Contrast Mondelez, a snack company, acquiring a snack company; Amazon [Prime Video] buying MGM for its legendary movie library, Discovery merging with AT&T’s erstwhile subsidiary Warner Media, or Kansas City Southern’s proposed merger with Canadian Pacific Railway as against the SPACs and private equity firms, loaded to the gunwales with cash, deploying it on deals such as Medline’s purchase by a P/E consortium including GIC Pte Ltd., Abu Dhabi Investment Authority, and the Carylyle Group.

Our question for today is, “So what?”

So lots, particularly when it comes to the mix of law firms most deeply engaged in each category of M&A. We’ll get to that, but first a quick overview of what’s been happening

Helpfully, Bloomberg just published a story giving us some detailed insight into the internal dynamics of this “sale of corporate control” market. It opens with a throat-clearing recap of the sheer volume of deals, which to me at least prompt a sharp intake of breath and limbic system responses akin to the legendary “You’re going to need a bigger boat.”

Deal activity soared to record levels in the first half of 2021, a giant leap from the first six months of 2020 that’s put this year on track to be one of the busiest periods in memory for transactions practices at the nation’s high-end law firms.

Buyers announced $2.5 trillion in deals so far this year, propelled by a resurgence of business and consumer confidence as well as mega deals and a growth in private equity work. That’s more than double the $1.2 trillion announced in the first half of 2020,

A final observation about what’s driving these two types of deal-making:

- On the strategic/corporate side, if the Covid Pandemic taught business (and all of us) anything, it’s that the way you’d always done business might need to change–and could change. So as the world begins to emerge from the worst of it, corporate leadership, the C-suites, and the boardrooms, are talking about how to nimbly reconfigure themselves. No surprise that acquisitions (or divestitures–see AT&T/Warner Media–are red-hot.

- On the financial/Private Equity side, we all know (because you’ve read this far, if for no other reason) that investable capital looking for a home has perhaps never been so plentiful, nor interest rates so low for so long. And investors want their portfolio managers to, well, invest!

Now let’s finally look at how different the Top 10 roster of law firms is in each of these areas.

First, the “deals by principal,” or strategic cohort:

- The “classic club members” you’d expect to see on lists like this: Wachtell, Simpson Thacher, S&C, Cravath

- The pair that often seem to appear side by side-ish, no matter how dissimilar their business models: Latham and Kirkland & Ellis

- Paul Weiss [#7]

- And a somewhat varied but impeccably credentialed final thee: Skadden, Fresfhfields, and Sidley

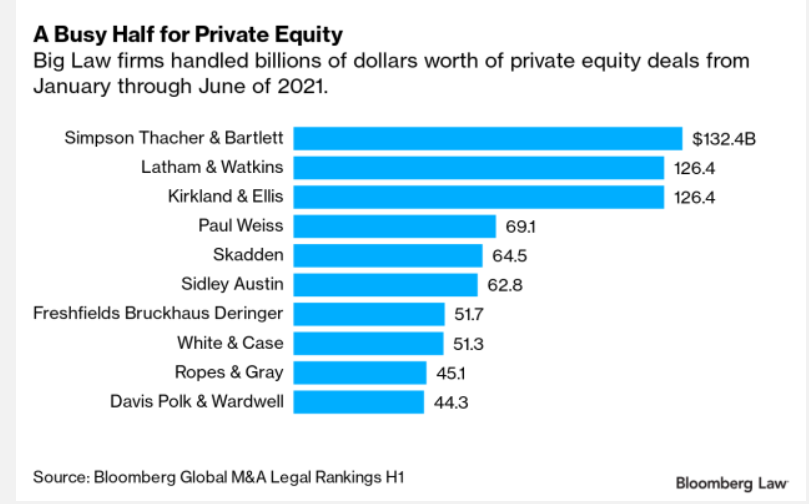

Then contrast the P/E Financial driven deals:

- Simpson Thacher, Latham, and Kirkland & Ellis at the top–all with their “go-to” P/E practices

- Paul Weiss jumps from #7 to #4–because they also have a strong P/E practice, But the firm lacks the century-old roots of an S&C or a Cravath representing corporate America. Paul Weiss didn’t get serious about building a corporate practice until about 15 years ago, but they’ve made up for lost time

- And three wonderful firms appear out of nowhere on this list, that were nowhere to be seen on the earlier one: White & Case, Ropes & Gray, and Davis Polk.

Understand the point I’m making. It’s not that any of these firms is “deprived” by appearing on one list and not the other, or high on one and low on the other. No, the point is that law firms, as individuals, have followed different paths and, at the risk of exaggeration, lived different lives. No wonder they end up in slightly different positions.

Taking the current sample at face value, all massively successful market positions. But the numbers represent just a snapshot of one point in time: The final score of the game doesn’t reveal how the players got to where they did.

If one aspires to manage strategically, God is actually in the details.