For the armchair economists in the crowd, the geopolitically curious, or faithful leaders of law firms wondering whether they should plant a, or more, flags abroad, how would you instinctively answer that question? Does the US sell more legal services abroad than it buys, or vice versa?

Recently I reported that the new, 2021 Annual Report Recent Trends in US Services Trade, faithfully published every year since 1993 by the United States International Trade Commission, had come our way. Where if not here to find the answer to our questoin?

But first, note the prominence they give to NewLaw, not a topic we would necessarily have anticipated they would touch upon.

Chapter 3 of the report (starting at p. 61) is titled New Business Models and Mode of Supply Shifts in Professional Services, and here’s what they have to say right off the bat about NewLaw:

This chapter highlights three professional services sectors that have been making changes in the way services are provided in their industry, whether by adopting new business models and supply arrangements or by shifting from providing services in person to offering them online. Some of these changes were prompted or accelerated by the pandemic; others are changes that have been occurring for reasons unrelated to the pandemic. For example, the growth of alternative legal services providers has diversified the type and scale of firms that provide legal services.

And this, two pages on (citations omitted):

“Alternative legal services providers” (ALSPs) is a broad term, encompassing a diverse group of companies that supply certain types of legal and related services but are not full-service law firms. As a group, ALSPs have grown faster than traditional law firms in recent years, as evidenced by their growing use by law firms and corporations, the adoption of in-house ALSPs by some law firms, and the increasing competition between law firms and accounting firms. Their growth has been facilitated by advances in information technology and ALSPs are frequently characterized by their adoption of new and sophisticated technologies as well as their related efficiency and ability to manage high volumes of work. They have been categorized into the following segments: (1) legal process outsourcing firms, both independent and affiliated, (2) companies that offer flexible staffing services, and (3) providers of managed services, which offer clients ongoing services (versus temporary or project-based services). Examples of companies in each segment include Integreon (legal process outsourcing), Axiom (flexible staffing), and Elevate (ongoing managed services), though all appear to provide overlapping services on a variety of flexible timeframes.

Good stuff, but back to our question about the US’ balance of trade in lawyers.

OK, the USITC report doesn’t break out “lawyers” specifically, but you can infer with confidence where we’d fall on the map.

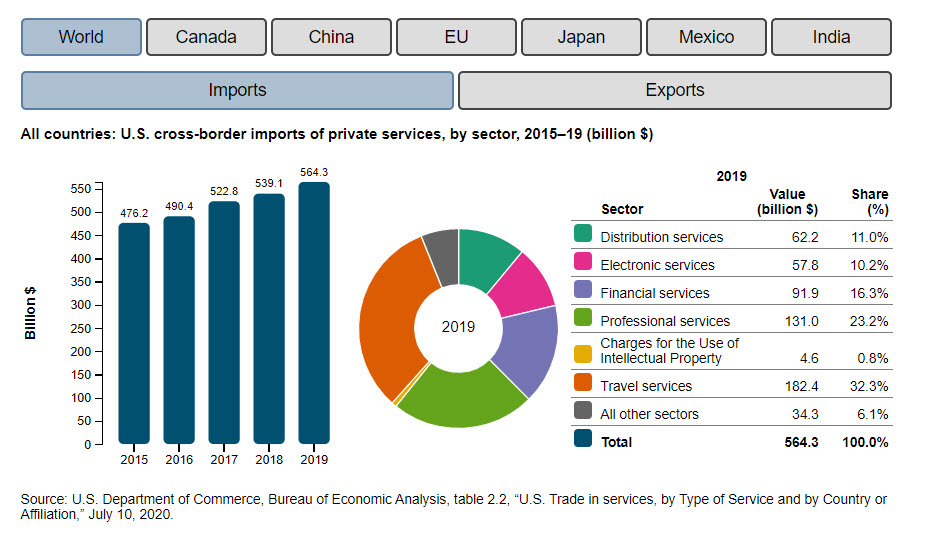

The headline news is that the US shows a vibrantly healthy trade surplus in services. Here are the figures for imports to the US in 2019–$564 Billion:

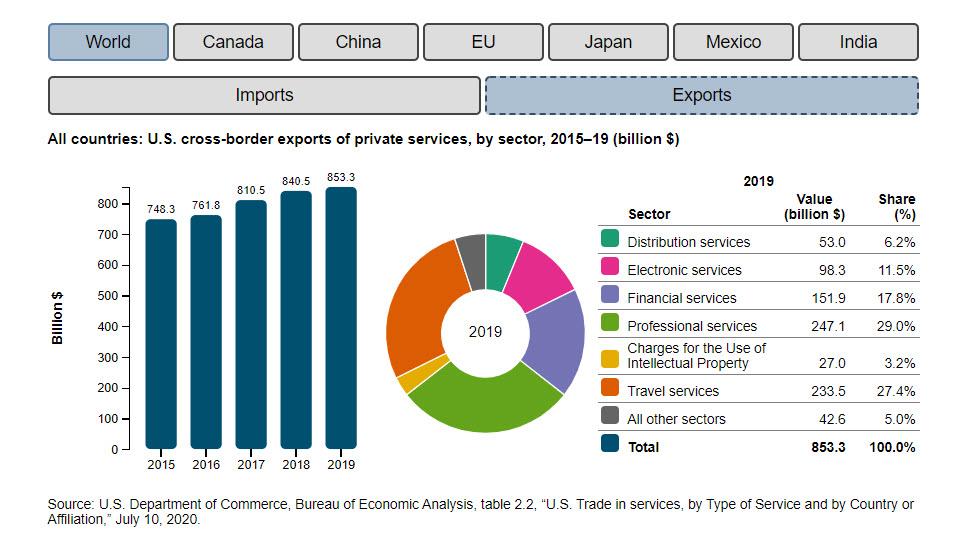

And here the exports from the US: $853 Billion:

Just looking at professional services, we import $131 Billion, almost three-fifths from the EU:

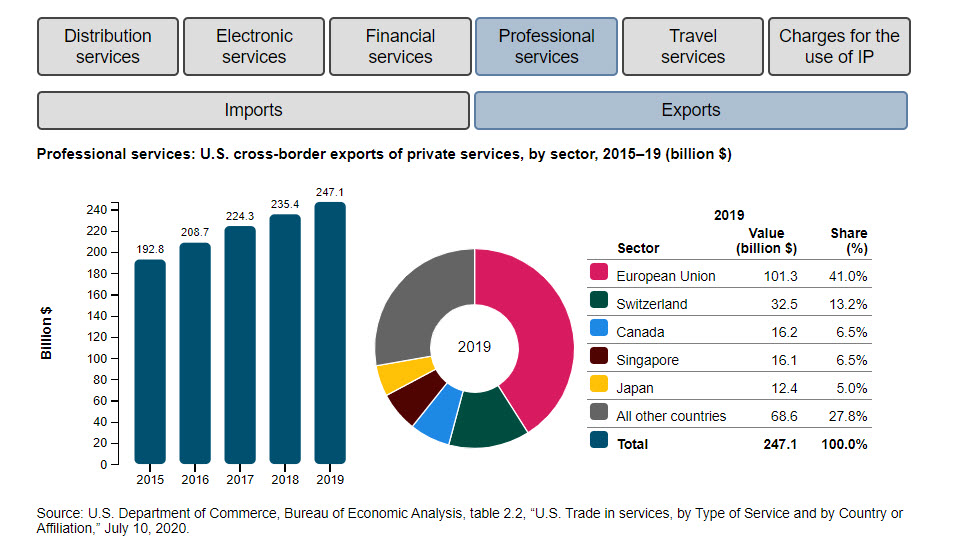

And we export $247 Billion, more than half to Europe:

Evidently, the US has a “comparative advantage” in lawyers; thank you, David Ricardo. This might not be surprising, but we find the magnitude noteworthy.

And yes, I understand the USITC is measuring “professional” and not “legal” services, but the ~150% surplus of exports over imports is too large to imagine that legal services goes the other way and that we import more lawyering than we export.

Maybe all you US-based firms should open another overseas office.