Consider:

- According to PwC’s annual 2023 survey of CEOs worldwide (4,410 from 105 countries), 40% said they did not see their own companies as viable in 10 years if they stayed on their current path. Bob Moritz, PwC’s global chair, summarized it as follows: “Chief executives are thinking, can I move with the speed necessary?,” Moritz said. “They worry: I kind of know what the issues are but can I survive in the next 5 years and thrive in the next 10?”

- The theme of this week’s Davos conference, unofficially but firmly, is that decades of liberal Western democracies increasing globalization and interdependence are over.

“Davos was built on the idea that the world was getting better and more global and more honest and more tolerant and the economy worked better because of that,” said Alex Karp, chief executive of Palantir Technologies Inc. “Well, it doesn’t look like we’re living there anymore,” he said, adding that “you see the results of that in firing and restructuring.” - For the first time in nearly three quarters of a century, China’s population actually shrank last year and its economy slowed to one of the lowest growth rates in decades. The country also faces deep structural challenges, with or without the challenge of emerging from Covid Zero: A rapidly aging demographic, slowing productivity,chronically high debt, and even troublesome and growing social inequality. (Set aside the potentially explosive issue of Taiwan or China’s own military ambitions.)

- Russian President Vladimir Putin’s decision to use its oil and gas reserves as a weapon of financial war at the start of the Ukraine conflict has officially backfired, “threatening the core of Russia’s beleaguered economy and curtailing its geopolitical influence.” Western sanctions are beginning to bite, and the decision to cut off natural gas to the EU has also backfired as its fossil fuel industry has been unable to adapt to the one two punch of an EU embargo and the US’s leading a coalition to cap the price on its crude. In the meantime, Russia’s having to turn to China and India as buyers of last resort has drastically cut the price it receives for its crude or its gas since the cost of shipping means the fuels are already expensive when they get to their end buyers. Understand that I am not crying tears for Russia, but history might take a moment to observe that absolute economic shrinkage, declining life expectancy, and suppression of all dissent have not customarily led to peace and tranquility. Just sayin’…..

- In the (only slightly) longer run, Russia has discredited itself once and for all as a reliable energy supplier in world markets and EU and other customers will never again trust it as a source of supply. That, in turn, has accelerated the EU’s turn to renewables and non-fossil fuel sources of energy supply vastly beyond the wildest dreams of The Greens or the Paris Accord maximalists. And the EU will never go back: Solar cells are now the single cheapest available source of electricity generation, undercutting even coal, the previous title-holder.

And even if this were to inexplicably reverse, shall I mention again that no rational country, corporation, or utility would turn for its energy supplies to a source whose credibility was shredded?

- Closer to home, Goldman Sachs just announced its quarterly profit was down nearly 70% from a year ago (Morgan Stanley was at -40%) as the global M&A boom of early 2022 hit the skids laid down by the Fed and the ECB.

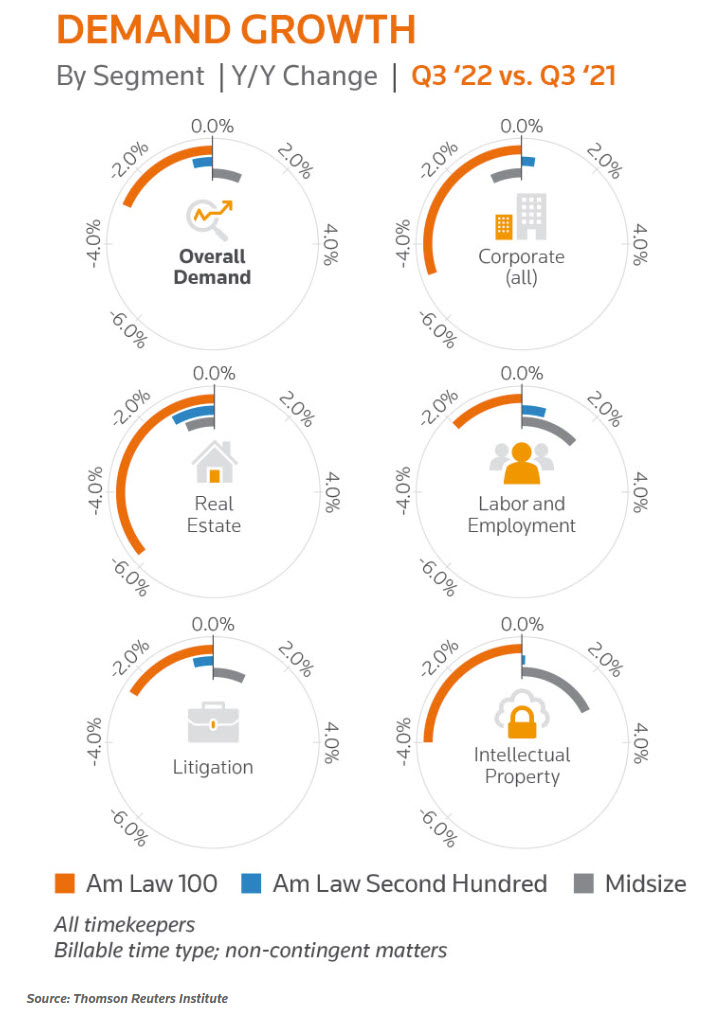

In Thomson Reuters’ recently released Law Firm Financial Index for Q3 of last year we see that, yes indeed, corporate/transactional work and M&A demand took it on the chin–especially among the AmLaw 100, which is the closest this particular data index has to the most expensive, elite firms.

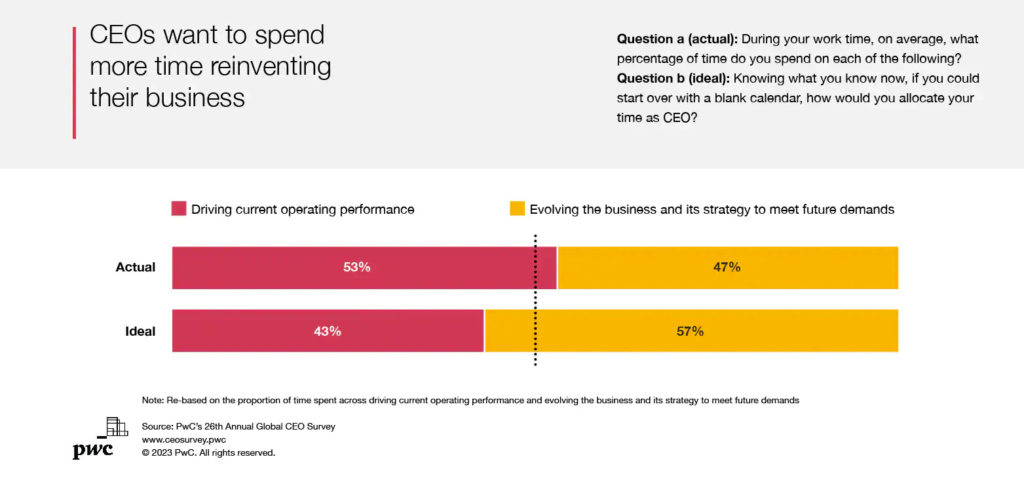

This illustrates a problem. CEO’s are consumed by the short term operational fires that need to be put out and do not/will not/cannot devote the time they know they should to longer-term and vastly more consequential strategic issues:

And, since you asked, Managing Partners of law firms are even more short-term oriented. Their “operational fires,” after all, tend to arrive at their door in person with real and perceived complaints, slights, and injustices.

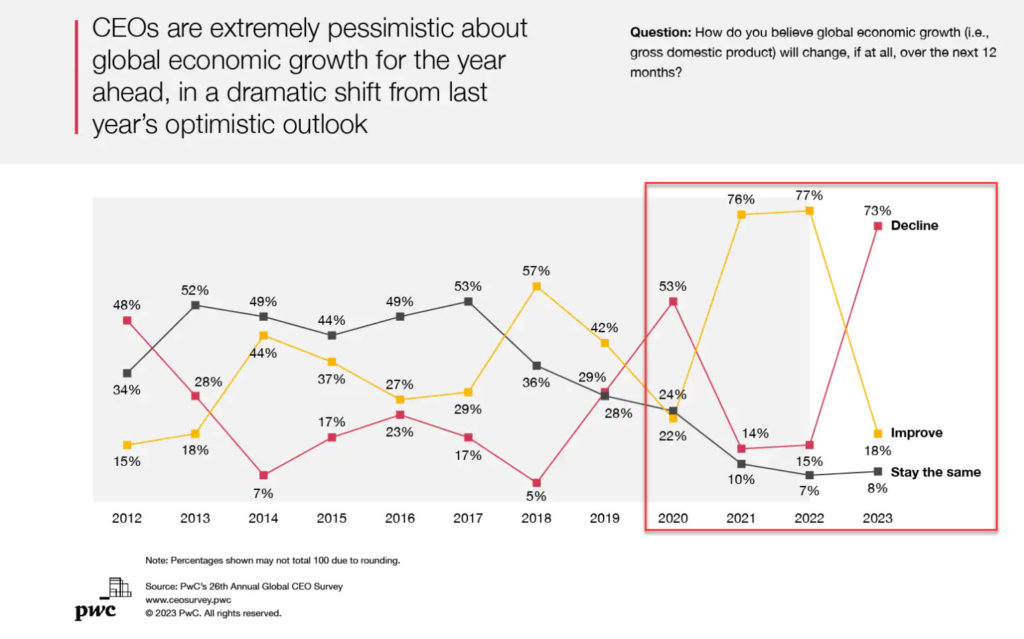

Let’s compound this nasty inability to focus on the important-but-not-urgent while giving far greater attention to the urgent-but-not-important by showing what PwC’s survey revealed about how optimistic/pessimistic business leaders are. Attitudes have shifted drastically, almost manically, from blue skies to storm watch:

So: Now what?

First, understand, even embrace, your own personal limitations. You cannot remotely control Russia, China, Ukraine, the price of oil, what Jay Powell’s next move will be, whether the economy’s leaders are feeling those lurking “animal spirits” beat pitter-patter in their deal-making hearts or just wanting to retreat to their study with some single malt. So be it.

Second, this is normal, not deviant. (No, not the part about controlling Putin, although that is in the bullseye of normal for any individual.) By that I mean that volatile and uncertain business conditions are normal, not deviant. The (largely) up and to the right trajectory of BigLaw financials over the past decade+, roughly since the 2008/09 GFC, is what is shockingly, aberrantly, 2.5 Standard Deviation territory, deviant. Get used to it.

Third, the horses scare easily; many of them already are skittish. Here is where you can actually have an impact, do something, in short, lead.

Talk to your partners, your associates, business professionals, legal and business staff:

- in plain English, explaining what you and they and the firm can and cannot control

- telling them to prepare for rough seas and high winds ahead

- and reassuring them, to the extent credible and true, that the firm has plans in place to do everything within your control to modulate the volatility, hedge against the steepest declines, and share the sacrifice that will probably be called for. (You did make those recession scenario plans we talked about, right?)

In other words: Be candid. Tell the truth. Don’t sugarcoat it.

In the depths of the Nazis’ waging the Blitz over London and Britain in the early days of WWII (1940 and 1941, before Pearl Harbor and the US’ entry onto the field of battle), Churchill lectured his direct lieutenants firmly and succinctly: “Facts beat dreams.”

Your turn.

Photo by Lawrence Hookham on Unsplash

Excellent analysis. Could you expand, though, on bullet #5 as it relates to Russia not being a reliable or trusted source of energy? This may certainly be the case, but how will countries truly extricate themselves from Russia if it happens to not only supply 8% of the world’s uranium (thinking nuclear and its potential role in energy transition) but – more importantly – 38% of the world’s supply of converted uranium (as in, uranium that can actually be used as nuclear plant fuel)? https://www.rferl.org/a/russia-nuclear-power-industry-graphics/32014247.html

Seems to be something of a Catch-22. Would love to hear more on this!

Based on the link you provided, 38% of “fuel grade” uranium comes from Russia but 36% comes from France and Canada–an essentially immaterial difference–who are of course actually in or very very friendly with the EU. (The rest comes from China, an international pariah these days.)

I find it hard to believe that between the US, Germany, and the UK a healthy supply of additional fuel-grade uranium could not be made available on extremely short notice if Western Europeans are otherwise going to freeze in the dark, so sorry (or should that be “relieved”?) to say that I think Russia will remain patria non grata on this front as well.

Thanks for the contribution and the additional analysis!