The Report pegs New Law revenue in 2018 at $10.7-billion, which may sound nonthreatening next to law firms’ aggregate revenue of approximately $285-billion, but consider that (a) there’s a “multiplier” applied to New Law spending if you’re asking the question, “How much of this comes out of the hide of traditional law?” (we have estimated that multiplier at about three, and you’re welcome to prefer two or four, but you are not permitted to prefer one as the multiplier); and (b) New Law’s revenue–counting standalone companies only and not “captive” offshoring or near-shoring operations under the umbrella of law firms themselves–is growing at nearly 25%/year.

Do that for three years in a row, and things will have (just about) doubled. After six years, quadrupled. That would put NewLaw’s revenue in 2025–tomorrow in the history of major industry life-cycles–at $40-billion. If you’re not noticing now, would you notice then?

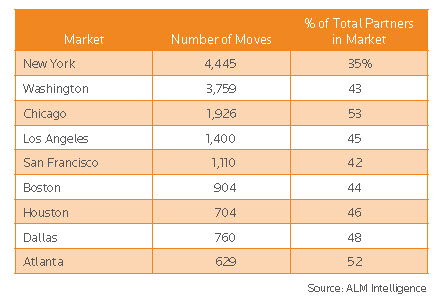

Let me share with you a stunning table from the report, which details the number of lateral partner moves from 2010 to 2017 in nine leading metropolitan areas in the US:

Need I go into excruciating detail? In Atlanta and Chicago, it’s more than half of all partners, and in every other market save New York–which is constrained by its own peculiar, rigid, and super-hierarchical pecking order–it’s darned close to half. (Give it one more year to run, shall we?) With magnificent understatement, the report summarizes this: “Clearly, the competition for lateral talent is at an all-time high.”

The question then, is whether this is a good thing or a bad thing. If you prefer highly liquid talent markets and a rich array of personal options over institutional memory, deep trust within a firm, and collaborative team-building over time, you like it. And vice versa.