The low end is, conceptually if not emotionally, easier to deal with. My favorite remark of all time about lockstep was Tony Angel’s when he was running Linklaters: “There is no such thing as a tolerant lockstep.” In a rather profound sense, that’s all you need to know about this end of the curve.

Now, in real life it’s not remotely that simple. Dick has been a stalwart comrade, Ellen’s had a ghastly series of tragedies in her personal life, Mike is just struggling through a downturn in an intrinsically cyclical practice, etc.; the litany will be endless. Yet at some point we all know who’s going to stage a comeback and who’s lost the capacity or the will to do so. Leadership knows it, colleagues know it, associates and staff know it. (And you think clients don’t? Really?) Some of our most emotionally charged engagements have addressed situations like this.

But when I titled this column, “The Death of Lockstep?,” I was obviously referring to the high end of the performance curve. This is where lockstep meets its acid test.

And I submit it is here at the high end that lockstep is on the wrong side of history.

Since Steven Brill launched his “AmLaw 50” over thirty years ago with its notorious revelation of PPP, the trajectory of BigLaw has been towards more and not less transparency. You can celebrate or mourn this vector–or you can perform what is for today’s purposes a somewhat beside-the-point holding action questioning the veracity of the AmLaw numbers (as we have and will continue to do until they clarify their methodology)–but this is the way we are moving in the 21st Century.

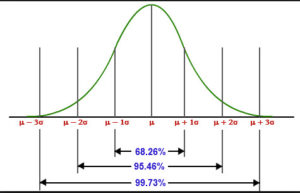

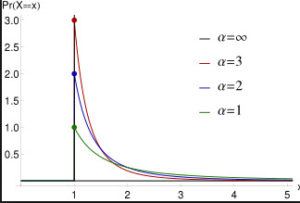

Which brings us to labor market economics. In labor markets where talent is a key differentiator (celebrity entertainers, sports stars, best-selling authors, software coders, hedge fund managers, and yes, law firm partners at the tippy top of the most elite ranks), compensation tends to migrates towards an equilibrium distribution resembling a classic power curve. To oversimplify, assume that the top 20% make what the next 80% make, and the top 20% of the top 20% make what the bottom 80% of the top 20% make, and so on. This is of course a simplifying approximation but the key point is that labor markets for talent depart wildly from our familiar bell curve “normal” distribution at the high end of the ladder.

If you’re looking for a geometric analogy, the distribution is “fractal;” at whatever degree of resolution you analyze it, the pattern is the same. Nautilus shells, fern leaves, and even Jackson Pollock paintings are fractal patterns.

Back to BigLaw:

We have crossed an irreversible threshold from institutionalized clients loyal to a law firm for decades, as partners and general counsel come and go, to a more transactional world where law firms are only as good as their last deal, and Fortune 500 firms increasingly look for marquee lawyers (yes, backed up by prestigious firms with impeccable boardroom credentials) more than they hew to traditional relationships, Marquee names matter in ways they didn’t ten or twenty years ago.

This describes a labor market for talent, where the power curve compensation distribution trumps the normal/bell curve distribution of talent. Lockstep has met the 21st Century, and it’s becoming clear who the winner is.

Can firms overshoot the market, overpay stars, and come to rue the day? We’ve already seen it happen. And can firms proudly refuse to participate in this marketplace reality and, shoulders squared and heads up, march into the future without change? Yes, and a fortunate handful will shoulder on in that posture, blessed by history, culture, and strong spines.

All the Magic Circle firms (I put Slaughters in a different category) have “broken” their locksteps at the high end, and the New York white shoe elite has also done more than a bit of nipping and tucking, especially when it comes to accountability at the low end. And note what’s not happening: An equivalent number of firms is not moving in the other direction. If you wonder what the future holds on this score, I don’t know that you need to look too much further than this. There may never be zero lockstep firms, but there will be fewer five years hence than five years ago, and so on and so on.

Lockstep for the rest of us mere mortals? As I implied earlier, you can mourn increased transparency and its inevitable corollary of our labor market for talent moving towards stars and superstars and almost everyone else, or you can celebrate it, but you cannot lead your firm as if it isn’t happening.

Jamess C., Fresno, CA, wroe to me as follows, and kindly gave me permission to share his thoughts (reproduced verbatim below) with all readers:

Additional thoughts from our loyal readers?

It is harder than it might seem to come to terms with what loyalty ought to mean. It seems to me best to think of it in terms of “faithfulness,” much as is meant in “Semper fidelis”. To inspire something approaching that level of commitment, it seems clear that the basis of connection cannot be simply transactional, but rather implies the existence of a common meaning at some fundamental level between the people who are involved – a meaning that is fundamental to each party, and therefore binding.

The underlying meaning that binds loyalty does not have to be between equals – the ancient concept of a good and faithful steward would be a sample of loyalty that might apply in asymmetrical circumstances, or even between a person and an institution.

The operational test for loyalty is whether a failure between the parties has the bitter taste of betrayal.