As we are all fellow members of the human race, I suspect you would join me in admitting that, yes, certain decisions and behaviors are indeed compelling (irresistible) and irrational (self-defeating from the perspective of the longer view). We may not, indeed should not be, proud of these behaviors, but they come with our territory as homo sapiens.

Bringing us without further ado to the widely publicized announcement by Milbank that in light of the firm’s exceptionally strong financial performance through YTD 2024, it would be awarding generous mid-year bonuses to its associate ranks. Barely had the ink dried (the pixels lighted up?) on this news than Law Land media organs published commentary such as “legal recruiters anticipate a ripple effect, with other major firms expected to follow suit in announcing similar bonus payments for their attorneys” [this from Law360, but the thrust of the story is fungible with many other outlets’ coverage].

Cards face up here, folks: I am deeply of two minds about this: The legal industry veteran in me reacts instinctively with detachment and an attitude of “so tell me something new,” but the economist and management consultant in me is affronted and appalled.

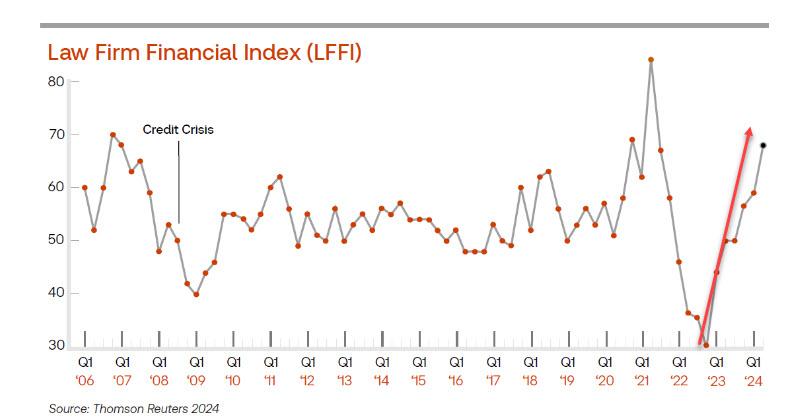

No question that our industry has been on a bit of a tear for the last few quarters, as our good friends behind the indispensable Thomson Reuters “Law Firm Financial Index” make clear (red arrow an Adam Smith, Esq. addition):

But look at the timeframe, which is the entire length of the published data series—approaching twenty years at this point. The sun has been shining on our industry more brightly and for longer than ever before in the time period displayed, but I dare you to identify any long-term sustained trend line in this data.

You can’t because it’s all over the place: The very picture of “volatility” displayed with undeniable consistency and duration. A dictionary could use this as its definitional illustration of the word.

This brings us immediately to the point: In what other industry/sector of the US economy would senior management of leading firms decide this to be the moment to pay out a large share of retained earnings? The industry’s track record paints a picture of “retained earnings” being very much a sometimes thing: Sporadic, unreliable, and even in the best of times far from generous in amount.

Of course, and here we have the real point of this succinct commentary and observation, Law Land is unlike any “other industry/sector” of the US economy in terms of how it treats retained earnings. It doesn’t retain them; there is no such thing in our world, not year over year anyway, which is the only timeframe that counts.

Does this come with competitive structural risks? Well, so far the answer of course has been no, because law firms don’t have to run “faster than the bear,” only faster than other law firms.

What would happen if that were to change?

Just a thought.

Photo by Florian Klauer on Unsplash

What jumped to mind for me about this is the concept cloud of versatility, resilience, and agility. We might say, fairly, that we’re looking at a graph depicting something meteorologists understand better than mechanics. But it also resembles a narrative about migratory hunters. The underlying question is, what set of elements provide the dimensions in which a trend of *continuity* emerges? And is the business model for ROI predicated on the long game or not? Logically, this winds up pointing at different classes of investors, and at understanding whether firm x is built for a long term or short term bump. While one size does not fit all and never will, in every case versatility allows resilience which supports agility underpinning persistence. An industrial study of versatility will yield a different graph, and versatility is an architectural property.