Don’t worry; this is not going to be about what’s “trending on Twitter,” which I used to think was merely amusing but which I’m coming to believe is borderline evil. (Topic for another day, or on second thought, a topic for never.)

No, this is about equity market trends, and what they do—or don’t—portend for law firm health.

The veteran New York Times business journalist Floyd Norris writes in “A Tale of Two Recessions and World Markets, Turned on Their Heads:”

On Oct. 9, 2002, the American stock market hit bottom after the 2001 recession and began a great bull market.

Exactly five years later, on Oct. 9, 2007, that bull market reached its peak. Within months, stocks around the world were tumbling into the worst bear market since the Great Depression.

A look at what happened over the two periods — from 2002 to 2007 and from 2007 to 2013 — shows a pattern of reversal. What was best during the first period was worst during the next one, and vice versa.

Actually there are three periods in question:

- The Global Bull Market of 2002—2007;

- The Great Bear Reset of 2007—2009; and

- The recovery of 2009—today.

In the first period:

- The US stock market did quite nicely, thank you, doubling from 2002 to 2007.

- But every major market around the world did better—tripling at a minimum—while the “BRIC” gang made up the four top performers, each up at least 400%.

In the second period:

- US equity markets declined nearly 60%

- So did the MSCI “All Country World Index [excluding the US]”

And finally, blending the second and third periods together (producing the time span October 2007 to October 2013), we can see how markets performed globally from peak to peak.

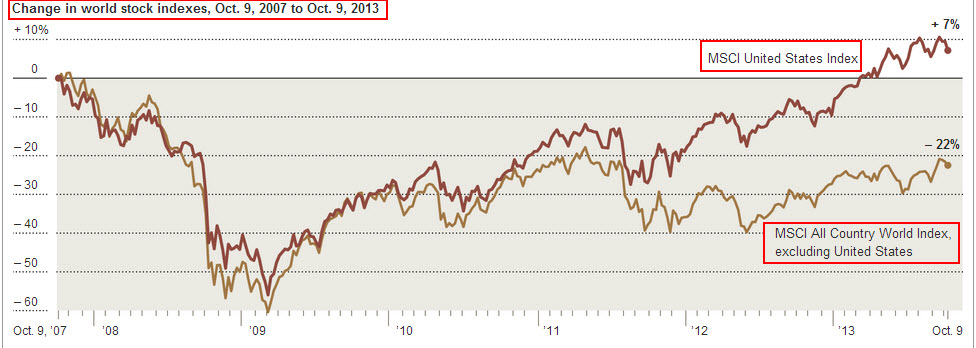

Here’s the overall chart:

A nice performance, at least if you’re invested in the US equity markets. In fact, only two of the 15 largest stock markets in the world—the US and Switzerland—were higher than they had been at the prior 2007 peak.

But “God [not the devil, at least not in my book] is in the details” and here’s where it gets interesting.

Breaking down country by country performance in the Great Bull Market of 2002—2007 and the collapse and recovery phase of 2007—2013 gives you these numbers:

Fortune has been turned on its head, as Mr. Norris observed: The best performers in the first period, the BRIC gang, have been the poorest performers in the second period (joined by the sorry state of Spain).

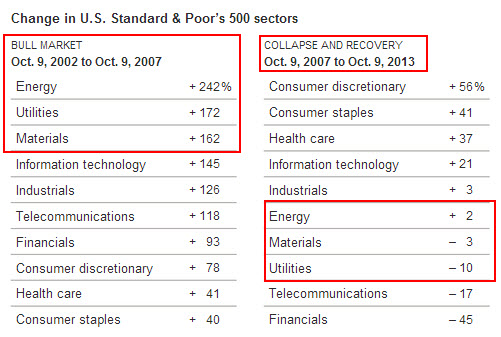

And if you want to go to the next level of detail and look at industry sector performance across the two periods, here’s what you see:

In the first period, energy, utilities, and raw materials (natural resources) performed best, while in the second period they were bringing up the rear (accompanied, predictably, by the chronically battered and besieged financial services sector), and none are materially higher than they were six years ago at the previous peak.

All very elucidating, you may be saying to yourself, but so what?

Let’s lay the global and sectoral equity markets performance up against where law firms have been investing. What correlations do we see?

- In terms of BigLaw, few territories were more popular greenfield or office-expansion destinations over the past decade than the BRICs (well, India won’t let us in, but we’d have been there in a heartbeat were it otherwise). Yet their overall equity market performance has been disappointing at best. I hear three things far more often than I used to:

- Brazil has hit an air pocket;

- Russia is a kleptocracy; and

- China is a vortex sucking deeply underwater any expectation of profitability.

- As for the sector analysis, the performance profile of the energy/raw materials group is strikingly parallel to that of the BRICs: On a tear during the first period, a complete yawn during the second.

- Yet firms are piling into anything and everything energy- or raw-materials-related, at, if anything, an accelerating pace.

- Finally, what about the global legal market’s elephant nation, the US itself? You would think, looking at the equity indices, that this would be an irresistible magnet for law firm expansion and easy pickings for growth; after all, the US stock market is up 38% since its October 2009 nadir. What could be wrong with that?

- Of course, the environment for US law firm revenue growth since 2009 has been notoriously tepid.

In other words, I believe there is no consistent correlation between stock market performance and law firm performance—certainly not in the shortish run of a decade or thereabouts.

- Many of us piled into the BRICs when they were red-hot, with seemingly little to show for it.

- Most of us discovered the energy and raw materials sectors only after they were achieving room-temperature performance.

- And while the US has been—equity-wise, at least—on a tear compared to the rest of the world, the BigLaw environment here has never been more challenging.

Good heavens, have macroeconomic factors no consequences? Aren’t we supposed to expand in vibrant areas and dial back in stagnant ones? What’s a body to do?

Remember: “God is in the details.”

Markets, be they geographic or sectoral, are not intrinsically attractive or unattractive based on conspicuous and highly “legible” indices such as stock market performance. Remember that markets can remain disconnected from underlying economic reality for quite awhile. (Most memorably, and thank you, John Maynard Keynes, “markets can remain irrational for longer than you can remain solvent”).

“The details?”

Yes, the details. I have bad news for you: Deciding whether to expand or contract in a locale or a practice area requires painstaking analysis.

Jumping on bandwagons has a crummy track record (Exhibit A: Piling into Silicon Valley ca. 2000).

Being opportunistic rather than purposeful and thoughtful almost assures you’ll buy at the top and sell at the bottom.

Doing research, a/k/a looking before you leap, is hard work: Don’t fool yourself that all signals are go if your loyal clients say (when you ask) that they think it would be a splendid idea if you opened up in XYZ. What do you expect them to say? How about asking them which firm(s) they’re using there today that they’d ditch in your favor?

Finally, one size never fits all.

If the first question your partners ask, when you’re contemplating a contraction or expansion, is “who else is doing it?,” I despair. Few things in life and work are certain, but this is: A “strategy” of followership guarantees mediocrity.

“Who else is doing it” does not define “best practice;” all it defines is “common practice.” Which is usually, truth be told, “least common denominator” practice.

I was recently talking about the increasing dispersion of performance results across the AmLaw 200 and the Global 100 and I noted that I thought the phenomenon—the best doing a lot better and the worst falling behind the pace more seriously—reflected the new reality that “strategy matters more than ever,” and I was asked: “What strategy?”

Not comprehending the question, and after a bit of awkward back and forth, I finally realized my interlocutor wanted to know what The Strategy (the one and only, that is) was to assure out-performance. This took the impulse behind wanting to know “who else is doing it” to Olympic levels.

Equity markets—and hunch and instinct—are very blunt instruments of analysis indeed. One size does not fit all.

God is in the details.

A.S.,esq: >> If the first question your partners ask, when you’re contemplating a contraction or expansion, is “who else is doing it?,” I despair. Few things in life and work are certain, but this is: A “strategy” of followership guarantees mediocrity.<<

Assume that the presentation of the new plan has been proposed in a full and coherent manner, predicated on the underlying values of the firm and with compelling evidence that risks and opportunities have been analyzed openly and fairly. If the question has been asked as if it were the determinative factor, regardless of the business case presented, then I certainly would agree. However, could there not be a legitimate context: Are there risks here that have caused others to avoid the action, or even, is the market not already saturated? A well wrought proposal will have covered these questions off in a manner that supports the value proposition.