, to highly competitive marketplaces, fully integrated into the global legal services market.”

At the most general level, this should surprise no reader of Adam Smith, Esq. What may come as news is how much of this growth and change in composition of the law firm landscape has come at the hands of a distinct minority of firms: A mere 11% of the 250 firms account for 50% of all the new NLJ 250 offices launched since 2001. (Bet you didn’t know that!)

Here are a couple of nicely informative and highly legible charts summarizing some of the highlights:

You can see both how a tiny proportion of firms has accounted for the bulk of the new office openings and how some domestic-US markets seem to be more attractive than others.

[Sidebar for the US-curious: Why are Denver and Houston such magnets and New York evidently the least attractive? My surmise is that Houston and Denver were, compared to the rest of the country, relatively virgin law firm territory in 2001 or even, judging by the inflection points/slopes of the lines for those two markets, even immediately post-Great Meltdown in 2009. Supporting this: Most of the action is in the past 8 years, not the first 8. As for New York’s evident “repellent quotient?” The most competitive, saturated, expensive market of the six by far. Also, New York partners tend to be “stickier,” certainly at the high end of the market: Tougher to dislodge and more costly if you can do it. Finally, there’s the off-putting “40% Manhattan Tax”–the rough but ready rule of thumb that anything {rent, transit, housing, salaries, a ham sandwich} costs 40% more in New York than most places.]

But this is a “letter from Bogota,” so what might the experience of other markets augur for that market now that the world has well and truly discovered it?