John Adams notably wrote that “facts are stubborn things.” Words, however, can be fluid, flexible, and subject at times to arbitrary diktat. This last sense was famously expressed in Alice in Wonderland “When I use a word,” Humpty Dumpty said, in rather a scornful tone, “it means just what I choose it to mean – neither more nor less.” “The question is,” said Alice, “whether you can make words mean so many different things.”

Today I’d like to write about four words universally used in Law Land which, I believe, have been twisted so far beyond their intrinsic sense as to act as continuous distorting lenses on our perception of firms and their performance.

I realize I’m about to argue against conventional usages so widely employed that a handy retort could simply be, “It doesn’t matter what these words originally [or intrinsically] meant, all that matters is that everyone understands and agrees on what you mean when you invoke them.” But I maintain that sloppy language leads to, or reflects, sloppy thinking.. If nothing else, I feel compelled to point out what is, to an economist, obviously misguided or worse.

Demand:

The standard quantitative industry reports (Citi, Thomson Reuters PeerMonitor, others) use “demand” to connote aggregate law firm revenue. The fundamental oddity here is that revenue is, well, revenue, which is the measure of what clients are paying to supply their demand for legal services from law firms. The quantity of demand for law firm services can rise or fall without regard to or even in inverse correlation to revenue collected by firms.

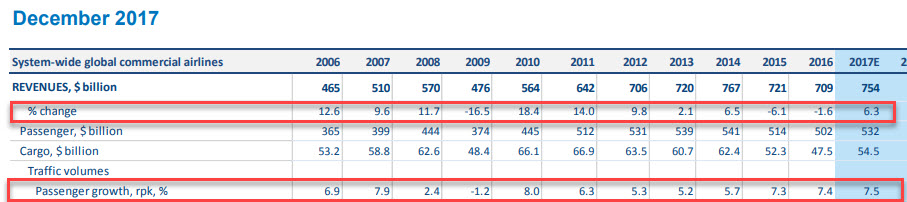

A simple example should clarify the difference: Every year the International Air Transport Association (IATA) publishes comprehensive statistics on the economic performance of the airline industry. Here’s a pertinent snippet from their most recent chart, where I’ve highlighted the % change in industry revenues and the % change in passenger growth, which they shorthand as “rpk” (revenue per passenger kilometer). You can see that in no year over the last 12 were these two numbers the same and in 2016, the last full year’s worth of data, revenue change was a negative number while passenger miles flown was a positive number.

Are our imaginations so impoverished that we can’t figure out a better measure of demand for our services than the sum total of how much we can get away with charging clients?

Equity:

We have long since become accustomed to the coinage of equity partners as distinguished from non-equity partners, but it’s not the oxymoronic quality of the second of those categories that I’m interested in today. (“Income partners” works somewhat better in terms of semantics, but isn’t perfect–a nit to pick another day, or never.) I’m interested in the implication that full-bore equity partners have an economic ownership interest in the firm. Let’s unpack what they actually do have and see how it squares with the conventional meaning of equity in finance and economics. What they do have:

- A vote on substantial and material changes to the firm itself–but, as reported in this month’s American Lawyer, this is an eroding franchise.

- An expectation (but not an entitlement) to some discretionary share of the earnings of the firm following year-end;

- And a requirement that they contribute to capital in an amount determined by a formula often constituting a function of their annual compensation. In almost all cases, this mandatory capital contribution does not earn interest, is subject to unilateral demands that it be supplemented at any time, and following separation from the firm is repayable in amounts and on a schedule determined solely by the firm. Even hedge funds offer periodic windows when investors can withdraw their money!

Does this resemble the concept of “equity” elsewhere in the economy?

Only in a remote sense. One of the most important characteristics of equity ownership, certainly in publicly listed companies and subject to shareholders’ agreements or other contractual provisions in private companies, is that the stake can be bought and sold. The market for equity in any given organization may be thick or thin, highly liquid or afflicted with price opacity and high costs of search and transaction fees in general, but there is a market on which one can exchange one’s equity interest for cash.

Bruce –

Great post.

This should be Exhibit #1 when addressing why clients complain that outside counsel don’t understand the clients’ business. How can they even understand each other when the definitions of key terms are different for each party?

I’ve been annoyed by the “profitability” metric for more than a decade for a different reason, because it distorts the effect of leverage, and I’ve advocated measuring a firm’s financial success by its average lawyer income, rather than average partner income. Consider two firms, both grossing $2MM/year and with identical overhead of $800,000 each on all things except lawyer salaries. Firm X has 2 partners and 4 associates. Each associate is paid $100,000/year. Firm Y has 6 partners and no associates. Four of the partners In Firm X, the two partners make $400,000 each. In Firm Y, the six partners make an average of $200,000 each. In both firms the six lawyers together make $1,200,000 – maybe in Firm Y two partners each have 1/3 of the profits ($400,000 each) and four partners have 1/12 of the profits ($100,000 each). Firm X is more profitable to the partners, but it’s no more profitable as a law business.