Capitalism without failure is like religion without hell.

–Charlie Munger of Berkshire Hathaway and to our readership famously of Munger Tolles as well (noted in The Wall Street Journal.)

By the time you read this, all of these visuals will be yesterday’s news. And Adam Smith, Esq. never has been and never will be a site for “breaking news” (that unspeakably alarmist and attention-grabbing 24/7/365 chyron at the bottom of CNN, MSNBC, etc.).

By the time you read this, all of these visuals will be yesterday’s news. And Adam Smith, Esq. never has been and never will be a site for “breaking news” (that unspeakably alarmist and attention-grabbing 24/7/365 chyron at the bottom of CNN, MSNBC, etc.).

But.

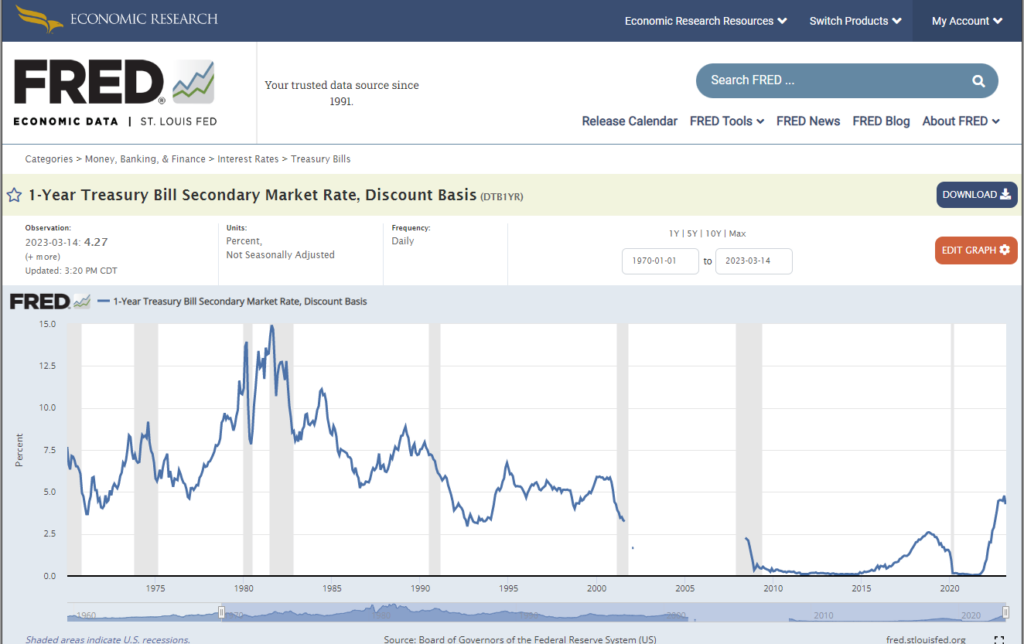

Let’s take a longer term perspective. For 20 years or thereabouts money has been almost free.

These two decades were not normal. But unfortunately for the macro economy, they bracket the entire span of many people’s career. “Unfortunate” in the sense that memories are not only short–the psychology of bubbles and pin-pricks which blow up bubbles amply prove that. But more important for the macro-economy, “unfortunate” in that many people running large amounts of money and institutions which live or die depending on the price of money (did I hear “banks?”) have not only never experienced a rising rate environment but cannot imagine it: It’s beyond the ir ken.

ir ken.

One more time, with feeling: What we are not predicting (and we’re not in the prediction business anyway):

- We’re not predicting a rash of systemic bank failures

- We’re not predicting a material impact on law firms from clients finding themselves on the wrong side of higher interest rates and coming up short on their legal bills

- And we’re by no means predicting a US or global recession a la the GFC of 2008/-09. (That was an utterly different, completely incomparable, torpedo strike below the waterline to the massively interconnected financial system.) Whatever else Silicon Valley Bank might have been, it was not a systemically important institution–nor, for the record, are the crypto repositories and exchanges.

But many firms in industries from warehousing and trucking; to SaaS and temp agencies; to food services and construction; to large-scale commercial landlords and facilities services; to import/export and apparel; to… [you get the picture] could be caught with their balance sheets and income statements structured on the assumption that “free money” will be in the very air they breathe for as far as the eye can see.

No one knows yet who these firms are or whether they’ll be regionally or industry concentrated, but as a generalization the more capital-intensive the industry, the more likely we’ll find Warren Buffett’s famous naked swimmers when the tide starts going out.

Around about now you may be thinking, “interesting, but so what…?” so here’s what.

If our thoughts on the composition of the P&L’s and balance sheet of capital-intensive industry sectors, and the cumulative narcotic impact of 20+ years of free money on CFO’s and portfolio managers are anywhere near descriptive of the real world in March 2023, lots of people have been or about to be rudely surprised. Many will over-react and over-correct, and “cash is king” will no longer be stale and defensive counsel, but savvy and cutting-edge. In general, when capital investment becomes more expensive, firms spend less on everything: Machines, hardware, software, facilities, T&E, and most of all, people (a/k/a jobs),

Don’t act surprised by this. Greenspan, Bernanke, Jay Powell, Mario Draghi, and Christine LaGarde notwithstanding, the business cycle has not been repealed. And as a for-profit business, your firm will be affected by these macro developments–if for no other reason than that law firms can never in the long run do better than their clients. When the economy has just been shocked to the downside, it’s impolitic to look for a silver lining, but impolitic has never stopped us, so here’s your thought for the day: Law firm partners, even in the most stratospherically prestigious and profitable firms, are not entitled to a lifelong career of every year being better than the one preceding. Capitalism doesn’t work that way. If all those initial screenshots didn’t convince you, I give up.

So don’t be alarmed.

But do dust off those recession scenario planning workbooks you created when we advised such an exercise almost a year ago. Better to have them and not need them than, well, you know.

Photo by Firmbee.com on Unsplash