What will differentiate winning firms from “mere” survivors is adaptability.

As the Organization for Economic Development wrote in 2019:

Resilience centers on the ability not only to resist and recover from adverse shocks, but also to “bounce back” stronger than before and to learn from the experience.

Adaptability, in short, requires learning from the heart-stopping experience with a gimlet eye trained on where your firm was vulnerable and how to make it “anti-fragile” going forward.

Here’s where we left off, having stolen a page from Law Land’s learning in its emergence from the GFC over a decade ago. I asked if your firm is a Maroon or a Gray and I asked if you think all Grays are the same?

We have extensively fleshed out our model of Law Land being divided into Maroons and Grays (follow those links!) but in 25 words it posits that clients have become more sophisticated, purposeful, and selective in differentiating between matters that represent rare events in the corporate lifecycle, have boardroom visibility and high stakes, and where cost is tertiary, vs. “run the company not bet the company” matters, which need to be dealt with promptly and efficaciously but also at low cost commensurate with their routine nature. The “maroon” law firms win the lion’s share of the first set of matters, “grays” the rest.

Yes; this is a model, not a rigorous map of reality. In the classic phrase of George Box (British statistician, 1919—2013), “all models are wrong but some models are useful.” We are fond of the Maroons/Grays model primarily because we find it useful. As we do here.

If you’re a Maroon, your post-Covid world is likely to look a lot like your pre-Covid world. I set aside details like whether your offices get smaller (this remote working thing has legs), or your practice mix morphs a bit. The foundation of your business model hasn’t changed: Serving the world’s most sophisticated clients in their gnarliest matters through utterly superb, artisanal application of expensively pedigreed high legal IQ.

For the Grays the world promises to be different. Or rather, the same only more so on an accelerated timeline. What precisely are the elements of that “sameness?” By and large, they’re unwelcome:

- As the indispensable Jae Um just pointed out, the conventional wisdom that the AmLaw 200 is “a perpetual growth engine” is false: “The real story here is one of sustained and gradual consolidation rather than perennial prosperity.”

- In 1998, the first year of the “200,” the list collectively embraced 58,000 lawyers or 6% of ABA membership;

- By 2019 the lawyer headcount had more than doubled to 134,000 and 10% of ABA membership.

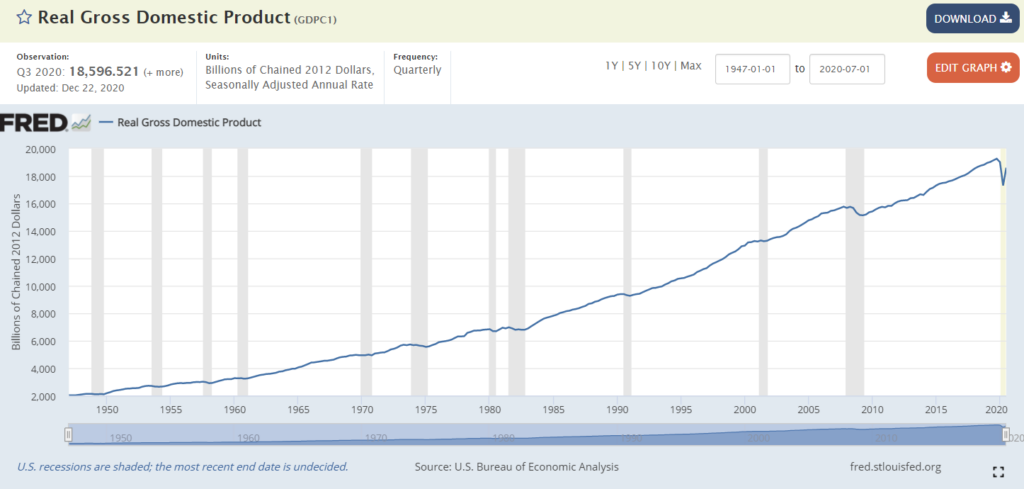

- As we’ve demonstrated ourselves, while nominal revenue of the AmLaw 100 rose 54.4% over the period 2010-2019 (4.9% annualized), once you adjust for inflation (19.5% per the BLS) and headcount growth (24.4% per AmLaw), the net real growth in constant dollars was 3.9% over the entire decade. This during the longest sustained economic expansion in US history, officially running from June 2009 to February 2020, or 128 months.

- Even more tellingly, the average real, inflation-adjusted GDP growth over that 10+ year period was 1.1%/year, while the AmLaw 100’s comparable growth rate was less than 0.4%, or one-third the growth in GDP.

This, to paraphrase the late great Sen. Daniel Patrick Moynihan, is “defining growth down.”

It would be churlish to ask the macroeconomic gods for a more sustained period of “wind at our backs” and this is the best we can do? But we must continue on this jolly track.

Two more points:

First, if you’re a Gray or large components of your revenue stream come from “Gray” activities, you now face nontrivial competition from NewLaw to handle run-the-company or business-as-usual matters. At the very least, you need to have a ready answer if clients ask why large components of and activities comprising those matters shouldn’t be unbundled and handed off to NewLaw or accomplished through a different service model.

This is the first noteworthy place where learning from the GFC breaks down: NewLaw had no measurable market presence a decade+ ago during the GFC; now it’s an established, capable, and sizable part of the legal service delivery supply side.

[There are responses to this, which we’ll get to in Part 3 of this series; but responses there need to be.]Second, and perhaps even worse—we cannot come up with a snappy response for this one, try as we might—is that looking at that deplorable lackluster AmLaw 100 performance more closely reveals that this is a situation where averages mislead to the point of fibbing.

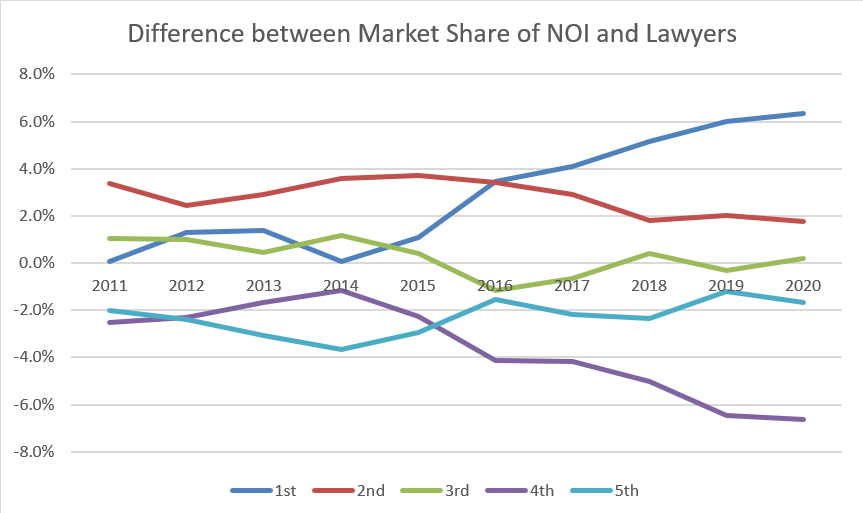

The difference in performance between the top 20 or first quintile of those 100 firms and the rest is striking. Back in August (“Part 3 of Our Series on the AmLaw 200: Envy and its Discontents”) , we published what we reproduce below showing the performance of each of the five quintiles of the AmLaw 100 on three core financial metrics. These charts show the relative performance of each quintile vs. the AmLaw 100 as a whole over the period 2010—2019.

Two prefatory notes before we go to the key chart:

- First, we chose that decade carefully. We started in 2010 because by then the hangover from the 2008 GFC had worn off, and we ended in 2019 because Covid-19 was, hard as it is to believe lately, nowhere to be seen. It was a “normal” 10 years.

- Second, the technique we used to emphasize how the performance of each 20-firm quintile fared was to make the AmLaw 100 overall an “index,” so that the sum of all the component quintiles, by definition, is zero. We hope this vividly displays who’s winning and who’s losing:

Here’s what’s happening at a narrative level.

Simply put, the top quintile of firms outperforms everyone else where it matters: They’re more powerful, efficient, and effective at (a) converting lawyers into revenue (chart not displayed, but the net result is >2.5% by 2019); (b) converting revenue into profit (“NOI,” or net operating income) (chart not displayed, but >4% by 2019); and (c) converting lawyers into NOI (see above, > 6% by 2019). The third and final comparison is the one we chose to show you here because it is, after all, the acid test.

Not only are they substantially outpacing everyone else by the end of our chosen decade, their lead is growing.

If you’re in that golden quintile, more power to you. You’re either a high-performing Maroon (so don’t f*(#& it up!) or, perhaps, a very special type of Gray. We hereby deem that special type of Gray a category worth differentiating in its own right. We’ll call them Superb Grays.

What position do the few Maroons who may be backsliding or the great majority of Grays who are not “superb” find themselves in?

The challenge they all face is a familiar one: So familiar, in fact, that people (including, resoundingly, us) are sick of hearing about it. It’s the conversation we’ve all been having for 10, 15, or 20 years, depending on when your antennae became tuned in its direction. It has long since ceased to be productive or informative, much less novel or even newsworthy: It’s now simply tiresome. The three-word summary of that conversation is:

More for Less

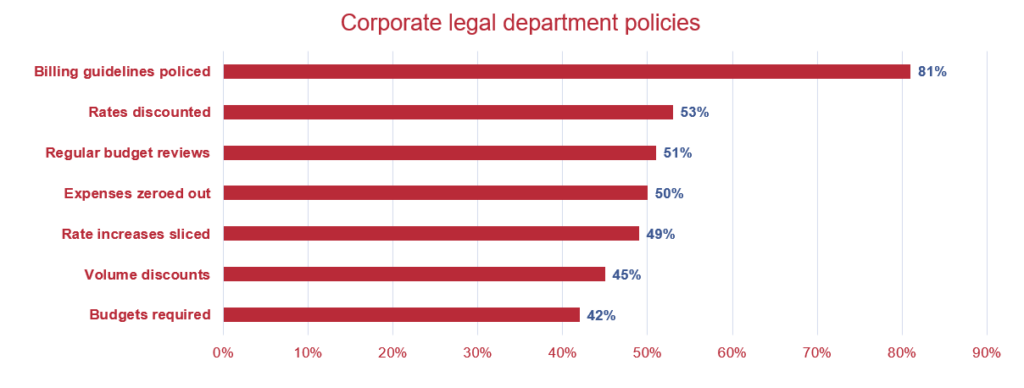

The days of BigLaw occupying a sellers’ market and clients being price-takers is fading into memory—and that’s limited to the memories of fewer and fewer still-practicing practitioners. Entire industries have arisen to cut into BigLaw revenue: E-billing software, legal “spend management,” benchmarking, “RFP optimization” (no, I did not make this up), invoice analytics, compliance, “zero data entry” task sorting, invoice rejection/kickback on a line item basis, and on and on.

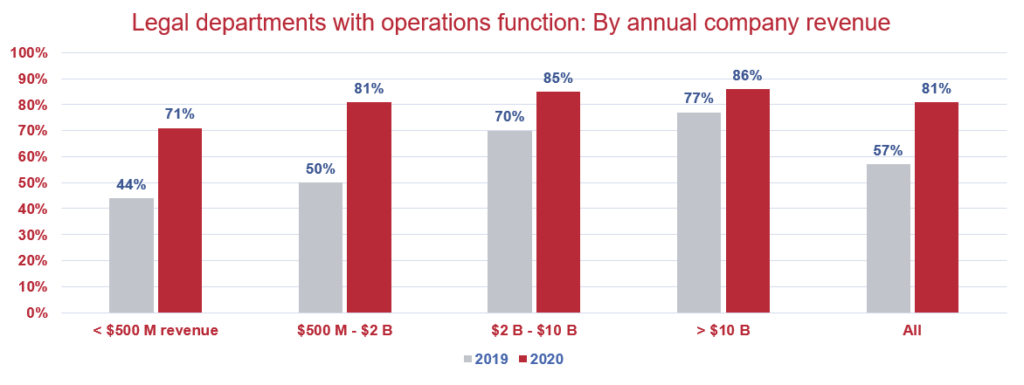

Here are two charts derived from the June 2020 Thomson Reuters’ Legal Department Operations report showing how saturated the market for corporate legal spend tools has become:

The price/cost conversation has degenerated into zero-sum bickering and in fact is no longer a “conversation” at all; it’s punctuated monologues brought to a conclusion only by who chooses to stand up and walk out first.

Worse, if possible, is that this talking-past-each-other syndrome bids fair to escalate, if you believe two pieces of current data.

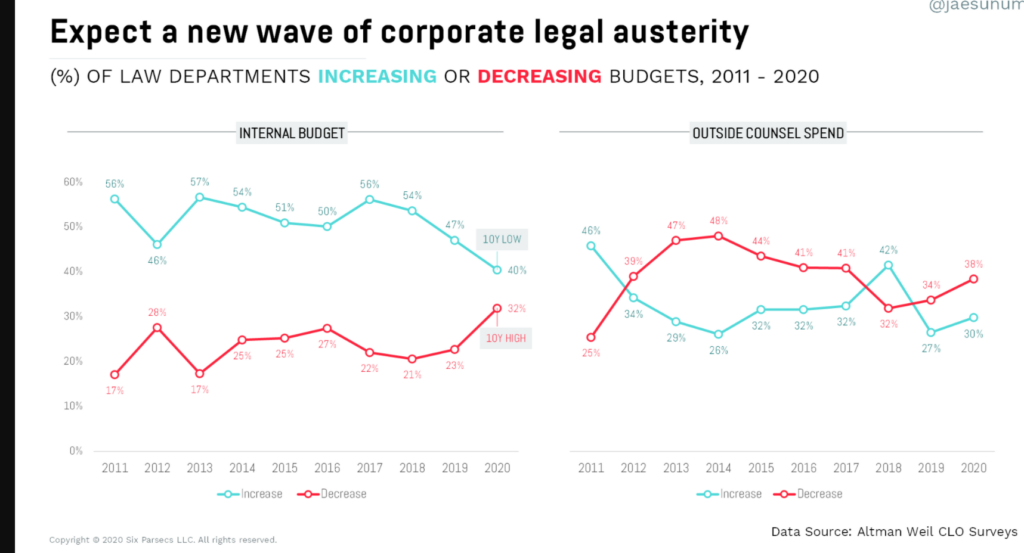

First, respondents to the annual Altman Weil CLO [Chief Legal Officer] Survey who say they’re decreasing outside counsel spend has gone up three years in a row after a one-year dip in 2018:

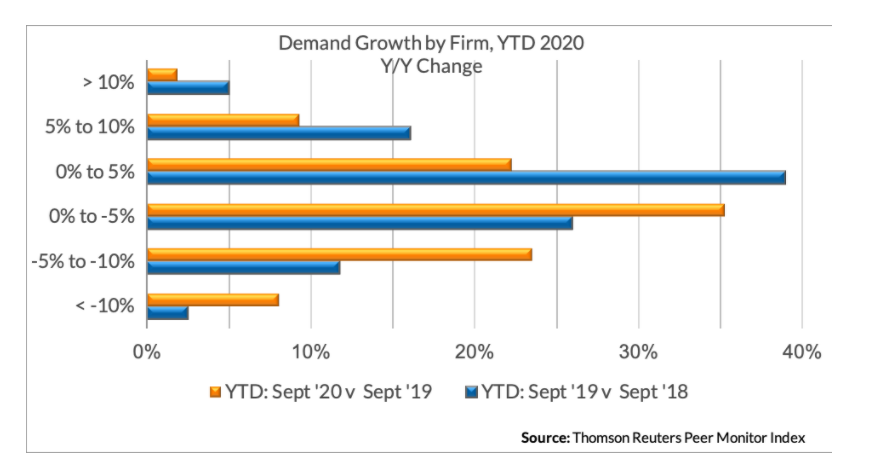

Second, the Thomson Reuters’ Peer Monitor dataset, which tracks large US-based firms (n=171), supports the case for three trends: (a) that Covid-19 is generating headwinds for Law Land in general; (b) that volatility continues to rise; and (c) that outperforming firms continue to pull away:

Our industry deserves better.

Who’s ready to try to break this cycle with some imaginative—by which we do not mean delusional or far-fetched—initiatives?

Look for Part 3 of this series to provide some thoughts.

More pointedly:

- We have posited here that a distinct minority of BigLaw firms is dramatically pulling away from the rest, at a pace that seems relentless–and we hope you concur that we have supported that with data.

- For that “pulling away” minority of firms composed of high-performing Maroons and Superb Grays, our best advice is to keep doing what you’re evidently doing, only (a) double down on kaizen (continuous improvement), (b) question received wisdom (“Why is it that way?” is a good start, followed by “And why that?” and then “And why that?” until you reach genuine insight); and (c) be vigilant about rejecting complacency.

- And for everyone else, keep an eye out for our third and final installment where we will put meat on the bones of what it takes be become a Superb Gray.