Few brands are more prominent in our daily lives (well, at least if you’re a Western world urban dweller) than Starbucks. Its rise to prominence has become standard-issue corporate lore: From its single Seattle store founding in 1971 to Howard Schultz’s acquiring it and spreading it explosively worldwide.

But you don’t need to read Adam Smith, Esq. to know that.

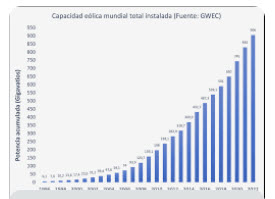

Instead we want to talk about corporate mis-steps and resilience. Starbucks seems to have gone through a lot of the former and so far not so much of the latter in recent years. Here’s the historic growth:

Harvard Business Review was on the story back in June well before the selection of a new CEO was announced (sit tight…) and diagnosed the problem trenchantly:

Starbucks is in trouble again. In its last quarterly-earnings report, it announced disappointing results, including a 4% drop in same-store sales (11% in China, its second-biggest market). After that announcement, its stock plunged. (It is still well below its 12-month high.) And its founder and three-time CEO Howard Schultz once again fired off a missive on LinkedIn pleading with Starbucks’ current leaders to rediscover and embrace the company’s core purpose, its reason for existence. […]

Going to Starbucks isn’t what it used to be, and the brand itself isn’t what it used to mean. The fundamental problem: Starbucks has been commoditizing itself.

The bill of particulars recapitulating Starbucks’ recent-ish changes to its business model and, shall we say, their unintended consequences include:

- Above all, embarking on a concerted campaign to maximize efficiency and not the customer experience. Specifically:

- Comfortable and welcoming chairs and tables have been removed and replaced (if any seating is provided at all) by hard and unwelcoming benches;

- Electrical outlets–at least ones besides those behind the baristas’ counter–are dwindling or nonexistent;

- Orders that used to be handwritten on cups, often with personalized smiley faces, are now pre-printed and purely generic/functional;

- Coffee is no longer roasted in each store–one of the greatest aromas in the world–but delivered in Cryovac-sealed packs;

- Drive-throughs are ubiquitous, making any non-hermetic human interaction off-limits; and perhaps to the greatest effect in terms of devastating the customer experience:

- Mobile order-in-advance was introduced during pandemic lockdown and has now become a monster devouring the host.

If you used to be a Starbucks aficionado (I was when it had novelty value and “third place” appeal), when was the last time you entered a store? Lingered there?

Now Starbucks has hired a new CEO, Brian Niccol (ex-Chipotle, where he engineered a universally lauded recovery) for a compensation package worth a $10-million signing bonus plus $75-million in stock, use of a corporate jet to commute to Starbucks’ Seattle headquarters from his presumably lovely home Newport Beach, CA, and, oh, a regular salary and bonus–estimated NPV of about $115-million. But this article isn’t about that, breathless as the business press has been about it.

Rather, for readers of Adam Smith, Esq., the issue is: What learning can we derive from this high-profile corporate saga-in-progress?

To be more pointed about it, few observers of our industry would argue that the composition, rank order, and business models of BigLaw are in a period of peace and quiet. You know the causes as well as I so I won’t go into detail, but (a) Generative AI; (b) accelerating hourly rate inflation and declining billable hours per timekeeper; (c) turbocharging of the industry’s segmentation into the Elite and all the rest; and (d) the currently unknowable but potentially existential threat from sophisticated and well-capitalized “NewLaw” companies with zero allegiance to conventional ways we’ve always done it.

As I said at the top of this show, whether Starbucks can or will recapture its romantic cachet and glory is not what we write about–feel free to lay odds yourself at home–but the moral it exemplifies is straightforward enough: Stray from the essence of the business model that made you so successful at your peril. Satchel Paige may or may not have said “Don’t look back; someone might be gaining on you,” but surely he would have emphatically agreed with the counsel to ignore and worse, dilute, the strategic foundation of your success.

“Stray from the essence of the business model that made you so successful at your peril.” Decades ago I flirted with the banking business and became a director of the “Bank of A” (not the Bank of America, but a community bank about 1/1000 the size of BofA). Two counties over was the “Bank of B,” an exceptionally well-run bank about the same size as Bank of A that marketed only to its county, where it had four offices, and typically turned in a 2.0% or better return on assets and a 15%+ return on equity, year after year after year. (We did well, but not as well as that.) I posed the question to my fellow directors, all much older and mostly much wiser than I was: “If we could acquire the Bank of B, how should we run it?” My own answer was to do three things: (1) appoint one more director to their board to be the representative of the parent company, (2) have Bank of B send us its financial statements once a month, and (3) tell its management to keep on doing exactly what it was doing. Its eventual acquirer (not us) promised not to change anything and then closed a branch, dumped the home mortgage business, changed the name from its intensely local name (branding), and got creative with the loan programs. Our acquirer did much the same thing. We (the selling shareholders) did okay, but our acquirer didn’t. When you’re on to a good thing, don’t mess with it simply for the sake of messing with it.

Many thanks for your characteristically enlightening and engaging comments. Your own story of several years ago with Banks A and B is “on point,” as they say.

Unspoken but, I believe, pregnant in your personal story is how damnedly tempting it is for the acquirer–or the reactive incumbents in the case of Starbucks and Covid–to mess around even if “it ain’t broke.” Warren Buffett has not fallen into this trap, and he appears to have done OK.