Of late we’ve gotten a number of queries from reporters asking us if we think the M&A/private equity investment tsunami of the last year and a half or more has peaked.

A wise friend once advised that volunteering forecasts could be performed safely so long as you discussed the event or the timing, but not both. With that in mind, we think that yes, the M&A avalanche/frenzy/whatever must hit a peak and enter decline, and some credible indicators are beginning to tell you it already has or must in the near future. Why?

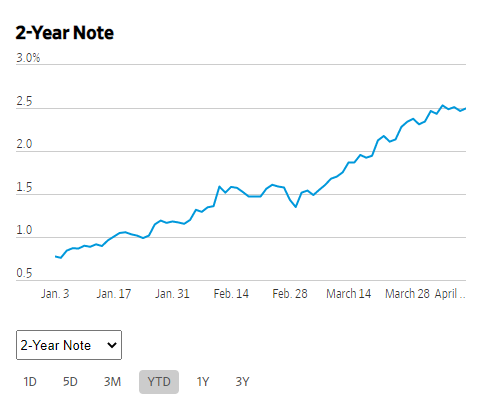

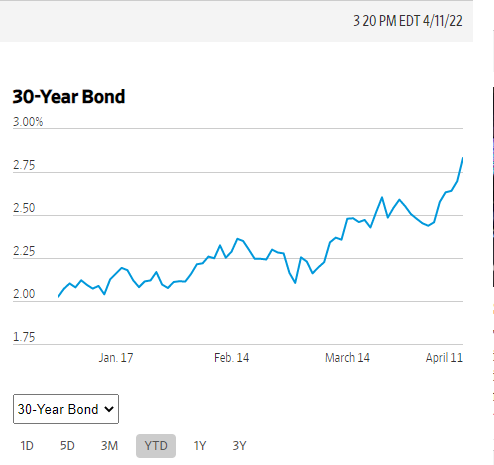

- Interest rates have been at record historic lows for a long time (see below);

- Central banks worldwide (well, China is always its own charming special case) have been beyond “accommodative” for years, with G20 real interest rates in negative territory for an unprecedented duration and to an unprecedented extent);

- Liquidity–investable assets –has been sloshing around the world’s capital markets at, again, historic levels–and whether it’s nominally housed in the City of London, midtown Manhattan, a sovereign wealth fund domiciled in a fortunate country, Greenwich, Connecticut/Silicon Valley/Newport Beach, California, or offshore islands–its holders are demanding that it be productively invested. That is synonymous with “M&A.”

- And we won’t even go into the unyielding human reality that the capacity of deal-makers and deal-doers (BigLaw, we’re talking to you) has long since been exceeded and people are burning out at record rates.

And while we’re at it:

and:

And all of these conditions are getting very long in the tooth at the same time. And, as happens in spikes of excess such as this, they have been increasingly generating their own self-correcting forces and the unyielding gravitational pull of reversion to the mean begins to be visible.

For starters, to cite just one such corrective force, massive liquidity and dirt-cheap borrowing cause asset price inflation and even bubbles, the cure for which is the disease itself. High prices beget less investment. This is the B2B version of the economists’ old joke that “The cure for high prices is high prices.” People find substitutes, cut back on demand, producers/suppliers see profits to be made, new and improved methods of production and economies in the supply chain are discovered, and–you get the idea. When gas hits unnerving price levels per gallon, people can at once drive less, bus or carpool, plan more efficient trips, etc., and in the longer run they can buy an EV, weatherize their home and modernize the HVAC, discover the sartorial riches of sweaters, &c.

In terms of M&A and private equity investments, if an attractive area for investment has been “overbought” (in the charming phrase), pickings are slim, and the remaining acquisition opportunities relatively unattractive, certainly at the prices now being demanded.

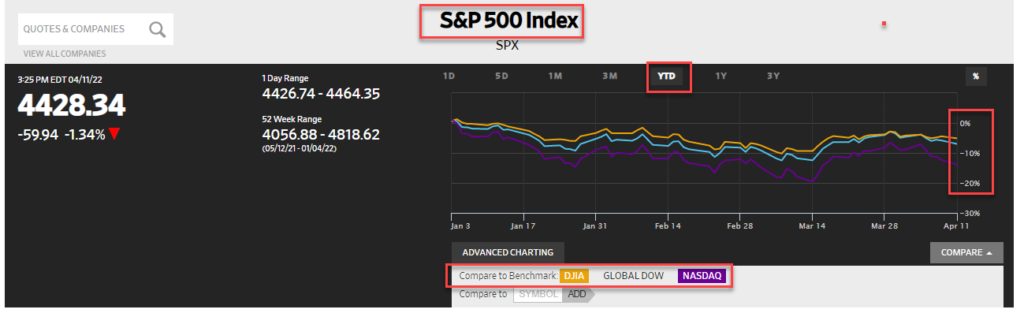

On that note, there’s a general impression abroad that the stock market has taken a big hit: Not so! Not, at least, if you look at the numbers:

For all those reasons, this particular tree will not grow to the sky and early indications are that it may be close to exhausting its available headroom.

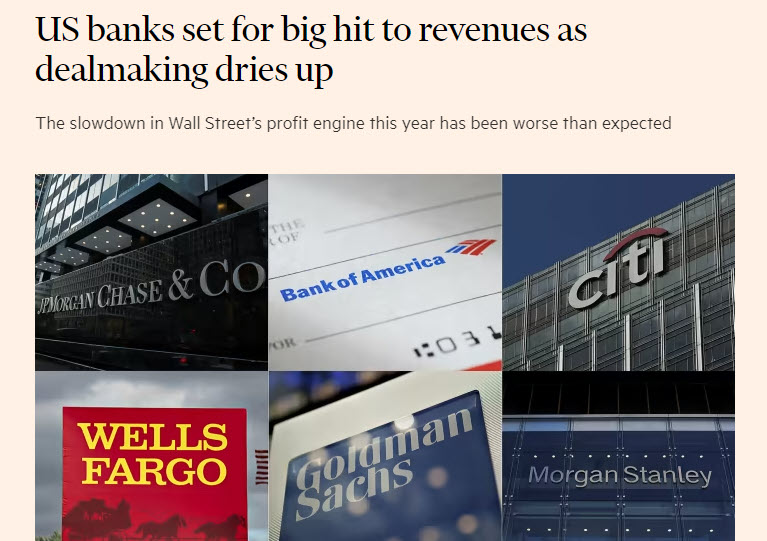

Earlier this week, the FT reported on its front page that banks including BofA, Barclays, Deutsche Bank, Goldman Sachs, and JP Morgan Chase were seeing M&A activity plunge in the first quarter of this year. Representative is this remark from a senior research analyst at Deutsche Bank: “we were probably expecting capital markets revenue to be down 10-20% [but] now we’re down 30-50%. It’s pretty materially weaker.”

So am I foreseeing dark days for BigLaw as the M&A frenzy struggles to maintain momentum as the course ahead of it gets steeper and steeper? Not at all! Some deals that needed to be done may need to be undone. Assets acquired often become assets liquidated. There may not be a revolving door between the M&A practice group and the bankruptcy practice group, but there’s a history of migration back and forth over that border.

M&A is famously cyclical. Alert the media!

A more enduring shift has been underway for at least five years and the Russian invasion of and depravities in Ukraine have thrown gasoline on this particular smoldering fire.

I speak of the slowdown and now reversal of globalization as a worldwide phenomenon.

According to The Economist (19 March 2022, Globalization and autocracy are locked together–for how much longer? :

The strain on globalisation comes on top of the effects of the financial crisis of 2007-09, Brexit, President Donald Trump and the pandemic. For years measures of global integration have gone south. Between 2008 and 2019 world trade, relative to global GDP, fell by about five percentage points. Tariffs and other barriers to trade are piling up. Global flows of long-term investment fell by half between 2016 and 2019. Immigration is lower too,

David Brooks in the NYT wrote last week (Globalization is over) that:

Sure, globalization as flows of trade will continue. But globalization as the driving logic of world affairs — that seems to be over. Economic rivalries have now merged with political, moral and other rivalries into one global contest for dominance. Globalization has been replaced by something that looks a lot like global culture war

But wait, aren’t the forces of commercial integration and worldwide cross-border trade too powerful and entrenched to reverse? Maybe, but I for one am not so sure; and I seem to have good company.

The “globalization is unstoppable” thesis reminds me a bit of the infamous predictions before WWI that great power conflict would be so costly it had become unthinkable. Well, costly it surely was. But a wide range of disparate and mutually reinforcing trends have been eating away at the foundations of globalization since at least the GFC of 2008. In fact, according to Bloomberg, trade’s share of global GDP reversed its upward trajectory in that very year and has been falling for the past decade+. The GFC itself notably launched, or at least made manifest, a populist backlash against efficiency and in favor of “Made in [Home Country].” The US was hardly the worst about this; President Xi Jinping has his own “Made in China 2025” program, which is motivated not by economic optimization of anything, but by giving China the leeway to operate more autonomously.

A few other developments, or, shall we say, attitude adjustments, have helped put globalization into reverse:

- If the Covid-19 coincident supply chain crises–in everything from semiconductors to fertilizer commodity components to shipping containers themselves in an expression of diabolical humor–has taught Global Corporate Land anything, it has taught them that “nearshoring,” a bit more resilience and redundancy (more inventory, more storage space, operating under the assumption of longer lead times) is a good thing. The miracle of just-in-time manufacturing and supply chains has no clothes. Erego: We don’t need to so globalized as we thought.

- And in a far more existential attitude change, the West (which is not a geographic adjective but, again, an attitudinal adjective–Japan is “West” in this sense as Venezuela is not) has realized that liberal democracy, freedom of speech and religion and petition, the rule of law, and the sanctity of individual human beings ,is not a disposable or transitory world-view.

- Similarly, autocracies and kleptocracies are hunkering down, reinforcing their own walls, and finding common cause in denouncing the historic and surely future depredations of the West, as well as caricaturing them in ways only they can because of their totalitarian media control.

In other words, business is moving away from globalization as is cultural, political discourse, and nation-states.

Russia’s invasion of Ukraine for not even the most tissue-thin of pretexts has shocked the world: First by its reversing the course of international law and diplomacy and turning the clock back a century or more, but second by the totally unforeseen discovery of a united sense of purpose and common bonds in the West. Who would have imagined that a remilitarizing Germany would be widely seen as a cause for relief if not deep satisfaction and relief. (By Us, if not by Then–Germany’s arming up has never been a terrific omen for Russia.)

So the M&A boom may have peaked and globalization may have been thrown into reverse. Seismic developments–at least the second is–but do law firms as private for-profit have anything to fear? I don’t think so.

Every time the world ratchets up to a new level of complexity more lawyers are required as midwives of the future and last rites givers for the past. New supply chains to be negotiated and old ones to be wound down! Plants, people, warehouses, and capital to be relocated and redeployed! Contracts to be undone and redone! Currency swings to be accounted for!

In Part 2 of this two-part series we’ll talk about something that I do think is threatening. It always has been and it may be on the horizon again.