Don’t worry; this is not going to be about what’s “trending on Twitter,” which I used to think was merely amusing but which I’m coming to believe is borderline evil. (Topic for another day, or on second thought, a topic for never.)

No, this is about equity market trends, and what they do—or don’t—portend for law firm health.

The veteran New York Times business journalist Floyd Norris writes in “A Tale of Two Recessions and World Markets, Turned on Their Heads:”

On Oct. 9, 2002, the American stock market hit bottom after the 2001 recession and began a great bull market.

Exactly five years later, on Oct. 9, 2007, that bull market reached its peak. Within months, stocks around the world were tumbling into the worst bear market since the Great Depression.

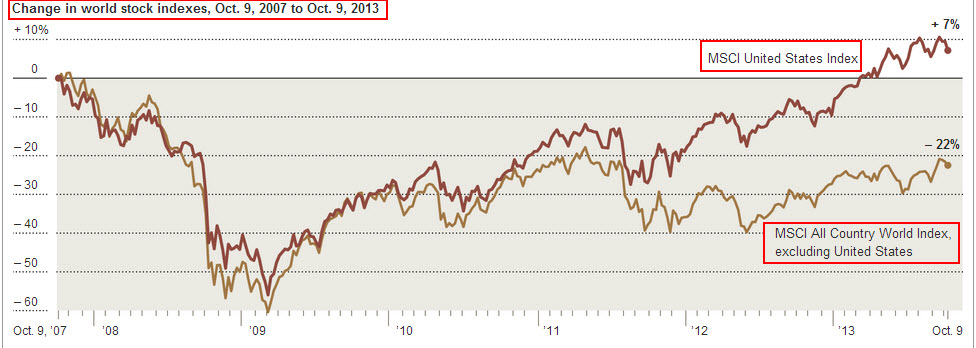

A look at what happened over the two periods — from 2002 to 2007 and from 2007 to 2013 — shows a pattern of reversal. What was best during the first period was worst during the next one, and vice versa.

Actually there are three periods in question:

- The Global Bull Market of 2002—2007;

- The Great Bear Reset of 2007—2009; and

- The recovery of 2009—today.

In the first period:

- The US stock market did quite nicely, thank you, doubling from 2002 to 2007.

- But every major market around the world did better—tripling at a minimum—while the “BRIC” gang made up the four top performers, each up at least 400%.

In the second period:

- US equity markets declined nearly 60%

- So did the MSCI “All Country World Index [excluding the US]”

And finally, blending the second and third periods together (producing the time span October 2007 to October 2013), we can see how markets performed globally from peak to peak.

Here’s the overall chart:

A nice performance, at least if you’re invested in the US equity markets. In fact, only two of the 15 largest stock markets in the world—the US and Switzerland—were higher than they had been at the prior 2007 peak.

But “God [not the devil, at least not in my book] is in the details” and here’s where it gets interesting.

Breaking down country by country performance in the Great Bull Market of 2002—2007 and the collapse and recovery phase of 2007—2013 gives you these numbers:

A.S.,esq: >> If the first question your partners ask, when you’re contemplating a contraction or expansion, is “who else is doing it?,” I despair. Few things in life and work are certain, but this is: A “strategy” of followership guarantees mediocrity.<<

Assume that the presentation of the new plan has been proposed in a full and coherent manner, predicated on the underlying values of the firm and with compelling evidence that risks and opportunities have been analyzed openly and fairly. If the question has been asked as if it were the determinative factor, regardless of the business case presented, then I certainly would agree. However, could there not be a legitimate context: Are there risks here that have caused others to avoid the action, or even, is the market not already saturated? A well wrought proposal will have covered these questions off in a manner that supports the value proposition.