Two prefatory notes before we go to the key chart:

- First, we chose that decade carefully. We started in 2010 because by then the hangover from the 2008 GFC had worn off, and we ended in 2019 because Covid-19 was, hard as it is to believe lately, nowhere to be seen. It was a “normal” 10 years.

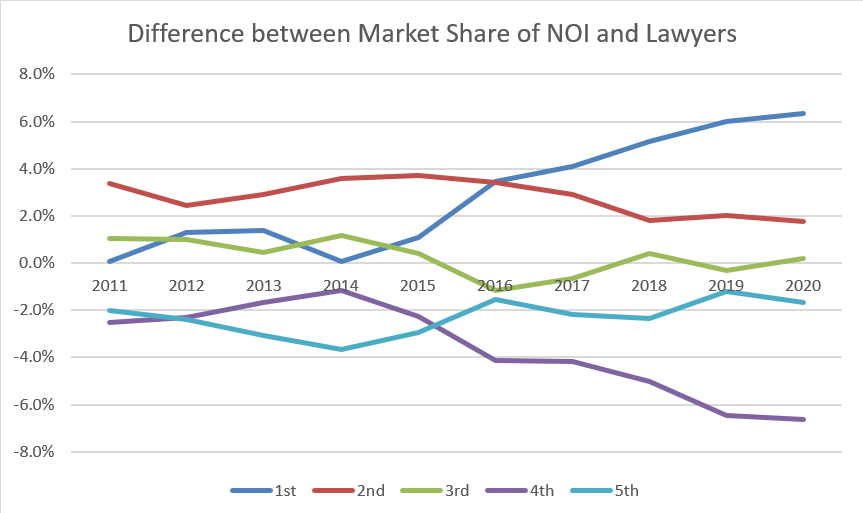

- Second, the technique we used to emphasize how the performance of each 20-firm quintile fared was to make the AmLaw 100 overall an “index,” so that the sum of all the component quintiles, by definition, is zero. We hope this vividly displays who’s winning and who’s losing:

Here’s what’s happening at a narrative level.

Simply put, the top quintile of firms outperforms everyone else where it matters: They’re more powerful, efficient, and effective at (a) converting lawyers into revenue (chart not displayed, but the net result is >2.5% by 2019); (b) converting revenue into profit (“NOI,” or net operating income) (chart not displayed, but >4% by 2019); and (c) converting lawyers into NOI (see above, > 6% by 2019). The third and final comparison is the one we chose to show you here because it is, after all, the acid test.

Not only are they substantially outpacing everyone else by the end of our chosen decade, their lead is growing.

If you’re in that golden quintile, more power to you. You’re either a high-performing Maroon (so don’t f*(#& it up!) or, perhaps, a very special type of Gray. We hereby deem that special type of Gray a category worth differentiating in its own right. We’ll call them Superb Grays.

What position do the few Maroons who may be backsliding or the great majority of Grays who are not “superb” find themselves in?

The challenge they all face is a familiar one: So familiar, in fact, that people (including, resoundingly, us) are sick of hearing about it. It’s the conversation we’ve all been having for 10, 15, or 20 years, depending on when your antennae became tuned in its direction. It has long since ceased to be productive or informative, much less novel or even newsworthy: It’s now simply tiresome. The three-word summary of that conversation is:

More for Less

The days of BigLaw occupying a sellers’ market and clients being price-takers is fading into memory—and that’s limited to the memories of fewer and fewer still-practicing practitioners. Entire industries have arisen to cut into BigLaw revenue: E-billing software, legal “spend management,” benchmarking, “RFP optimization” (no, I did not make this up), invoice analytics, compliance, “zero data entry” task sorting, invoice rejection/kickback on a line item basis, and on and on.

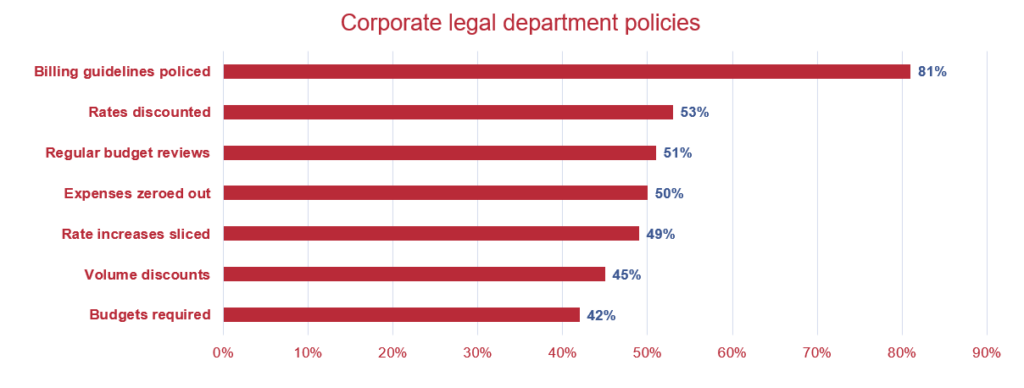

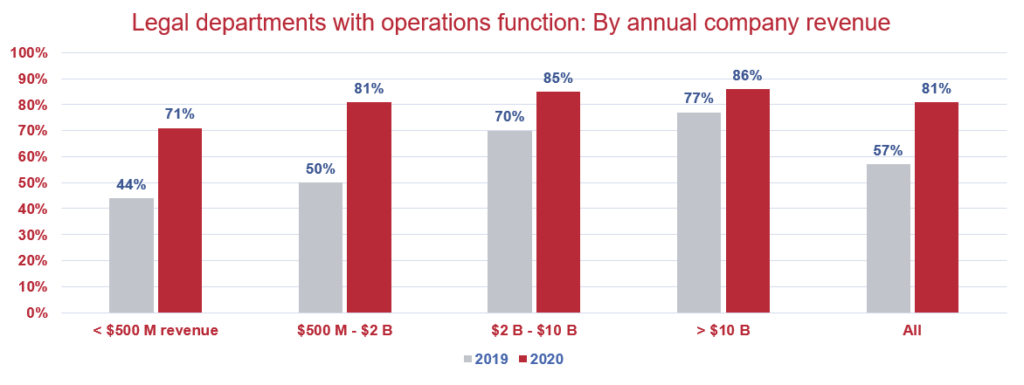

Here are two charts derived from the June 2020 Thomson Reuters’ Legal Department Operations report showing how saturated the market for corporate legal spend tools has become:

The price/cost conversation has degenerated into zero-sum bickering and in fact is no longer a “conversation” at all; it’s punctuated monologues brought to a conclusion only by who chooses to stand up and walk out first.

Worse, if possible, is that this talking-past-each-other syndrome bids fair to escalate, if you believe two pieces of current data.

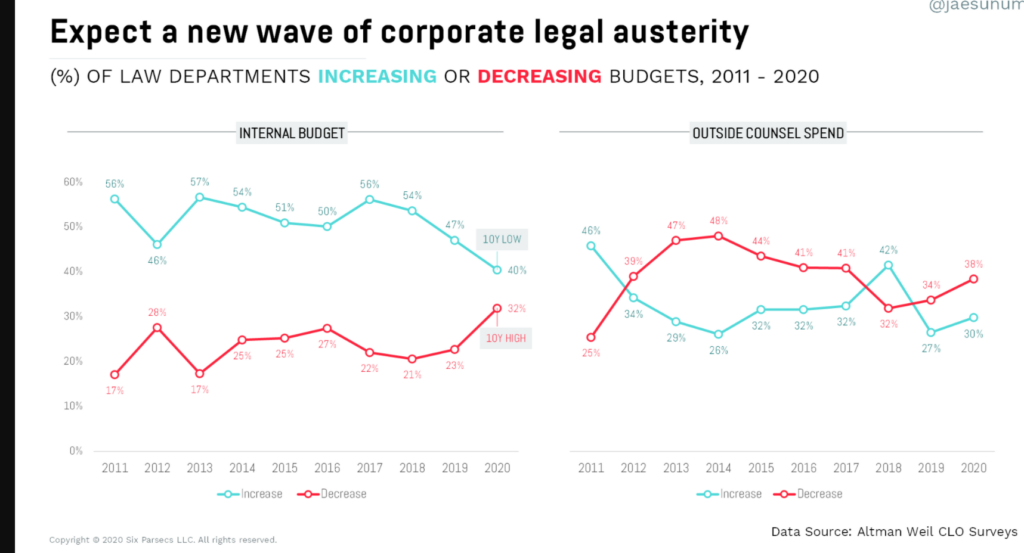

First, respondents to the annual Altman Weil CLO [Chief Legal Officer] Survey who say they’re decreasing outside counsel spend has gone up three years in a row after a one-year dip in 2018:

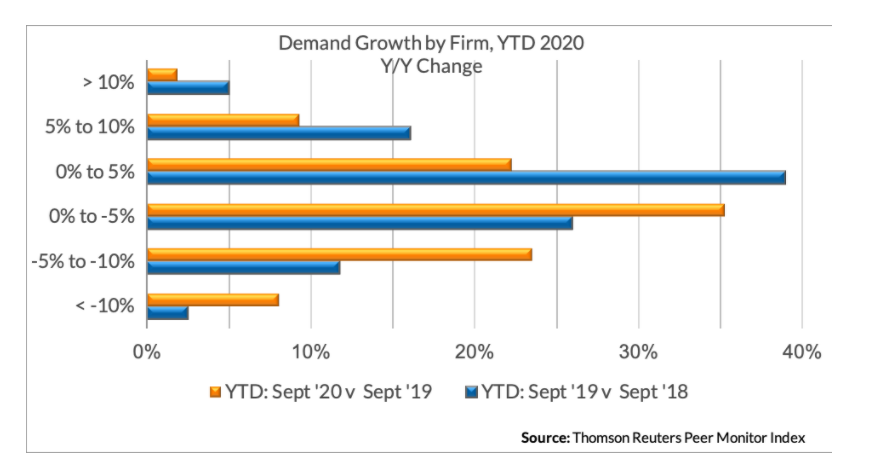

Second, the Thomson Reuters’ Peer Monitor dataset, which tracks large US-based firms (n=171), supports the case for three trends: (a) that Covid-19 is generating headwinds for Law Land in general; (b) that volatility continues to rise; and (c) that outperforming firms continue to pull away:

Our industry deserves better.

Who’s ready to try to break this cycle with some imaginative—by which we do not mean delusional or far-fetched—initiatives?

Look for Part 3 of this series to provide some thoughts.

More pointedly:

- We have posited here that a distinct minority of BigLaw firms is dramatically pulling away from the rest, at a pace that seems relentless–and we hope you concur that we have supported that with data.

- For that “pulling away” minority of firms composed of high-performing Maroons and Superb Grays, our best advice is to keep doing what you’re evidently doing, only (a) double down on kaizen (continuous improvement), (b) question received wisdom (“Why is it that way?” is a good start, followed by “And why that?” and then “And why that?” until you reach genuine insight); and (c) be vigilant about rejecting complacency.

- And for everyone else, keep an eye out for our third and final installment where we will put meat on the bones of what it takes be become a Superb Gray.