I call it the Hollow Middle, but Knowledge@Wharton prefers “Disappearing Middle.” Here’s what, writing in their pages, the CEO of the Cambridge Group, identified as “a growth strategy consulting firm that is part of Nielsen,” has to say about it:

The Great Recession forced consumers to drastically rethink their purchase behaviors and, even though many have regained their financial footing in the five years since the downturn officially ended, those buying patterns have remained. As a result, more and more products are moving toward the “value” or “premium” ends of the spectrum, leaving a middle market that is struggling to remain relevant.

Not too many analyses have been written of the hollow or disappearing middle in Law Land (I suspect I may have authored many of them), so it’s edifying to look to other industries and see how the structural dynamics play out there. For myself, I find the following analysis essentially congruent with how Law Land is experiencing it (with appropriate nomenclature substitutes, of course). I invite any readers who may disagree to do so enthusiastically, either in a private email or through the comments. But let’s read on.

Our author starts by noting the increase in both “premium” and “value” products—reflecting what I’ve called elsewhere the “flight to quality” and simultaneously the “flight to economical” (all emphasis mine in what follows):

This month marks the five-year anniversary of the end of the Great Recession, but the 18-month economic downturn that began in December 2007 has had a more permanent impact on consumer purchase behavior than companies expected. That fundamental change in consumer behavior — coupled with a “hollowing out” of the market as more value and premium products become available — has resulted in the greatest challenge to the established market order in the last several decades. […]

The dramatic change in circumstances caused by the Great Recession has forced consumers to reconsider their choices in category after category. For many, the new choice stuck.

Consumers (read: clients) tasted the fruit of lower-priced products and in many cases were pleasantly surprised by the performance of the purchase. Lawyers tend to have a difficult time understanding that clients’ preferences could rationally be for “good enough,” in many situations, so let’s stick with consumer behavior for now, which exhibits precisely that type of rational selection.

This nicely explains why something that is, strictly speaking, “inferior” can still represent a compelling alternative:

While mainstream products may perform better than value products, the difference in performance created by a particular benefit (say, the freshness of beer, or convenience in banking) is not creating sufficient differentiated value to support the cost differential. Instead, it is adding material amounts of cost. What results is a preference, among many consumers, for the value offering – not necessarily because it is better and not only because it is less expensive, but because its price is more in line with its benefits than is the case with the mainstream product. This can be true even if the mainstream product improves its absolute performance advantage.

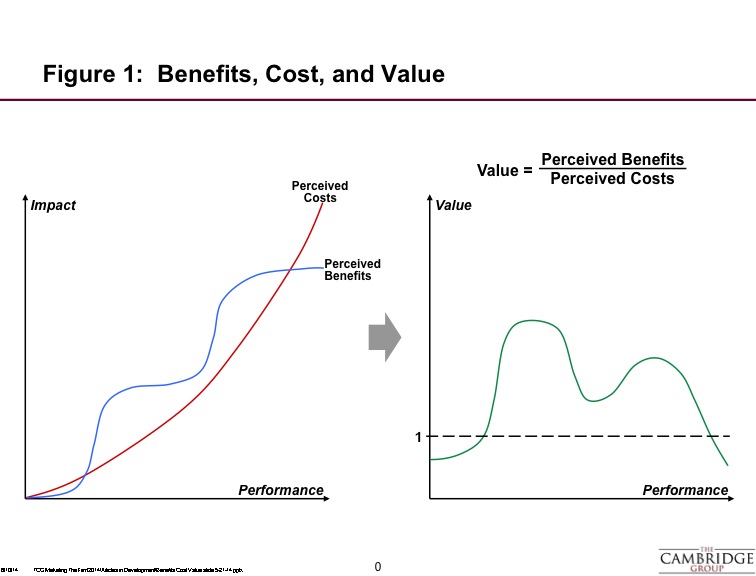

Here’s how the author visualizes it. The left-hand chart illustrates a fairly traditional cost/benefit tradeoff curve, where the two tend to march together more or less linearly: The more something costs, the greater its benefits in terms of impact. Quite familiar, and comforting to all of us aspiring to charge $1,000/hour.

The right hand chart, however, represents the new psychology—or more strictly speaking, and which matters far more profoundly, the new market behavior. On the right, it’s the ratio of benefits to costs that’s the pertinent metric (>1 is a win for the consumer, <1 a loss). And here, as you can see, both “too cheap” and “too dear” disappoint the client.

The psychological and economic behavior is blisteringly straightforward: Clients look at what you’re offering, and its cost, and at what the next plausible but lower-cost alternative firm is offering and what it costs. Yes, what you and they are “offering” includes all the intangibles of relationships, just as in B2C land it includes the intangible of brand.

But the brutal reality—of which both Adam Smith and Charles Darwin would approve, as do I—is that if the cost gap is too wide to justify the incremental value, you will be attacked from below. That’s a battle you’re very likely to lose.

Well, then, you protest, “we’ll just move up-market!”

Fine; let’s play this out.

First of all, you might have noticed that the commanding heights are already occupied. Publication of this year’s AmLaw 100 delivered that message right between the eyes, had you theretofore been inattentive. The 20 “Super Rich” firms are bunkered in at the top of those cliffs and going nowhere soon, or easily:

- “Since the start of the deepest recession the modern legal economy has experienced, The Am Law 100 has grown into a series of microclimates. These subgroups pursue different strategies, compete in different sectors, and have widely divergent results. As such they need to be judged on their own terms, against the performers in their bands. For this year we divide them into the 20 Super Rich, the six Giant Alternatives, and the 74 who loosely constitute Everyone Else.”

- “Simply put, the Super Rich firms—the 20 with PPP of at least $2 million and RPL of at least $1 million—outperformed the financial averages by four or five percentage points while holding head count growth to a mere 1 percent. Average partner profits hovered at $3 million; average RPL at $1.2 million. These firms house 18 percent of the lawyers in The Am Law 100 and earn 26 percent of the fees.”

- And for “everyone else,” the other 74 AmLaw 100 firms (not counting the six vereins), it’s been a time of “modest, hard-won gains.”

Second, and back to your firm, “moving up-market” means increasing the benefit/cost ratio clients perceive you as offering drastically. Incremental improvements won’t do it. Why not? Because clients are inured to services that are only somewhat better. Stated more precisely, clients have copious access to lawyers and law firms that are “only somewhat better:” Look across the ranks of the NLJ 350 and you will find no dearth of talented, ambitious, and capable lawyers; a wide and proliferating array of fees and pricing structures; and hungrier and more market-savvy competitors than ever. (We’re in a battle for market share, remember?)

Incremental innovation is no longer sufficient given how value is being perceived by consumers in most categories. There’s no more room for improvement when offerings are already over-improved, creating a need for an “innovation reset.”

Our friend’s B-school-pedigreed phrase, “innovation reset,” means in plain English finding new ways to differentiate yourself in the eyes of clients, beyond legal competence and fee structure. With the iPhone, for example, Apple didn’t really introduce a better phone or email device: It taught customers that there was an unexplored “benefit dimension” occupying the plane of design, sleekness, and apps. Easier said than done, perhaps, but time to get to work.

May I suggest you enlist the best technology talent you can afford to help you do that?

This is not idle speculation or the Silicon Valley envy syndrome; it’s what inhouse counsel at the smartest companies (Google, Cisco, Vodafone, HP) are doing. Here’s an example from Reena Sen Gupta’s devastating column in LegalBusiness, “A self-deceiving return to business as usual:”

The Enterprise Solutions division of Verizon (its B2B business) recently overhauled the way in which it goes to market, works with its customers and uses its lawyers. Initially the task of standardising its commercial interactions with a variety of clients, ranging from small-to-medium enterprises to bigger businesses seemed impossible. But the lawyers, alongside their business colleagues, were instrumental in reducing the time it takes for Verizon to contract with its customers from an average of seven days to a matter of minutes. Lawyers are now no longer required in many elements of the commercial process. In effect, Verizon’s own competitive pressures have changed what its lawyers do and the way they work.

Let me close with the last best hope of, I’m sure, many of you: That you need only continue to pursue the high-margin, price-insensitive work most critical to your clients—that with “boardroom visibility”—and all will go swimmingly. This is a business model that:

- places inordinate reliance on personal chemistry; and

- entrusts the firm’s future prosperity to the continued good will of a small number of individuals each possessed of their own (truly) unique IP;

- in an environment where the most talented, sought-after, and mobile partners are free agents in the most radical sense of the term.

As Reena puts it, “For most rational businessmen, a commercial model that focuses on winning rare but lucrative bet-the-company work would be precarious.”

Is that what you’re staking the future of your firm on?

A favorite analogy for me, since you mentioned beer, is the effort by “Big Brew” to emulate the success of the craft brewing industry. Big Brew has seen flat to declining revenue for years while small, niche craft brewers are seeing double digit growth. Big Brew takes that half-step to moving up market by slapping a label on an undistinguished product seeking to tell the world, “we’re craft brewers, too.” It hasn’t worked too well.

Bruce:

Re Figure 1.

If I am reading this properly, it is important to understand that for these charts the entity rating cost and benefit (value on the right) is Client. The service provider has some vision (ideally, reasonably specific) about where its products/services lie. It is possible (likely?), for both Client and provider that value vs performance actually entails a range, not a point, both because performance may range (and/or vary in time) depending on specific resources available and also because different practice areas may have different cost-benefit characteristics. The first issue, on both sides, is how to make such an assessment in any meaningful way. The second issue for the provider is how to accurately understand how Client sees this chart and to determine how it may be possible to respond to improve the value case.

The qualitative graphs are fine for the conceptual-level, but the actual responses will depend on the ability (and effort) to quantify such matters and then to calibrate the curves to the Client’s vision of such matters. In doing the latter, the provider may well need to finding practicable ways to improve the value proposition.

If this seems roughly right (and it is what other industries do routinely, with greater or lesser success), perhaps in some later episodes AdamSmith,Esq. will pursue some of the approaches that may exist to would allow firms to appropriately measure the value they offer and how their internal estimations can be calibrated to the views of their clients?

Mark L.