We’re in the thick of BigLaw’s year-end earnings season, where firms left and right are reporting their FY2024 financial results. The numbers of greatest interest from a macro-industry perspective–setting aside the perennial gossip-intensive zero sum game of lateral partner musical c hairs–are obvious: Changes in (a) top-line revenue and (b) bottom line profits.

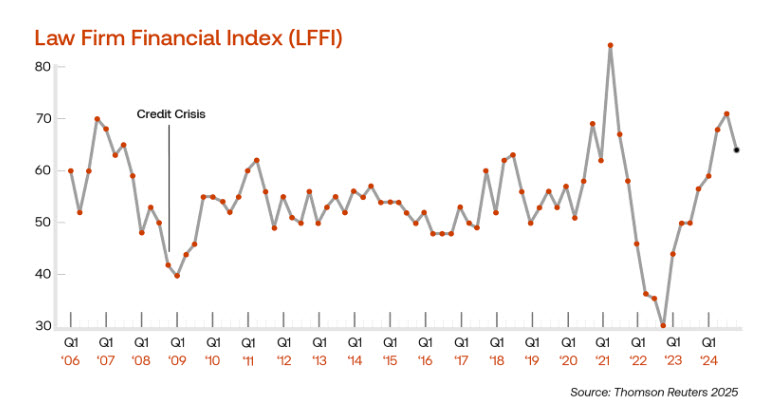

All in all, it’s a bumper harvest of impressively strong reports. As of this writing, our favorite statistically-driven reporting, the Thomson Reuters Law Firm Financial Index (made up of nearly 200 law firms, not coterminous with the AmLaw datasets or any other regularly published “index” dataset), reports 11.5% profit growth in 4Q2024, confirming double digit profit growth for the full year 2024. (As regular readers here know, we’re fond of the TR data series in general because their underlying data is pulled from law firms’ actual financial and accounting systems, not wistfully optimistic boardrooms nor rose-colored glasses press releases.)

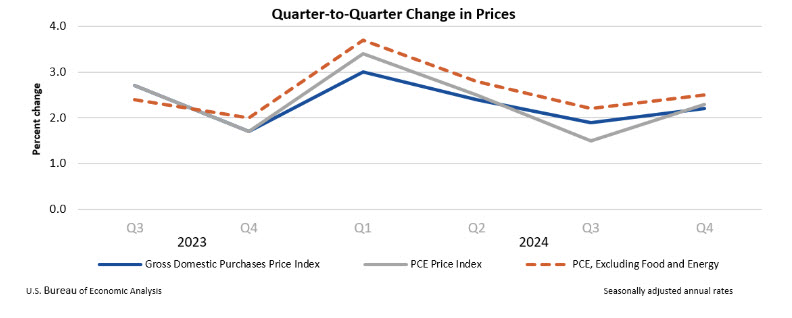

Notably, worked rates are up 6.6% Year on Year, comfortably exceeding the US Bureau of Economic Analysis’ tracking of price changes over the same period, which are gently fluctuating around one-third that level:

Those healthy rate increases combined with demand growth of 2+ to ~4% tell you what you need to know.

Meanwhile, profitability jumped by enviable amounts. As the intrepid Dan Roe reports over at The American Lawyer:

Big Law broadly had a strong year in 2024, according to a new survey from Citi’s Global Wealth at Work Law Firm Group that illustrated a team effort from a spectrum of pro-cyclical and countercyclical practices.

Gross revenue increased by 12.3% and net income rose 16.6% on average across Citi’s cohort of 200 law firms, according to Citi’s Full Year Quarterly Survey, which includes a roughly even distribution of Am Law 100, Second Hundred and unranked firms.

As usual, the Am Law 50 saw the biggest gains, with gross revenue up 14.1% on average and net income up 19.1%. But the Second Hundred had a respectable year as well, posting 9.3% revenue growth on average and 12.4% higher net income.

“Nice work if you can get it?” You bet.

But the financial analyst in all of us (well, me; I’m writing this column) has to ask, how high the sky?

The stalwart TR Law Firm Financial Index records unusually strong historic performance of late (their time series here goes back two decades):

The convention for this scale is that “50” represents the historic norm of performance, so a score of 65 (now) is exceptionally strong. Indeed, eyeballing it, excepting the global Covid pandemic anomaly, we’re at or about the highest growth rate in this entire span.

Now, we’re not exactly here to tell you what’s wrong with this picture; “we report, you decide,” as one prominent news outlet hereabouts pompously likes to declare. But do read on.

One of the truisms of economic market analysis is that sustained supranormal profits in an industry or sector attract attention. Once this happens, “Stein’s Law” tends to kick in: “If something cannot go on forever, it will stop.” This is one of the insights popularized by Herb Stein (1916–1999) (Williams BA, Chicago Ph.D), who was among other things an econ professor at UVa, a senior fellow of the American Enterprise Institute, and chair of the Council of Economic Advisors under Nixon and Ford. Stein was fond of Adam Smith neckties.

In Law Land, as in many many industries before, the consequences of prices rising:

- rapidly and above inflation

- over a sustained period (years)

- faster than quality or convenience improve

is that competitive substitutes begin to appear.

We are beginning to see that here in the backyard of BigLaw.

Doubt me?

A final sampling of data points. According to the irreplaceable Thomson Reuters 2025 “Alternative Service Provider”Report, revenue in the ALSP market is $28.5 billion as of 2023 (latest figures available) , with a CAGR of 18%. Less than 100% of that revenue is earned by firms and products/services focused on Gen AI, but a plurality of respondents from both law firms and corporate inhouse departments report that the most attractive offerings from ALSP’ are those using Gen AI.

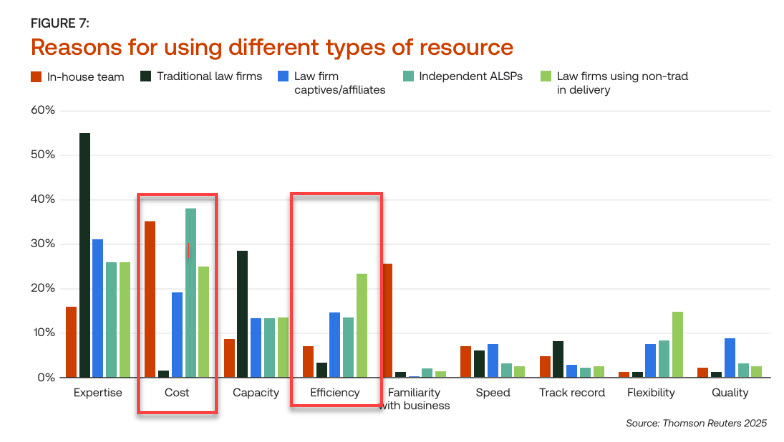

Of greater interest is where respondents think GenAI excels. Take a look:

Let’s give Thomson Reuters the (next to) last word here:

Legal services buyers expect to increase their spending with ALSPs. Among law firms, 40% expect to increase their use of independent ALSPs in the next year, while only 1% expect to decrease such use. And 16% of corporate law departments plan to spend more with independent ALSPs, while only 4% say they’ll spend less.

These projections may even underestimate the strength of the market, as ALSPs have historically been successful at introducing new services. Interviews with ALSP leaders indicate that this innovation will continue,

These statistics may strike you as underwhelming, but invert them to see what a profound impact GenAI is already having. Can you imagine only 1% of corporate legal services buyers saying they will cut their spend on traditional BigLaw? And that somewhere between 16 and 40% saying they’ll spend more on not BigLaw?

See you around.

Your margin is my opportunity.

–Jeff Bezos