Scorching new data out on the volume of deal-making over the last 12 months or so, from Refinitiv courtesy of The Wall Street Journal (“Cash-laden companies are on an M&A Spree”).

Ready for some once-in-a-lifetime-career numbers?:

- In the first six months of 2021, businesses spent more on mergers & acquisitions involving US companies–$1.74 trillion–than they had in over four decades [when the data series they’re citing was first calculated–Bruce].

- The comparable figures for the first six months of the last two years were:

- $1.28 trillion in 2019, or about 30% smaller;

- and $512 billion in 2020, barely one-quarter as much.

- The total count of deals “with US involvement” was 9,725, also a new high.

And a voice from the front lines:

“The market is clearly hot,” said Luca Zaramella, the chief financial officer of snack-foods maker Mondelez International Inc., which in May agreed to spend about $2 billion on Chipita SA, a European snacking company. Mondelez plans to finance the transaction with new debt, existing cash and $1 billion it received after selling down part of its stake in Keurig Dr Pepper Inc.

“The cost of capital is pretty compelling,” Mr. Zaramella said. The pandemic delayed the companies’ negotiations. “I feel more comfortable having taken the time,” he said.

You’ve heard me say this before, but it’s always reassuring to have an outsider voice confirmation:

“There has probably never been easier access to capital,” said Brian Salsberg, global head of the integration practice at professional services firm Ernst & Young.

Need we add that SPACs don’t hurt all this musical chairs? A well informed estimate (Refinitiv’s) of the number of SPACs globally is 500, many of course US-based or with a large proportion of US DNA.

Occam’s Razor would counsel that the simplest explanation is often the best, and here we have it: Cash is burning holes in people’s pockets:

And we’ll give the last word to someone whose billable hour targets for the year are not, I’m highly confident, under threat:

“You still have a lot of runway for this cycle that we are in,” said Noah Kornblith, a partner at law firm O’Melveny & Myers.

Stepping back, there are actually two types of deals being done and two separate drivers for each. On one side we have “strategic” acquisitions, almost exclusively performed by F500/Global 1000 corporations for, well, strategic reasons particular to their business; and on the other side we have “financial” M&A, almost entirely the domain of private equity, hedge funds, SPACs, and other varieties of financially engineered programmatic efforts.

Contrast Mondelez, a snack company, acquiring a snack company; Amazon [Prime Video] buying MGM for its legendary movie library, Discovery merging with AT&T’s erstwhile subsidiary Warner Media, or Kansas City Southern’s proposed merger with Canadian Pacific Railway as against the SPACs and private equity firms, loaded to the gunwales with cash, deploying it on deals such as Medline’s purchase by a P/E consortium including GIC Pte Ltd., Abu Dhabi Investment Authority, and the Carylyle Group.

Our question for today is, “So what?”

So lots, particularly when it comes to the mix of law firms most deeply engaged in each category of M&A. We’ll get to that, but first a quick overview of what’s been happening

Helpfully, Bloomberg just published a story giving us some detailed insight into the internal dynamics of this “sale of corporate control” market. It opens with a throat-clearing recap of the sheer volume of deals, which to me at least prompt a sharp intake of breath and limbic system responses akin to the legendary “You’re going to need a bigger boat.”

Deal activity soared to record levels in the first half of 2021, a giant leap from the first six months of 2020 that’s put this year on track to be one of the busiest periods in memory for transactions practices at the nation’s high-end law firms.

Buyers announced $2.5 trillion in deals so far this year, propelled by a resurgence of business and consumer confidence as well as mega deals and a growth in private equity work. That’s more than double the $1.2 trillion announced in the first half of 2020,

A final observation about what’s driving these two types of deal-making:

- On the strategic/corporate side, if the Covid Pandemic taught business (and all of us) anything, it’s that the way you’d always done business might need to change–and could change. So as the world begins to emerge from the worst of it, corporate leadership, the C-suites, and the boardrooms, are talking about how to nimbly reconfigure themselves. No surprise that acquisitions (or divestitures–see AT&T/Warner Media–are red-hot.

- On the financial/Private Equity side, we all know (because you’ve read this far, if for no other reason) that investable capital looking for a home has perhaps never been so plentiful, nor interest rates so low for so long. And investors want their portfolio managers to, well, invest!

Now let’s finally look at how different the Top 10 roster of law firms is in each of these areas.

First, the “deals by principal,” or strategic cohort:

- The “classic club members” you’d expect to see on lists like this: Wachtell, Simpson Thacher, S&C, Cravath

- The pair that often seem to appear side by side-ish, no matter how dissimilar their business models: Latham and Kirkland & Ellis

- Paul Weiss [#7]

- And a somewhat varied but impeccably credentialed final thee: Skadden, Fresfhfields, and Sidley

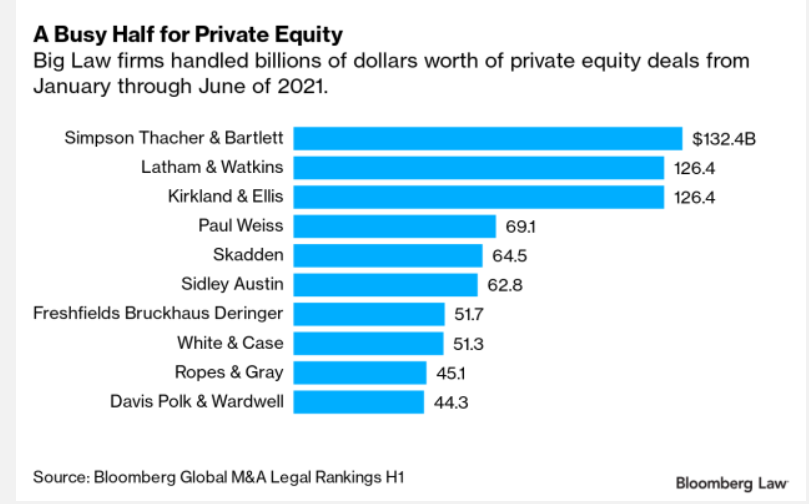

Then contrast the P/E Financial driven deals:

- Simpson Thacher, Latham, and Kirkland & Ellis at the top–all with their “go-to” P/E practices

- Paul Weiss jumps from #7 to #4–because they also have a strong P/E practice, But the firm lacks the century-old roots of an S&C or a Cravath representing corporate America. Paul Weiss didn’t get serious about building a corporate practice until about 15 years ago, but they’ve made up for lost time

- And three wonderful firms appear out of nowhere on this list, that were nowhere to be seen on the earlier one: White & Case, Ropes & Gray, and Davis Polk.

Understand the point I’m making. It’s not that any of these firms is “deprived” by appearing on one list and not the other, or high on one and low on the other. No, the point is that law firms, as individuals, have followed different paths and, at the risk of exaggeration, lived different lives. No wonder they end up in slightly different positions.

Taking the current sample at face value, all massively successful market positions. But the numbers represent just a snapshot of one point in time: The final score of the game doesn’t reveal how the players got to where they did.

If one aspires to manage strategically, God is actually in the details.