“The Church is always one generation away from extinction.”—Archbishop of Canterbury

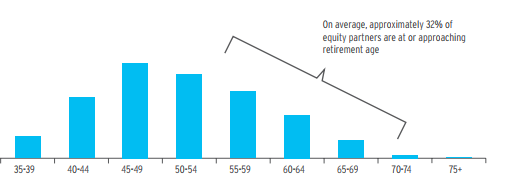

According to the 2018 Citi Law Firm Group Client Advisory, one-third of equity partners are at or approaching retirement age

Citi’s 2018 Report also has this to say:

“Looking ahead, we anticipate further changes to the leverage model in response to market pressures. And as the industry has slowed equity partner growth over several years, the result is an aging population. We anticipate an onslaught of retirements in the coming years, raising questions about the size and shape of law firm partnerships in the future.”

Yet according to various surveys, about two-thirds of firms have taken no real, meaningful steps towards succession planning. (We categorize “plans in development” or “we’re working on it” as not meaningful steps.)

There are two types of succession at law firms: One is the transition of key client relationships to the next generation and the second involves shifting responsibilities for managing the firm itself. Both are critical for law firm sustainability, and corporations routinely invest substantial time and energy in both.

Despite the glaring, demographics-don’t-lie, need for firms to engage in thoughtful, programmatic and long-term succession planning, the great majority simply cross their fingers and ignore laying plans for the inevitable.

[poll id = “12”]