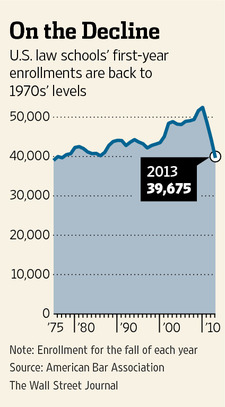

The all-time high of 1L enrollments was three short years ago, in 2010, at over 52,000, about 30% above this year’s number. Here it is graphically:

Meanwhile, The National Law Journal’s story on this quotes University of St. Thomas School of Law professor Jerome Organ writing in an evidently off-handed fashion, without comment or analysis, that “most law schools see further declines in their LSAT and GPA profiles.” This isn’t the first time we’ve heard this—that the decline in applicants/enrollees has been especially high among the more academically qualified students—but it certainly begs for an explanation. My hypothesis, divorced from empirical basis at this point, is that the brighter students have more options. But not to cast aspersions.

There’s more: In recent years, average graduating class size (3L’s, that is, and to state the obvious there’s shrinkage between 1L and 3L numbers) has been about 44,000. We’re now over 10% short of the number of students law schools have been graduating recently. This means that, for all practical purposes, law schools below the elite tier have become open enrollment.

But back to dynamic markets.

Admirable and swift has been the reaction of prospective law students to the changed legal marketplace since 2008—2010. Some people may not like what has happened, and many more may be completely baffled about how to respond, but this is the way markets are supposed to behave. Econ 101: When demand drops, supply should follow. As the WSJ drily puts it, “those considering legal careers appear to be paying attention.”

All the evidence so far, however, is that law schools are really not—or they’re not acting on what they’re seeing. If you beg to differ, I ask you merely to read on.

This raises a host of questions about the business models for law schools going forward—especially standalone, independent law schools—as the always reliable Bill Henderson points out with understatement:

“It is a big drop-off,” said William Henderson, a professor at Indiana University’s Maurer School of Law who has written extensively on the legal profession. “The wind has been at our backs for many, many decades, and we haven’t really had to operate like a lot of businesses, with adjusting to swings in demand.”

paradox is that we need better lawyers and law schools than ever (but not as many attorneys); problem of law schools is a lack of faculty skills induced by tenure; most faculties simply do not have the skills to teach what we need lawyers to be able to do

It will be very pivotal for the legal education market in February when the decisions are made regarding the Task Force’s recommendations. Significant deregulation is needed, but I highly suspect that the committee will remain very conservative and not adopt the necessary liberalization of the regulations, even in light of the declines in applications.

The State Bar associations and other Bar Associations seem remarkably quiet on this issue. They have a much greater incentive to turn around this decline than the ABA does yet we here very little, if any, response from them. They will pay the price in years to come as declines in bar fees and other fundraiser initiatives come as a result of a decline in lawyers. If the ABA does not deliver on the needed liberalization the State Bar Associations certainly should take action on their own, such as adopting the liberal education requirements of California.

Legal Truth, I agree that the ABA and state bars have a responsibility to review and reform a regulatory framework that has seen little change in decades. That said, I am not sure that deregulation will produce the required reforms. I would argue that the regulatory framework is overdue for a page 1 rewrite, and should not be scrapped until a sensible replacement has been drafted and adopted.

There should be a balancing that falls somewhere between the ABA and the AMA (a regulatory system that has curtailed the American educational opportunities to the point that we are unable to meet medical needs without importing foreign doctors). Likewise the state bars should revise their regulatory frameworks, and while I acknowledge that California stands as an outlier in its more flexible approach to educational requirements for bar admission, I am not sure that the resulting effect on legal education in the state is favorable.

To the question posed in the article, there are some schools that are taking steps to address the new market realities, and I would point to the University of Iowa as a school that has maintained its admissions standards, and decreased class size to do so. Its efforts to attract applicants have focused on cost and has announced its plan to reduce tuition. I have no idea whether it will work, but it signals an acknowledgement that the market for legal education has changed, and a willingness to act.

Finally, I would add that the decline of applicants/enrollees at law schools it not explained solely by the lack of legal employment opportunities. The lack of employment opportunities is compounded by the dramatic inflation of the cost of attending law school. Since 1975, the cost of tuition has increased at an alarming rate, and I would suggest that the cost now exceeds the anticipated return on investment for a huge number of potential applicants.

The points about

are all valuable contributions to my original article. Thanks.

All I would add re Iowa Law’s experiment is that while I have no idea whether it will work or not either, experimentation is exactly what we need a lot more of. As we know, the ideal solution is not always obvious and not always the first thing that comes to mind. How many years and generations of technology was it, after all, from the original (excoriated) Apple Newton to the Palm Pilot to the BlackBerry and finally to today’s smartphones and tablets?

Bruce, are you familiar with any historical examples of industries that faced a sea-change with similar features? I think that it could be illustrative to identify an example where:

a. Entry into the industry is controlled by a cartel;

b. Admission requires a significant initial investment of time and money;

c. there is no guarantee of admission or return on investment;

d. the public generally lacks accurate information or understanding about the industry and how it operates; and

e. technology and market forces are dramatically transforming the economic function of that industry.

The only thing that comes to mind immediately would be a guild or trade association that existed prior to the advent of organized labor. I was thinking about stone masons at the time when steel production transformed construction. I am not sure that any comparisons would withstand analysis, but perhaps there are lessons for the legal industry that can be gleaned by analyzing historical examples. If you had the time or energy to look into this, I would read it with enthusiasm.

Hayden:

A possible example would be diamond mining (and its downstream activities) prior to the entry of BHP and Rio Tinto into the Canadian deposits. It seems to me to match all five of your points. The vertically integrated cartel never saw it coming until it was too late: they didn’t believe the resource could be there; they did not imagine that anyone with the resources to invest would take them on; they did not imagine that their consumers (e.g., Harry Winston) would partner with their new competitors.

The analogy is not to law schools, so much as to alternative competitors that one simply assumed could never function successfully for the clients who were not nearly so captive as they appeared only a few years before.

Mark

The ABA’s representative blames law schools for not recognizing that the number of law students entering school in recent years was not sustainable, but the ABA seems unwilling to acknowledge its own role in the problem. A primary root of the supply problem is noted in the article. In the last 38 years, the ABA has approved almost 40 additional law schools. Apparently, the ABA never considered the effect of increasing the number of schools by almost a quarter in a relatively short period. The ABA had to have expected the number of law students (and, hence, graduates) to increase unless it believed that existing schools would shrink their enrollments, which was unlikely. The ABA needs to recognize its role in inflating the bubble, and allow the market to work. That means taking a serious look at the viability of all existing approved law schools and allowing some to fail. That may also include forcing the closure of some schools by revoking approval because sometimes the invisible hand needs guidance.

I don’t think the ABA can refuse to accredit a law school on the ground that the nation has an adequate supply of law schools already — that way lie the Scylla of the Sherman Act and the Charybdis of the Clayton Act. The ABA could, however, implement performance-based standards and reasonably say that a school that has (say) a 50% bar failure rate for two years running should lose its accreditation on the ground that it’s a failure itself.

Excellent Article.

“The State Bar associations and other Bar Associations seem remarkably quiet on this issue. They have a much greater incentive to turn around this decline than the ABA does yet we here very little, if any, response from them. They will pay the price in years to come as declines in bar fees and other fundraiser initiatives come as a result of a decline in lawyers. If the ABA does not deliver on the needed liberalization the State Bar Associations certainly should take action on their own, such as adopting the liberal education requirements of California.”

No, because the ABA doesn’t lose money if grads can’t get jobs, and they don’t even lose money if lawyers leave the profession, so long as there are replacements.