We distributed this column several weeks ago to our “friends and family” opt-in email list (which has a handsome level of subscribers and is free–what’s taking you so long? [sign up at the foot of our homepage]) but herewith on our public site.

You may not like what you’re about to read.

But we do say loud and clear under “Our promise to our clients” that we will “provide our unvarnished opinions and we will tell you what we think.” Forget what we say. How about, “the unexamined life is not worth living.” (You do remember your high school Socrates, don’t you?)

In a nutshell, I foresee a potential collision between two growing realities in Law Land, neither one desirable or a positive development for firms on their own but which, in combination, may strain a key structural component beyond its designed load level.

First up is the extraordinary, and unprecedented, spike in law firm overhead and fixed expenses over the past year. Culprit #1 has been, duh, the outsized associate compensation increases—which have received blanket coverage—but culprit #2 has been IT expense/investment. Since it’s essentially impossible to roll back baseline compensaton levels without firing people, and since most observers of Law Land would agree that heavier spending on IT is essential, worthwhile, and here to stay, we appear to have jump-shifted to a new, higher equilibrium level of fixed costs.

Jim Jones, director of the Center on Ethics and the Legal Profession at Georgetown University, said a long, deep recession could be particularly painful for some firms that kept up with associate salary increases.

“A lot of firms followed suit on that in a way they maybe couldn’t really afford,” he said, adding: “I think there were some firms that felt obliged to follow the increases dollar for dollar but don’t have the same strengths. And in an economic downturn, their expenses will grow dramatically…so that economic stress is going to come home to roost if the recession comes.”[1]

We’ll return to this data in a moment, but what’s the other piece of this “collision?”

The increased challenges around retaining talent and what I believe is the continued drift, sadly accelerated during the pandemic, of the lawyer/firm relationship driven by (and I would argue) degenerating into one based more on a transactional mindset and less of a reciprocal and bilateral “social compact” foundation.

In a very recent (6 July 2022) column, How law firms can address their legal talent issues, our friends at Thomson Reuters open by noting that while the unheard of attrition levels of late 2021 “may be stabilizing,” it may be because they’ve achieved a new and unhappy plateau, not that they’re tapering off.

flight risk among lawyers remains at uncomfortably high levels. What’s more, key drivers of retention for law firms aren’t always evident and don’t necessarily align with the traditional law firm solution of increasing compensation. The research also indicates that while higher compensation might be sufficient to entice lawyers away from a law firm, it won’t necessarily be sufficient to encourage them to stay, nor will higher compensation address many of the underlying problems that have led to high levels of flight risk in the first place.

I casually asserted at the beginning that law firm overhead has increased at an “unprecedented” rate, but let’s go to the data, shall we?

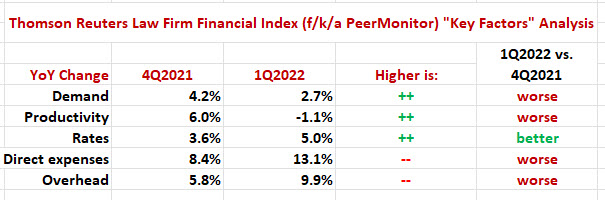

From Thomson Reuters’ most recent release (1Q2022) of their “Law Firm Financial Index,” a summary table we created to pack their five “key factors” into one quick and legible summary:

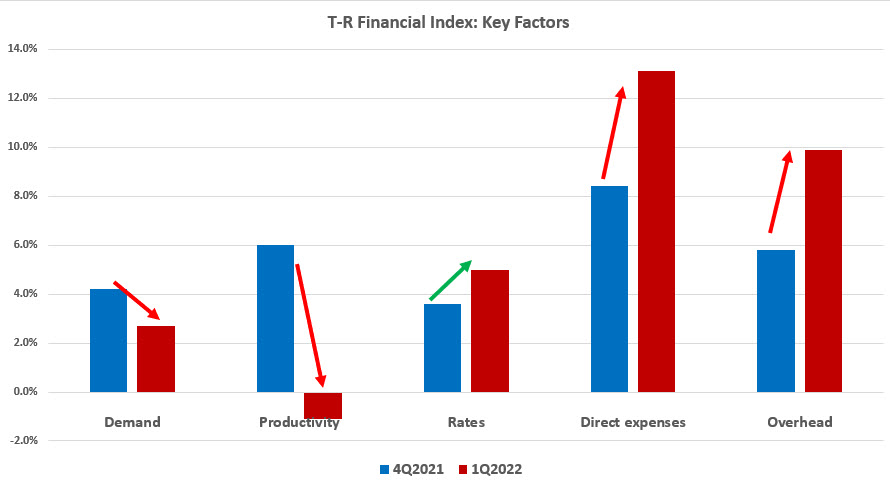

And for those who prefer visual to tabular presentations, the same information (T-R data, Adam Smith, Esq. presentation):

Four out of the five are going in the wrong direction and the only exception, “rates,” is, if you eyeball it, growing below our uncomfortably (and shockingly) high recent run rate of inflation. Seeing rates lose ground in constant dollar terms and declaring that to be good news strikes us as breaking new ground in defining performance down.

So, you may be thinking, these are nice aggregate statistics, but what’s happening really, on the ground?

Not much good right now.

A lead article in The American Lawyer a few days ago, ‘A Lot of People Are Not Busy’: When M&A Slows, the Whole Firm Feels It, discussed the consequences of the M&A practice slowing down in BigLaw corporate departments. (M&A, need I remind you, was the primary locomotive driving growth in activity and revenue for BigLaw throughout the pandemic and into the first quarter of this year.) In a nutshell:

- M&A kicks off a lot of work to ancillary, support, and service practices within the firm;

- Typically, those essential but not marquee practices substantially or almost entirely rely on healthy M&A dealflow to feed them work;

- And when M&A slows, the entire ecosystem of complementary practices (among them labor and employment, tax, real estate, IP, and potentially antitrust advisory services and regulatory response experts) slows down as well–“everything that ties into deal work [falls] off.”

The domino cascade goes like this:

Firms that lean heavily on corporate transactions, like most of the Am Law 100, could see a significant profit dip this year. “If you take 10% off the top, it all comes out of profit,” said Keith Wetmore, managing director of Major, Lindsey & Africa’s San Francisco office.

With Big Law becoming more dependent on corporate practices lately, a fall in M&A work can leave law firms more vulnerable firmwide to changes in the deal market.

[…]Bruce MacEwen, president of legal consulting firm Adam Smith Esq., said he doubted that clients would go to a law firm based solely on its “feeder practices,” and when M&A and corporate practices aren’t busy, “there are a lot of people that aren’t busy.”

Law firm leaders can talk a brave game that this is all to be expected, it’s actually a relief for the overburdened and overworked practitioners who live and breathe M&A, folks will have an opportunity to “do other things: thought leadership, seminars, tidying up,” “it’s to be expected,” and so on, but the longer this slowdown lasts the more conspicuous sky-high compensation costs for not particularly busy people will become.

Now chapter two of this micro-drama: The increasingly transactional, decreasingly loyal and stable, nature of the lawyer/firm bargain.

We wrote not long ago that the data about (a) increased compensation; (b) increased workload; and (c) associate attrition, “is just plain weird.” How so?

We were working off a “stay/go” study out of Thomson Reuters (what differentiates firms whose lawyers “stay” from those whose lawyers “go”) and it turns out that the conventional wisdom is wrongheaded. Specifically:

-

Comparing firms with the highest and lowest growth rates of compensation, associate attrition rates were…indistinguishable. And:

-

The firms with higher billable hours had lower attrition.

What gives?

In a nutshell, lawyers’ degree of loyalty to and “stickiness” at their firms does not depend primarily on their comp, not even their workload. (Industry-wide statistics resoundingly confirm that BigLaw lawyers were billing about ten hours a month more a decade ago than they are now–and no one was writing articles about burnout, the crying need for pay raises, insane rates of attrition, etc.) And as for sheer $$$compensation$$$, every credible HR and employee satisfaction survey across the economy has consistently agreed that comp as a job fulfillment metric ranks no more highly than priority # 6, 7, or higher.

The key differentiator between staying and going revolve around less tangible–but potently real–factors like:

- What “secret sauce” do we provide clients that other firms just can’t?

- What are we building here?

- What does this firm stand for?

- How can we leave this place better than we found it?

- And the all-important, What am I finding here that I could not find anywhere else.

Far too many lawyers at far too many firms cannot answer those questions. The glue has melted, if it was ever there.

A combustible mixture indeed: Unprecedented levels of compensation, breathtaking rates of increase in the direct and variable fixed cost base of law firms, shrinking revenue (in constant dollar terms) or tepid growth at best, and lawyers who’d as soon move across town, across the street, or to a different elevator bank in the same building.

These are the ingredients composing some of the primary pieces of the Fragile Law Firm recipe. Pay attention. Quickly, please.

[1] Facing a Potential Recession, Big Law is More Adept at Weathering a Crisis, The American Lawyer (editorial, published 6 July 2022), available at: https://www.law.com/americanlawyer/2022/07/06/facing-a-potential-recession-big-law-is-more-adept-to-weather-a-crisis/?utm_source=dlvr.it&utm_medium=facebook