We find ourselves from time to time wondering about many things:

- Will Moore’s Law ever hit a wall?

- When will the last print edition of The New York Times be published?

- Could Lord General Cornwallis have escaped the French/American pincer movement at Yorktown and gone on to win the war for King and redcoats?

- Are Social Media a dagger to the heart of civilization?

- And, how exactly does the “intensity” of the application of the Rule of Law and legal services vary around the world?

Some things are imponderable but that last question would lend itself to nothing more than some good old-fashioned solid data. Except we could never put our hands on everything we needed.

That is before last week, when the just-released 2021 Annual Report Recent Trends in US Services Trade, faithfully published every year since 1993 by the United States International Trade Commission, hit our desk.

It enabled us to finally pursue our mission of wrapping some data around the question of the relative “intensity,” or penetration, or scale, of the legal services sector in various regions of the world. I won’t be so audacious (or over-reaching) to suggest that this has anything to do with the power of The Rule of Law; let’s just be content to consider it a rough proxy for how much various countries are predisposed to “lawyer things up.”

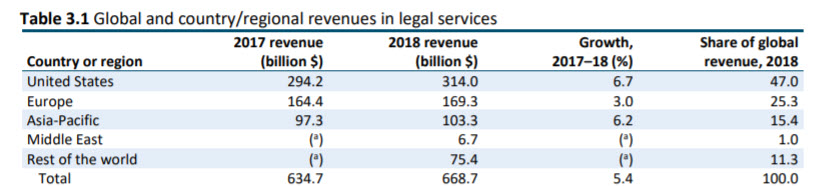

Here’s half the data we need:

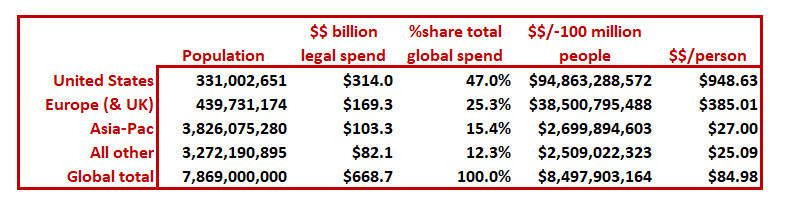

Using any number of widely available sources of (a) worldwide; and (b) country by country, population, together with the USITC’s handy listing of which countries it deems “European,” “Asia-Pac,” etc., here’s the punchline:

Surprised?

We were, and we were not. Nothing surprising in the least that the US is the most lawyer-centric economic model in the world, nor that “All other” (mostly Africa, the Middle East, and Islands and Archipelagos) is the least lawyer-centric. But we honestly anticipated Asia-Pac to be a bit more lawyer-heavy. (The USITC specifies that it includes Australia, China, Hong Kong, India, Indonesia, Japan, the Philippines, Singapore, South Korea, Taiwan and Thailand, as well as smaller players–China is just over half [50.7%] of all of Asia-Pac.)

And the scale of the differences was something we had not seen coming: It was within the range of reason that the US would be roughly three times as lawyer-intensive as Europe, but 35 times more than Asia-Pac?

I leave it to you whether to reassess your Asian office footprint–and granted, much of the Asia-Pac demand for lawyering that the Global 100 firms where many of the readers of Adam Smith, Esq. come from is actually driven by clients headquartered in the US or the EU. To that extent, the “indigenous” legal spend in (say) Japan or South Korea seriously understates the degree to which lawyers are in fact key players at the corporate boardroom tables. The fees they charge are simply recorded on the books of firms hailing from the US or the EU.

We will refrain from speculating about the sociopolitical implications of this, whether it reveals anything about cultural attitudes towards what it means to “agree” to something, risk aversion, and so on. We have satisfied our goal: Checking something off our “wondering about” list.

Perhaps part of the reason the Asia-Pacific values seem low is that there is a population structure with respect to the economy in at least three of the Asian countries (China, India and Indonesia) that differs greatly from the economic structure in US and Europe. Those three countries dominate the total population of the Asia-Pacific group, but a very large proportion of the population has no practical connection to revenue-producing legal practice. Perhaps a different perspective would emerge if one takes the “Legal Revenue per capita” value you derive and compare it to the GDP per capita. Just at a first cut (2019, because ease to locate) , I find values for GDP-pc to be:

US: $65,300; EU (assumed to be Europe + UK): $34,800 and Global average: $11,400.

Then, taking you values and producing the ratio as a %:

US 1.45%; EU 1.11%; Global 0.75%

Just to get a sense, using $10,300, $2,100 and $4,100 for China, India and Indonesia, and your derived value of $27 for legal revenue pc as applicable to all three, the range would be 0.26% for China to 1.29% for India, and Indonesia (0.66%) not far from the global average. (I apologize for not properly researching and weighting the categories you used.)

Looked at thusly, it might be that the intensity of Law with respect to national economies is typically around 1% of GDP-pc.

Comparing the United States to Japan suggests that supply induces demand. Japan has about 40,000 lawyers for a population of 126 million people. Illinois has 60,000 lawyers serving a population of 12.6 million – 1/10 of Japan’s. If the United States as a whole were lawyered at Japanese levels, we would have about 110,000 lawyers instead of 1.2 million. To be fair, in Japan many people have college degrees in law and hold corporate jobs that require legal knowledge, but have not attended law school and aren’t admitted to practice in Japanese courts.

Mark: Terrific perspective and analysis, and very helpful way to advance the conversation and widen the lens. IMHO it also drives home the point that most legal services are bought and sold as B2B not B2C.

Why do I say that? If most of it was B2C we should see a correlation between legal spend and population, but if it’s B2B not so. Your estimates demonstrate “not so.”

Thanks,

Nice point nicely supported by the data you offer.

I don’t know where one could go to try to answer the question, “What historic/economic/regulatory forces drove the US to be so lawyer-intensive in the first place?” When I see a statistical anomaly (lawyers as a % of the population in the US vs. everywhere else in the world), my mind immediately seeks an explanation.

Thanks again!