A few weeks ago I ran a column about “ReInvent Law,” an event in Silicon Valley in the first half of March, which presented some views about possible futures of BigLaw, most of which were, uh, challenging to those who think business as usual is a strategy. My column wasn’t so much about whether I thought ReInvent Law was on the right track or otherwise, but it was about asking your opinions on what the ReInvent Law event hypothesized in a survey.

Well, now you have spoken, and in combination with an interview on Bloomberg Law by the masterful Lee Pacchia (Bloomberg also provided the graphic charts below), I’d like to discuss the results. First, here’s my conversation with Lee:

Now, to more about the results:

Caveat: Although nearly 200 of you were moved to respond in whole or in part, this survey shouldn’t be confused with rigorous quantitative research.

And what do I think overall?

The strongest message is that we have achieved consensus that the world has changed. I have felt this as a growing awareness for quite some time now, but the debate is over. The issue is not whether “growth is dead,” but “now what?”

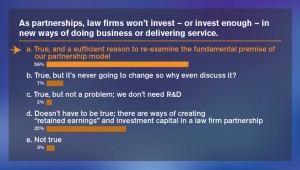

As I read the responses to this question, 12% (round it to 1 in 10) are fatalists; There’s nothing meaningful to be done. But 88% think we need to invest, and of that group those who think the “fundamental premise of our partnership model” needs to be re-examined outnumber those who think we can create retained earnings and investment capital in a law firm partnership by two to one. I find these results sobering and bracing at once.

First of all, pretty much 9 in 10 of us think we need to invest. This flies in the face of conventional wisdom that partners want to “strip-mine” the balance sheet of cash at the end of every year for distributions. Maybe we’ve all been wrong in making that assumption all along, although the question pointedly did not ask what percentage of income partners would be willing to forego this year, and the next, and the next, in order to fund these hypothetical investments. Still, I consider this a very positive straw in the wind that dedicating real resources to change may not be a non-starter.

What are the attributes of the respondents to the survey (profession, role, years of professional experience, age, gender, jurisdiction)? And how many respondents responded to each question? Because this is a convenience sample with some missing data we need to know this information in order to understand the relevance of the responses.

Here’s an example of a captive LPO led by a non-lawyer: http://www.legalweek.com/legal-week/news/2254737/addleshaws-eyes-flexiworing-push-as-lowcost-base-grows-with-new-hires (in the second half of the report). Keep watching and we will see whether it is the exception. (I suspect that your point about culture may be slightly less relevant in some UK law firms, but I may be wrong.)

So much of what ails big law is a direct result of up or out. Up or out by design means that the people who handle important, expensive and very profitable assignments like large e-discovery projects are ‘promoted’ out of running those projects as soon as they have had some experience. No wonder the LPOs are eating so much of that work – they hire professionals to handle the job and keep them there. Promotion typically means more responsibility to handle the same kind of work. Thus they do and likely always will have an efficiency advantage (regardless of billing rates) because these ‘junior associate’ projects are treated as core competencies instead of training exercises.

Big law recruiting plays a key role here too. It is expensive, and as you have recently covered not very effective. High attrition coupled with expensive recruiting should indicate a real problem to be solved, it certainly does to business people who aren’t lawyers. If big law can move from its current high attrition/lots of first year hiring/up or out system to one with lower attrition/first year or lateral hiring as needed/up based on merit, out based on performance in position or business needs… much money could be saved and value provided to clients would be much improved.