Fortune has been turned on its head, as Mr. Norris observed: The best performers in the first period, the BRIC gang, have been the poorest performers in the second period (joined by the sorry state of Spain).

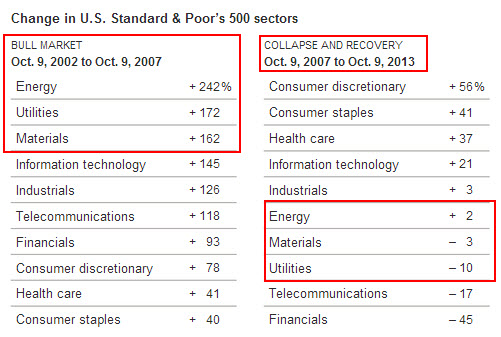

And if you want to go to the next level of detail and look at industry sector performance across the two periods, here’s what you see:

In the first period, energy, utilities, and raw materials (natural resources) performed best, while in the second period they were bringing up the rear (accompanied, predictably, by the chronically battered and besieged financial services sector), and none are materially higher than they were six years ago at the previous peak.

All very elucidating, you may be saying to yourself, but so what?

Let’s lay the global and sectoral equity markets performance up against where law firms have been investing. What correlations do we see?

- In terms of BigLaw, few territories were more popular greenfield or office-expansion destinations over the past decade than the BRICs (well, India won’t let us in, but we’d have been there in a heartbeat were it otherwise). Yet their overall equity market performance has been disappointing at best. I hear three things far more often than I used to:

- Brazil has hit an air pocket;

- Russia is a kleptocracy; and

- China is a vortex sucking deeply underwater any expectation of profitability.

- As for the sector analysis, the performance profile of the energy/raw materials group is strikingly parallel to that of the BRICs: On a tear during the first period, a complete yawn during the second.

- Yet firms are piling into anything and everything energy- or raw-materials-related, at, if anything, an accelerating pace.

- Finally, what about the global legal market’s elephant nation, the US itself? You would think, looking at the equity indices, that this would be an irresistible magnet for law firm expansion and easy pickings for growth; after all, the US stock market is up 38% since its October 2009 nadir. What could be wrong with that?

- Of course, the environment for US law firm revenue growth since 2009 has been notoriously tepid.

In other words, I believe there is no consistent correlation between stock market performance and law firm performance—certainly not in the shortish run of a decade or thereabouts.

- Many of us piled into the BRICs when they were red-hot, with seemingly little to show for it.

- Most of us discovered the energy and raw materials sectors only after they were achieving room-temperature performance.

- And while the US has been—equity-wise, at least—on a tear compared to the rest of the world, the BigLaw environment here has never been more challenging.

Good heavens, have macroeconomic factors no consequences? Aren’t we supposed to expand in vibrant areas and dial back in stagnant ones? What’s a body to do?

A.S.,esq: >> If the first question your partners ask, when you’re contemplating a contraction or expansion, is “who else is doing it?,” I despair. Few things in life and work are certain, but this is: A “strategy” of followership guarantees mediocrity.<<

Assume that the presentation of the new plan has been proposed in a full and coherent manner, predicated on the underlying values of the firm and with compelling evidence that risks and opportunities have been analyzed openly and fairly. If the question has been asked as if it were the determinative factor, regardless of the business case presented, then I certainly would agree. However, could there not be a legitimate context: Are there risks here that have caused others to avoid the action, or even, is the market not already saturated? A well wrought proposal will have covered these questions off in a manner that supports the value proposition.