This is the first of what I anticipate will be a three-part series discussing some of our thoughts on the potential macroeconomics of what the world is going through with Covid-19. This, Part 1, will talk about the likely contours of the recession we’re surely already in. Part 2 will discuss how demand for law firms’ services may evolve on the Day After and beyond, and Part 3 will offer some thoughts on staying intact and strong until that day.

V is for violent.

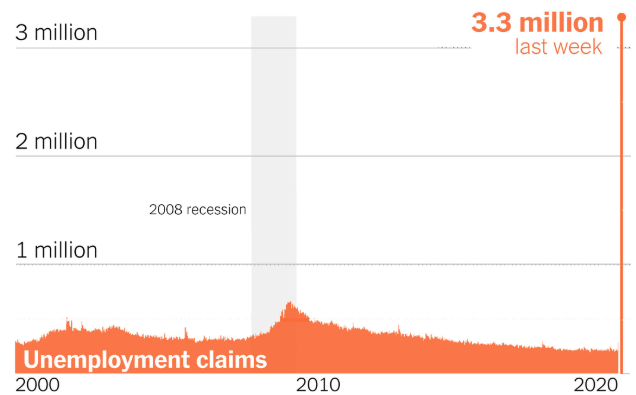

That’s the best case scenario for this recession. Certainly the kickoff has been violent:

(By the way, even this visual kick in the teeth number of 3.3 million is certainly understated, given the nationwide reports of swamped unemployment office phone lines and crashing websites–these are just claims that people actually managed to have recorded, not the number of people trying to record a claim.)

Estimates of how much GDP may decline in 1Q and 2Q 2020 range from (in my humble opinion) the laughable low single digits to 24% (Goldman Sachs), 30% (Morgan Stanley) or even higher. In parallel, unemployment forecasts for just a few months hence are (median estimates) over 10%. This is what can happen when an economy consisting of 70% services halts all “non-essential” services.

But as I noted, if the second leg (the recovery leg) of this recession forms a graphic “V” and not a “U” or the even more depressing “L,” we could be back to where we left off a couple of weeks ago in short order. That will depend on a host of unknowns, ranging from how quickly researchers can discover and manufacturers can bring to market effective clinical therapies and ultimately a vaccine, to how long global trade flows remain depressed, to the resilience (or brittleness) of supply chains, to consumer psychology, to whether protectionism gains a second wind worldwide or conversely globalization is seen as the only way at this point, and on and on. Far be it from me to prognosticate on even one of this variables, much less their cumulative interaction, velocity, and power.

But.

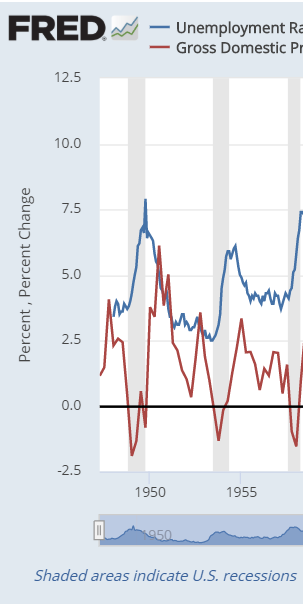

I mentioned “V”‘s as the best kind of recession. Here’s an example from reasonably recent economic history:

The red line is GDP and the blue line is unemployment. So you can see that in 1949 GDP plummeted to -(2%), unemployment spiked from roughly 3% to 8%, and lo and behold, Recession. But the recovery was as quick as the swoon: GDP shot up again to a brief (and of course unsustainable) rate of >+6%, and unemployment quickly regained its earlier low of ~3%.

In hindsight, economic historians have converged on an explanation for the short, swift, and violent nature of this episode: It was an “inventory recession,” which in this case meant that manufacturers that had rapidly ramped up capacity to meet the post-WWII consumption boom suddenly found themselves with overstuffed warehouses and supply chains and dialed everything back abruptly in fears that the boom wouldn’t last. As it turns out, of course the “postwar” boom lasted until the mid-1960’s, so manufacturing recovered almost immediately as the fears of sated demand failed to materialize.

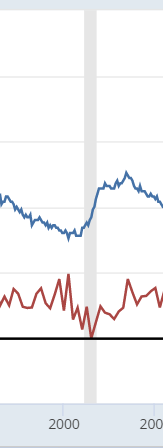

Next we have a “U” shape:

Here, GDP fell and unemployment rose starting in 2001, but the fall and rise were not dramatic or abrupt and they soon enough returned to the pre-recession levels. Various explanations have been proferred in hindsight, but the most probable seems to be a decline in capital investment following the spike to address the largely imaginary Y2K bug plus simple exhaustion, as it came at the end of a solid decade of growth. And as the National Bureau of Economic Research wrote in a post-mortem published at the end of 2003, it was notable mainly for being “among the mildest” of all post-WWII recessions. So a “U” is still a recession indeed, but business more or less as usual continues.

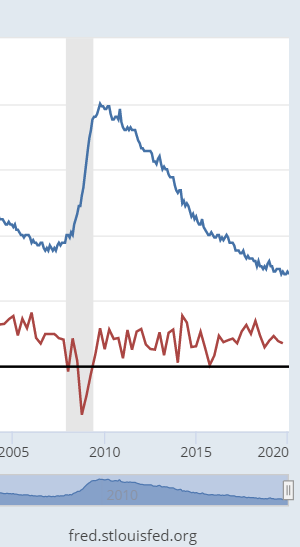

Bringing us to the dreaded “L:”

We have me the enemy, and he is “L.” This charts the decade following the Great Financial Meltdown of 2008/2009, showing (a) GDP going sharply negative, but then only “recovering” to bounce along in the very low single digits, and (b) unemployment doubling at the peak and taking nearly an entire decade to get back to its previous level. (The grand-daddy of all “L” shaped recessions, by the way, has been the decades and decades of economic stagnation in Japan.)

As we’ve written previously, and much earlier, in these pages the number one reason this 2010’s recession was so painful and protracted was its cause: Not a classic demand diminution or supply overshooting, and not the Fed “taking the punchbowl away” by raising interest rates to slay inflation. No, this was the financial sector collapsing, which, as Carmen Reinhart and Ken Rogoff instructed a decade ago in their classic, This Time is Different, is so awful and durable because a dysfunctional financial system causes almost all other kinds of commerce to seize up. Liquidity is slow to restore itself.

Where are we now?

The smart money would answer, “I’ll tell you in a year,” but here we are and here’s our educated guess: This is looking more like a “V” than a “U,” and certainly nothing like an “L.”

It’s not an “L” because there’s nothing wrong with the financial sector (well, nothing more wrong than is wrong with every other sector). And it’s not a “Japanese L” because the demographics of the US are, believe it or not, very healthy compared to most of the rest of the Western world.

I’m hoping of course that it’s a “V” but it wouldn’t be much of a challenge for reckless or short-sighted policies to turn it into a “U.” What might those ill-advised policies be? Plenty of candidates suggest themselves, but just for instance:

- If there’s no clear and persuasive plan for how we re-start almost the entire service sector from a dead stop. In other words, what happens on “The Day After?”

- If small businesses aren’t offered generous enough lifelines/loans/grants/forbearance to stay on life support until that day comes.

- If the unemployed aren’t offered [see above].

- If the impatience and notoriously short attention spans of some of our elected officials tempts them to plunge all or major portions of the country back into rubbing infected shoulders with each other prematurely and we have to impose self-confinement on major portions of the country yet again, and spasmodically perhaps yet again. (Hold your breaths, as am I, to see what will play out in Wuhan, South Korea, Italy, Spain, the UK, etc., etc.)

- If Covid-19 proves somehow inscrutable to medical researchers for “a long time”–a long time being defined as too long for small businesses and the unemployed to exist on life support.

I won’t go on but you get the idea.

So: Fingers crossed and rational faculties fully persuaded that a “V” is entirely within our grasp. But anxious that short-termism will defeat prudence and wreck not just the short- but the longer term as well.

“[T]here’s nothing wrong with the financial sector.”

AYDFKM?

Have you seen the lack of liquidity?

The exploding LIBOR rate?

The unprecedented intervention by the Federal Reserve?

Yeah, all looks good to me.

The operative phrase is “nothing more wrong:”

Is the financial sector under stupefying stress? Absolutely, and so are we all.

But if we’re talking relative pain (“more wrong”), here are a few other major sectors:

You can also find a highly current (yesterday) rundown of the impact on various industries from Business Insider (“restructuring bankers are suddenly Wall Street’s hot commodity”).

Even boring old brick and mortar retail banks are deemed “essential.”

So: “Looks good”? No, looks “not more wrong.”

But we shall all see, won’t we?

All of those other businesses existed and thrived before the financialization of the finance sector. Finance used to SUPPORT industry. Now finance IS an industry. Repealing Glass-Steagall opened the door, and, boy, did they run with it!

And now they ONCE AGAIN want to socialize their losses after a decade-plus of privatizing their gains. Funny what happens to banking stocks once the biggest buyer–the banks buying back their own shares to boost share price and juice executive compensation packages full of stock options–goes away.

How many Wall Street executives went to jail over the admitted and documented fraud leading up to 2008 again?

The financial sector has been a virus on America and the world since the early 1990’s. Amusingly ironic that another virus may be their ultimate undoing.

We could have fixed all of this after 2008, but we all chose to turn a blind eye and sweep the mess under the rug. “This time, things will be different.”

Let them burn. Break them all up. Start over. Go back to local and regional models. I agree that brick and mortar banks are essential. Namely, single-branch brick and mortar banks that serve the community.

And while we are at it, let’s have an equities market that reflects the value of businesses that actually make things and not businesses that “earn” their income trading secondary paper and credit default swaps or from Fed-injected financial steroids.

We have much rot and cancer to excise and flush from the system. Hopefully we will not screw it up this time. But we will.

Of course, at the rate things are going, Wall Street may have to worry about flames in the streets surrounding and engulfing their high-rise towers. Because this one is going to hurt.

Big fan of your work, by the way, and thank you for the thoughtful reply. I especially appreciated the dig on the complete shell game (pun intended) that is shale. Thank you, also, for the BI link.

The best was the note regarding “restructuring bankers.” Makes me think of the mob burning down a building and then getting the contract to rebuild it.

Pace!