We’ve had our corporate checking account with Bank of America for over 15 years. This is the story of why it’s no longer there.

A few weeks backI got a letter in the mail from BofA and luckily did not toss it aside unopened as very-likely-spam. It announced that our account was being closed, that I should not try to write any checks or make any withdrawals, and more:

- They would not accept any direct deposits;

- Our debit cards were useless;

- Online access to the account was shut off;

- and that their decision to close the account was “final.”

Lastly, it included hostile language to the effect that “the bank’s decision” could have an “adverse impact” if we tried to open any other, new account with “other financial institutions for up to five years.” It concluded by promising that a cashier’s check for the balance on deposit in the account (well over $100,000, which is real money to us) would be dispatched to us in the mail.

No reason, no explanation.

On the back were three (800) numbers to call for further information:

- One was at BofA itself;

- One was at ChexSystems (which I’d never heard of)

- and one was at Early Warning Systems (same)

The next morning I called all three.

First up was BofA; the rep was quick to identify the account and the issue but refused to give me one word of information about what was going on, repeating robotically the substance of what was in the letter plus adding that the bank could close any account at any time. “That’s the way it should be,” I finally expostulated, “but I doubt you choose our account at random. There must have been a reason; just tell me why.” Silence. Since it would be futile to continue, I hung up.

Next were ChexSystems and Early Warning Systems.

ChexSystems)is a nationwide specialty consumer reporting agency under the federal Fair Credit Reporting Act; our ‘ clients regularly contribute information on closed checking and savings accounts. ChexSystems’ services primarily assist its clients in the risk of opening new accounts.

Early Warning Systems,assists financial institutions,in detecting and preventing fraud,Co-owned by Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank and Wells Fargo.

With both, I went through the extensive online security check to get to the same result: Nothing whatsoever in our record that could be a blemish.

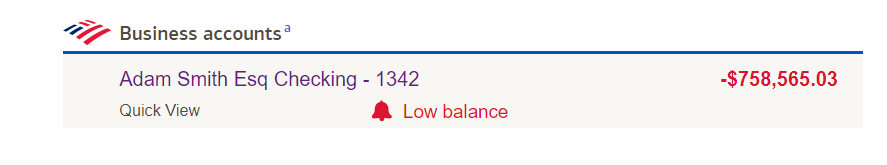

The next day I thought it might be prudent to check the status of our BofA account online and this is what I saw:

“Low balance??!!” (Your imagination can fill in my creative other reactions.) I could only conclude one thing: BofA thought we owed them over three-quarters of a million dollars.

Over the next 10 days, every attempt to get information out of the Bank ended in futility.: Try running a company that among other things pays people and gets paid by other people without a bank account or access to your own funds. “Trust us” only gets you so far.

Then one morning I logged in for the ritual of checking the account, and, mirabile dictu, our funds were back, the enormous negative balance had disappeared, and the status of the balance was “available.” I walked out the door to the branch to get a cashier’s check and close the account.

But one more gratuitously insulting step awaited. The branch manager wouldn’t believe the funds were ours even though when I asked him to print out what he was seeing, it was identical to what I saw on my computer and phone. The entire balance on deposit was “available.” Not good enough. I called the risk hotline and put them on with the manager.

Got the check, walked two blocks down Broadway to Chase, home of our new Adam Smith, Esq. corporate account..

I also closed my personal account at BofA the morning after I received the letter that kicked all this off. The same manager didn’t ask me why I was leaving after 15 years. After a few beats, I asked him, “Do you wonder why I’m closing the account?” He turned away and left without a word.

When we opened all new accounts at Chase, it was in a bright, large, and airy branch with high ceilings, the thrum of activity, a seating area with a large-screen TV with volume muted showing business news, weather, and the occasional Chase promos, cubicles with bankers on one side, ATMs front and center and in the large foyer before you entered the branch proper, welcoming teller windows, enclosed but glass-walled offices for the branch manager and JP Morgan private bankers. Inviting. (The BofA branch, by contrast, was low-ceilinged, dim, prominently featuring an armed security guard by the door, and cramped.)

The Chase branch manager insisted on helping us personally, and asked, “What did you love about your previous bank?” The answer of course was less than nothing, but what a fabulous question! She also gave us her card (with personal, non-Chase cellphone number) and insisted we should call her personally if we thought she could help with anything.

We had come to a business that ran based on client relations. Home.

- Coda 1: To this day we have no clue why BofA closed our account; it’s destined to remain their infuriating secret.

- Coda 2: If you think we will ever have a nice thing to say about BofA (should anyone ask….just sayin’), three guesses.

- But there s of course a far larger moral here about client service. The BofA manager’s stonewalling and hostile attitude towards his clilents, and the Chase manager’s curious, engaged, and personally committed to helping attitude, both come from the top of their organizations. They may not be senior executives, but they have been with their organizations long enough to thoroughly imbibe what works and what doesn’t within each firm; they’re both players on their team, and embody what coaching, spoken and unspoken, they have absorbed.

- And what if you have “bad news” for a client (BofA certainly put us through a scarring experience). You may be tempted to stonewall and leave the client no choice but to assume your firm acted capriciously and randomly, if atrociously. Yet how different would we feel if someone–anyone–at BofA had said, “I know this has to be very difficult and unpleasant for you; I wish I could do something about it but it’s out of my hands.” True, risk-free to say, human, eye to eye, takes much of the emotional heat out of the situation. But it was too much for them.

Bonus round:

Ten days or so ago, we took our first business trip/plane flight in > 20 months: Four days at an AmLaw 100’s annual partner meeting in Orlando. It was positively joyous being among hundreds of human beings united in a common cause again. Powerful.

We flew Delta, as we always do whenever possible.

As we taxied out from the gate at LGA to the runway, the lead flight attendant came down the aisle looking at her smartphone and looking at passengers. When she got to me she asked, “Mr. MacEwen?” “Yes?” “Welcome back from everyone at Delta; we’re glad to see you again.”

Of course I’ll never forget this and our loyalty to Delta is doubled and redoubled, but another far more substantive point: This face to face service provider/client conversation is the result of a programmatic initiative by Delta to give special attention to its most frequent fliers; they built an employee-facing app to make this possible. Not serendipity, not chance, not because this cabin attendant on this flight happened to recognize me from two years or more earlier.

A client relationship management program with the front line service providers all in. What a concept.

And it starts at the top.

I am going to take the unusual–make that first ever–step of reproducing some of the numerous comments I got on this column through LinkedIn. Because the friends who commented via that medium probably had no intention of seeing their remarks reproduced here, I have removed any identifying information but otherwise I have quoted them verbatim.

This column generated an unusually high response rate, about which I have a theory. See separate comment to follow.

Dear Bruce, great story, thank you for sharing this! It reminds me of a wonderful keynote of the late Prof. Sumantra Ghoshal

labeled “The Smell of the Place” on the power of leadership and corporate culture – and why some companies manage to introduce and maintain a genuine client facing culture, and others don’t. Here’s the Youtube-Video: https://youtu.be/YgrD7yJwxAM

___________

Powerful story.

Mr MacEwen we are always happy to see you here.

________________

We never should have uttered the words “Too big to fail” – it got to their heads.

_________________

I have a very similar story on BAML’s absolute despicable behavior.

Support you wholeheartedly with your support of Delta. Have my unconditional loyalty.

_______________

It’s more common than you’d think. Well done for getting the money back and getting the hell out.

__________________

It’s not just them, unfortunately.

__________________

Thanks to one and all, friends!

My promised follow-on with my theory as to why this column generated so many comments.

I revealed, to my loyal readers, without reservation, a horrible experience in my business life which left me feeling completely helpless. That is an extraordinary, almost unthinkable, sensation for me in my professional life–and I suspect the same is true for most if not all of you. But I was, for a time, completely at the mercy of Bank of America, with no plausible recourse or alternative but to wait until the demigods of the Bank decided to hang my company high or relent.

About what I have no idea and I fully expect I never will know.

Separately, but nearly coincident in time, we experienced a total WiFi meltdown here in our offices which last nearly four days. (Four days without WiFi may seem, and is, resoundingly a First World problem, but when your company lives and dies online, and your printers, sound system, cell phones [VOIP], and everything short of your dog and stove are disabled, it’s a problem.)

BUT: I had resources. I could call Spectrum (our internet service provider), contact Google (our super high-speed mesh WiFi router and hot spot/repeater provider), get a technician over here to diagnose and sniff out the problem from the fiber optic line’s point of entry into the building all the way through to our modem, etc.)

In other words, I had power, if not exactly control, over the situation. (And the happy bottom line is that our network topology is far simpler, more direct, faster, and more powerful than before–and we have less equipment and own everything now.)

But with BofA I learned an invaluable lesson: Imagine how many Americans, Brits, Canadians, [EU-]Europeans, and others who are privileged enough to live in comparable countries have not painful interregnums of helplessness but long sieges and years and even decades.

Nothing like it to humble you.

Am I “glad” it happened to us? Yes, oddly.

Businesses should not boast that the customer is always number one and then treat their actual customers like Number Two.