With vaccines no longer a distant deus ex machina but here today in the cargo holds of aircraft at 35,000 feet, on FedEx and UPS trucks nationwide, and soon at a friendly neighborhood pharmacy near you, it’s time to refocus on what the contours of Law Land’s post-Covid world might look like. The only answer that I can guarantee will be dead wrong is, “Same as before.”

“Resilience” seems to have become the touchstone by which the difference between post-Covid acceleration and stasis will be determined. I have a different view, and I think it’s more than semantic.

Resilience is, we can stipulate, the capacity to bounce back and recover from adversity, but I think its conventional understanding stops there. We took the blows, we got back on our feet, and we’re standing right where we were flattened moments ago. The fire in the engine room has been extinguished, the damage repaired, and the ship is seaworthy again.

But “resilience” alone does not make it a better, faster, larger, more modern, commodious, or capable ship; it restores your losses and puts you back at Go.

The missing ingredients that post-Covid outperformers will add to mere resilience are learning and adapting. Learning plus changing based on what you’ve learned puts the “better” in Build Back Better. Let’s elaborate for a moment. Resilience entails:

- Containing the damage ASAP;

- Being decisive about cutting losses;

- And recovering more or less to the status quo ante.

Adaptability adds to that:

- A thirst for learning: Being non-judgmental about weaknesses potentially revealed and candid and forthcoming about the need to fit to the new world;

- Taking, intentionally, a longer view—beyond damage control in the immediate crisis;

- And creating options for your future.

Before imagining in a free-form and relatively undisciplined way what our post-Covid world might look like, can we draw any lessons from history? Anything to learn here from the past? (And no, I’m not talking about the 1918 Spanish flu.)

This being a publication centered around economic perspectives on things, our minds might revert to the 2008 GFC, the last big bad and still memorable Western World recession. What happened to Law Land emerging from that economically traumatic period?

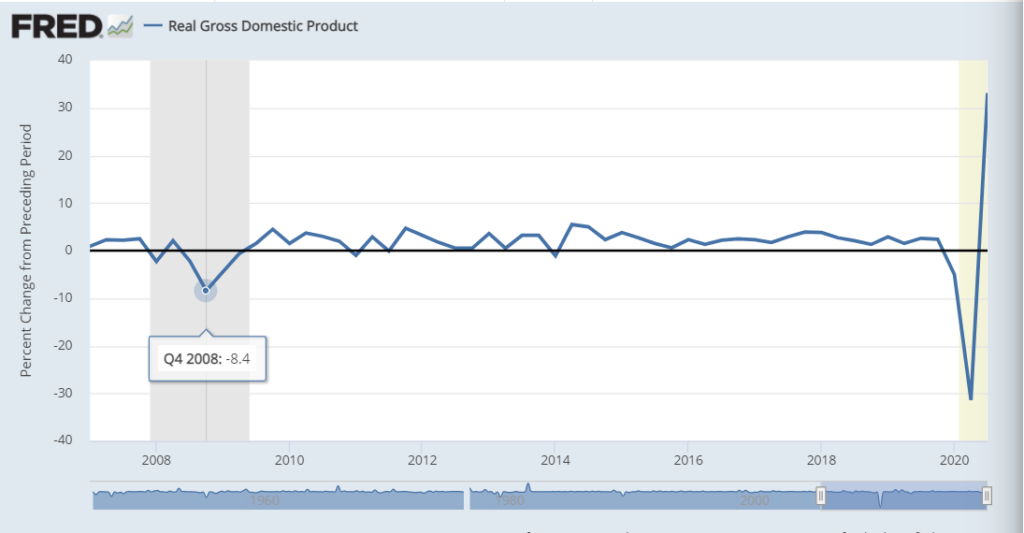

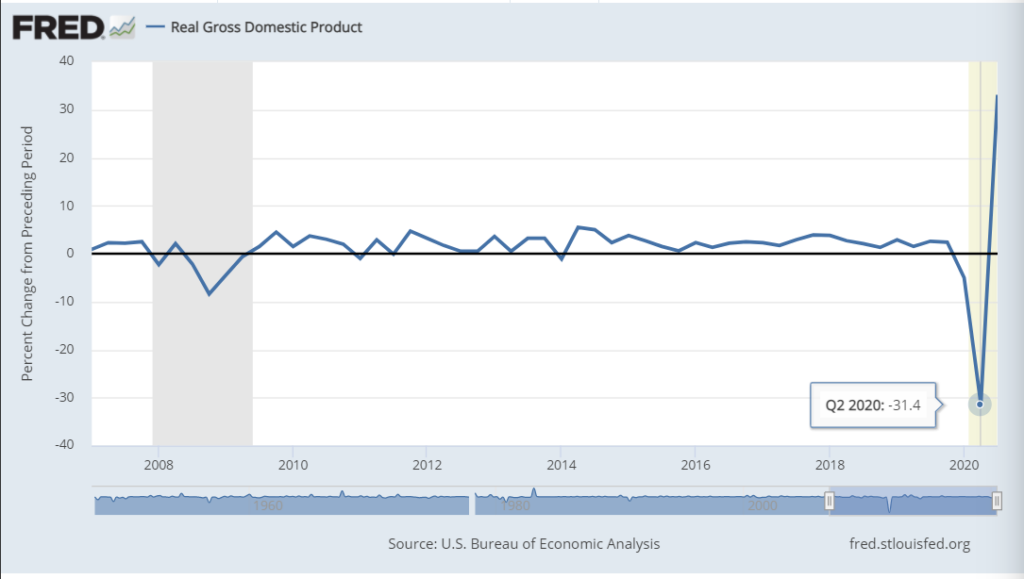

First, some data:

You can see that the 2008 GFC, severe as it was, was far less violent than the Covid-19 meltdown. A long list of differences between then and now explain this, but some of the headline reasons have to include, at least:

- The 2008 GFC was induced by a freeze-up of the financial sector. With everyone running towards safe, liquid, assets, lending and capital flows essentially stopped and save for the heroic efforts of the Fed, the TARP program, and shotgun mergers in the financial services sector, our recovery would have been far more prolonged and painful.

- The impetus for the Covid meltdown was of course not comparable in the least. Western World governments ordered large sectors of their economies to stop in their tracks.

And just as the precipitating events were quite unlike each other, the aftermath of these two recessions, it’s safe to predict, will be quite different as well.

Historically—as definitively outlined in Ken Rogoff’s and Carmen Reinhart’s 2011 This Time is Different: Eight centuries of financial folly—recessions caused by financial crises (government defaults, banking panics, currency debasements, large-scale asset bubbles, and more) are particularly long-lasting in effect. As we’ve written, a financial crisis is analogous to draining all the oil out of a car engine; everything is going to freeze up and some damage will be long-lasting. So unemployment remains high longer, GDP suppressed longer, consumer confidence shaken longer.

The global Covid-19 pandemic and its worldwide economic consequences—primarily in the form of shutdowns of selected markets—by contrast, suggests no reason to believe that the hangover will endure.

It’s worth a note that these “shutdowns” have had a myriad of causes, from outright government bans and prohibitions on certain classes of establishments like bars, restaurants, and “nonessential” shops, to far more widespread public anxiety at engaging in even permitted activity like flying, staying at hotels, or taking public transport, to what is effectively the total evaporation of demand for engaging in activities like attending live theater, opera, and other performing arts, or sporting events.

Why is this germane?

Because regulations can be lifted at the stroke of a pen and psychological comfort levels adapt to new circumstances (like widespread vaccination) swiftly. Who is not desperately looking forward to an unencumbered, worry-free, convivial meal at a busy restaurant ASAP? Or even, if you’re in the same improbable minority as I am, getting back on airplane to go visit clients and Law Land friends? (The technical term for this is “pent-up demand.”) And this matters economically because once the largely voluntarily applied brakes are lifted, the car is fundamentally sound.

Of course, pressing the analogy too far gets you in trouble, as almost invariably happens with analogies. After all, national and global economies are not “like” cars in any recognizable sense other than our own metaphorical coinage. So we won’t push our luck.

Saying large sectors of the economy are as sound as ever, while severe damage of unknowable duration has been inflicted on other sectors, is far more accurate. Those on the end of this dichotomy that have taken it on the chin include, as we all could recite in our sleep, hospitality/travel/commercial real estate, and—sadly, tragically, sometimes crushingly—small local retail businesses, while those apparently getting off scot-free or even leaping ahead include tech almost across the board, the online multiverse almost across the board, logistics, home improvement, fitness/entertainment-at-home, and…Law Land.

A final observation about the economic consequences of our hellacious global Covid-19 interregnum: The ubiquitous, but nonetheless accurate, assessment that it has accelerated a variety of trends already in place.

Stage thus set, what might we take from the aftermath of the 2008 GFC to inform our planning for the post-Covid-19 world?

- Before the GFC, one trend that was not apparent to most observers—it was “weakly signaled”—was clients becoming more purposeful about segmenting their legal work into one set of matters that demanded the highest quality and another set, the great majority of matters, where economy was the key criterion.

- This “flight to quality” vs. “flight to economy” came at the expense of what I later labelled in a different context the “Hollow Middle.”

- We felt that calculation was always present, but the market, at least the law firm side of the market, seemed unaware or dismissive of it before the GFC. Afterwards, everyone who thought much about it had to acknowledge this new reality.

- (BTW, on a semantic note, we do note use the conventional phrasing of flight to quality vs. flight to value because we firmly believe “value” can be found at all price points, as can, sadly, its opposite.)

- The second major development in Law Land that rose to the surface in the wake of the GFC was putting ALSP’s (“NewLaw” is our preferred coinage) on the map. From having a market presence that was not measurable beforehand, NewLaw had begun its entrance onto the stage, in the form of (a) revenue growth; (b) credibility, and (c) mind share.

What might these two developments foretell for our post-Covid world?

Our money is on the “Covid slingshot” effect redoubling their importance, with both trends accelerating well into the future.

Why?

Because both provide benefits to clients that are conspicuously self-evident, and because neither trend has exhausted itself:

- Matching outside legal services providers (primarily drawn from the ranks of BigLaw) more closely to the gravity and potential consequences of the matter in the client’s eyes (Trend #1); and

- Increasing the value received per dollar spent when it comes to preferring NewLaw over Big (a/k/a Traditional) Law—receiving higher quality and/or faster turnaround and/or a lower cost. And the tiresome “pick two” joke doesn’t apply here; this is a case where you can actually have all three if you pick your NewLaw firm right. (Trend #2)

Now imagine you’re some combination of a law firm’s Managing Partner, Executive Committee, Director of Strategy, or Practice Group Leadership—and we know that many of you reading this are just that.

What are you to do?

Your homework assignment is to ponder that while we put the finishing touches on the second column we’ll be publishing on this minor issue.

But in the meantime, we think torturing our best readers is highly inadvisable both as a matter of editorial discretion and business strategy, so we’ll give you two hints:

- Is your firm a Maroon or a Gray?

- And to the Grays in the crowd: Do you think all Grays are the same?

Courtesy Explorium