Written with Janet Stanton, Partner, Adam Smith, Esq.

In our first installment in this two-part series, M&A, Globalization, and Another Thing, we posited that although M&A is cyclical, and may be turning down from its stratospheric (and unsustainable) peak of 2021, and although globalization seems to have shifted into reverse gear, BigLaw had essentially zero to fear from reduced demand. We noted that deals done may need to be undone, that assets acquired may turn into assets to be disposed of, that global supply chains that need to be wound down or unwound, period, require analysis, documentation, and re-papering in their new form, etc.

But we also threatened to discuss “Another Thing” which could pose a threat to the run BigLaw has had for the past couple of years of hyperactivity.

That Thing, dear friends, is Recession.

We have found over time that one warning signal of recession is widespread confusion within the investment advisory community. A growth environment is, for wealth managers, a very simple, almost trivial, case: Buy tech over stable heavy industry and consumer staples, growth stocks over value stocks, equities over fixed income, anything over gold. Likewise, stagnant environments are, in their own rather charmless way, easy calls: Fixed income over equities, consumer staples and nondiscretionary spending over tech or travel and leisure, back off the business investment and consumer durables sectors, relearn the glamor of cash.

But these days confusion is the order of the day. JPMorgan Chase private client advisory services advertises (this week) an upcoming webinar:

Bank of America private client services opens its investor newsletter with a litany of bad news:

And of course the markets themselves provide nowhere to hide:

And just to complete the circle:

Front and center is of course the challenge facing the Fed: The horses of inflation have stampeded en masse out of the barn with YoY rates–depending on what index and time frame you’re fond of–showing inflation running at as much as the high single digit percentages per year. And the challenge for the Fed, not for the first time by a long shot, is to corral those runaway horses without throwing the economy as a whole into reverse, a/k/a a recession.

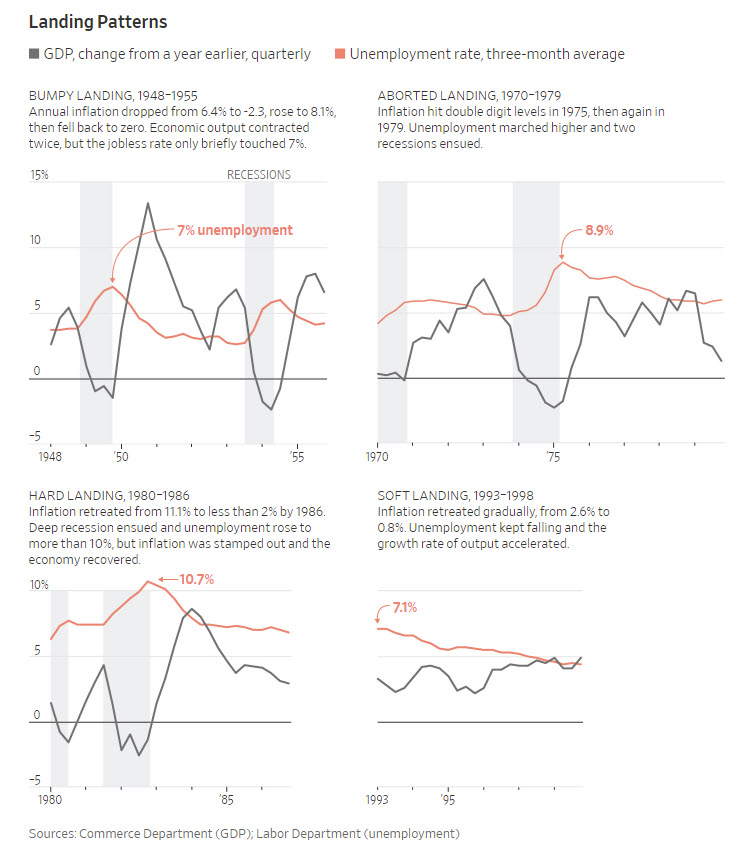

Historically, this has proven one of the most difficult, if not the single most difficult, agenda item for the Fed to fulfill gracefully, in the form of delivering the proverbial (mythical?) “soft landing.”

Again, courtesy of The Wall Street Journal, a quick tour d’horizon shows how hard it has been historically. (Actually, the article these charts are taken from takes an even stronger stand than that: It’s titled, “Hot economy, rising inflation: The Fed has never successfully fixed a problem like this.”

There’s more.