Two more data series and then I’ll offer my hypothesis:

This is the 10-year T-Bill rate going as far back as the data series runs–to about 1960, or six decades of data. It has never been so low.

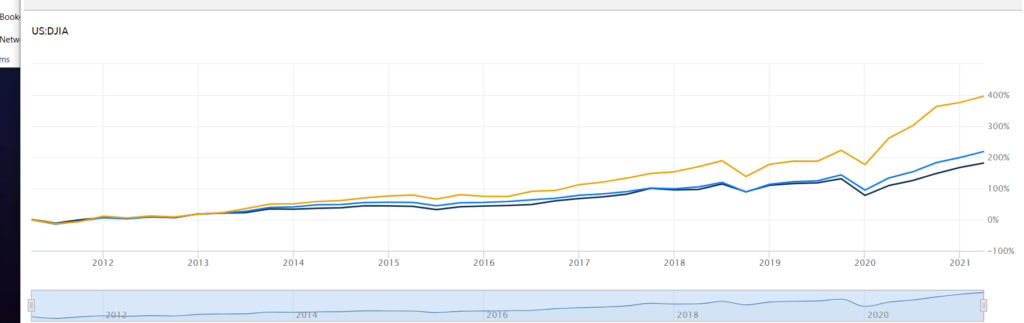

So what? So corporations, hedge funds, private equity, investors and acquirers of all types have the cheapest access to cash in anyone’s memory. And don’t forget the DJIA (black), S&P 500 (blue), and NASDAQ (yellow) have all taken off. Yes, cash and debt are cheap for funding acquisitions, but why not do it with some stock as well? It’s very valuable indeed compared to historic experience.

So this adds up to a very healthy US economy and loads of cheap dry powder for M&A or other investments. Heck, just take the opportunity to issue a lot of bonds! You never know when you might need the money.

The magnitude of the deal-making is beyond impressive. as the always-reiiable Patrick Smith reports in Crushing It (and this relates directly back to the “senior corporate partner” in London who introduced this column

According to financial data company Refinitiv, May became the third consecutive month with over $500 billion in global activity while also allowing the cumulative total to exceed $2.4 trillion through the first five months of 2021. The May 2021 total was four times the activity of May 2020.

That $2.4 trillion number is three times the YTD value from last year.

May of 2021 also saw 78 deals north of $1 billion announced, which is the seventh highest total since Refinitiv started keeping records in 1980. The combined value of those deals was $416.2 billion, showing that big deals still power the overall market.

There have been 428 deals announced thus far in 2021 that were over $1 billion, compared to 131 the same time last year. There have also been 82 deals announced that were over $5 billion.

Finally, it’s not just corporate deal-making that’s hot, although it has tended to hog the spotlight. Here’s a quick unordered list of some of the other practice areas/industries that are busier than ever:

- Cybersecurity (duh)

- Commercial real estate (wondering what to do about those central city skyscrapers that just took a 20% haircut in value, or that shopping mall that might as well be sold for scrap?)

- Litigation of every stripe:

- employment

- supply chain disruptions

- insurance coverage for pandemic losses

- garden variety breach of contract–all kinds of contracts

- EU/DOJ antitrust investigations of Big Tech and more

- A groundswell of support among developed countries and the G-7 to “harmonize” (and, er, actually collect) taxes on multinationals

- SEC enforcement that isn’t a paper tiger

- The (possibly) upcoming gold mine of infrastructure work

That’s the core of my hypothesis. Covid-19 has caused untold death, misery, destruction of dreams, and more, and it’s far too soon to predict it’s done with us. But it was not a torpedo to the economy. File this under “be careful what you wish for.”

And did I forget to mention one last thing without which none of this would be possible? The world figured out how this whole “WFH’ thing could, yes, Work.

Yep, the economy is likely going to roar for a few years here. Inflation and interest rates bear watching over say 18-24 months out. But there don’t really appear to be any structural barriers to robust top-line GDP growth.

Moral of the story, don’t bet against the American consumer?