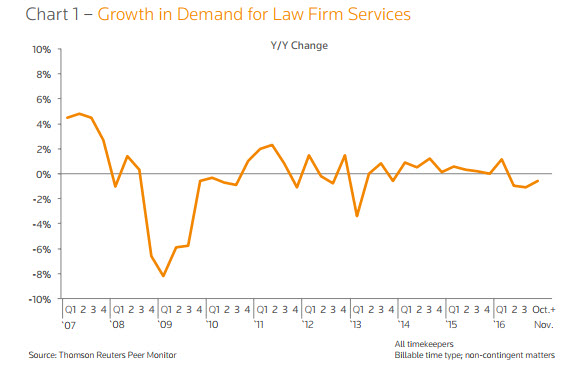

Here’s one of our favorite time-series from Thomson Reuters’ “Peer Monitor” showing “Growth in Demand” for law firms (defined as billable time for non-contingent matters) going back 10 years. You can see that it took a swan-dive from a healthy ~5% annual growth level before the meltdown to a low of nearly -10% but since then has been tracking right around +/- 0%. This is a classic pattern for a mature industry, to wit one characterized by a battle for market share among competitors.

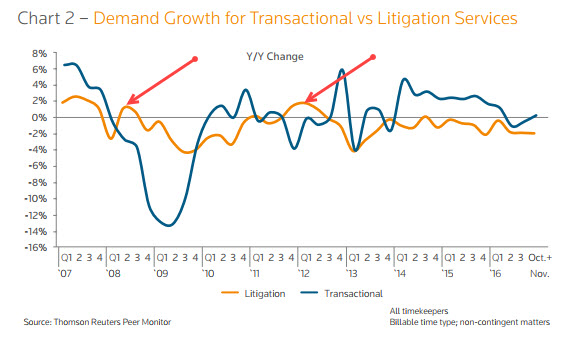

Next we segregate litigation from transactional services using the same dataset. You can see that since the meltdown–a full decade in the rear-view mirror at this point–litigation demand has never been positive with the exception of two brief blips above water.

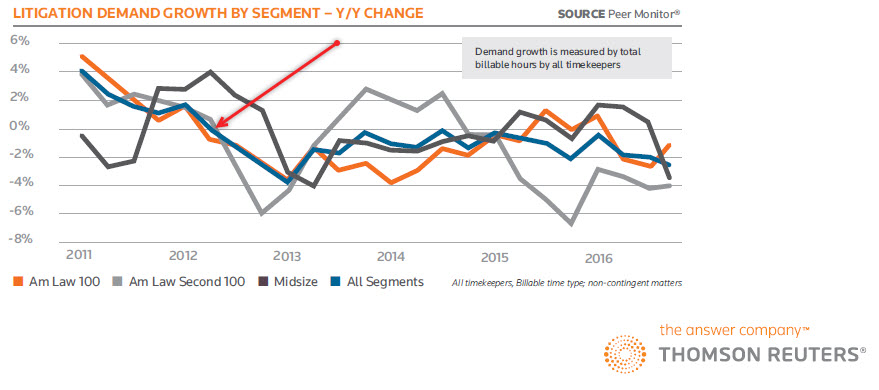

Finally, we zoom in on the past six years, breaking litigation demand into various law firm “sectors”–the AmLaw 100, Second 100, “Midsize” firms, and then “all segments.” This clearly shows that for the last five years the growth of litigation demand/all segments has been below 0%.

Without naming names, we will venture the opinion that a fair amount of what’s published and discussed about demand by practice area is anecdotal. Although there’s hopefully-untrue lore in journalism that “three examples constitute a trend,” we strenuously try to avoid that temptation.

And we would be the first to roundly affirm that this has been a discussion of averages; some firms will have enjoyed vastly different experiences–for better and for worse. Just because more Americans are obese than ever before doesn’t mean skinny people have disappeared.

Upcoming installments in this series will address additional evidence, as well as the long-run impact of newish developments on this landscape including predictive AI, litigation funding, and the changing composition of the sources of supply for “legal services”–of which law firms are a subset.

Bruce, would I be oversimplifying your argument to describe it as a suggestion that, although the number of disputes may be stable or even increasing, litigators believed that demand for their services was inelastic even as their fees reached and then surpassed the point at which the demand curve fell below the supply of lawyer time? Cases that a client might have been willing to bring for an attorney cost of $25,000 don’t make sense for the client if the attorney cost is $150,000. (Add a zero for New York City disputes.)

That’s definitely part of the client’s calculation. I can tell you from my decade in-house at Morgan Stanley that the finance folks were always on the back of the law department to “show some ROI.” Spending X to recover 2X might be justifiable, but spending X and then on top of that settling for 2X was inexcusable: “Why the (#(&$ didn’t you just pay them to go away and get it over with?”

The last chart is the most frightening. My first thought after reading the opening sentences was that your analysis might not consider the global expansion of firms. Litigation is largely an American phenomenon. As large firms expand globally, its makes sense to see the litigation’s contribution to firm wide revenue fall as a percentage. The last chart suggests that the AmLaw 100 is the only segment in which litigation is experiences some relative growth. My hypothesis would have suggested otherwise. I wonder how verins may impact these numbers?

James: Thanks for such a thoughtful observation. I especially appreciate your stating out loud, as it were, that you are capable of changing your mind if the data indicates one perhaps should! An altogether too scarce trait.

Your thoughts about lit as a US-centric phenomenon (indisputably correct) certainly has implications beyond the likely scope of this series. But thinking about the AmLaw 100 being the only litigation-growth cohort inclines me to believe that I might emphasize more forcefully the rather casual observation I made at the beginning of this column (bullet #3) about the stark distinction between “Holy S#%$!” matters and garden variety disputes. Reason and experience alike would both counsel that the “HS” matters go to the AmLaw 100.

Finally, re vereins: I will have to ask my friends at Thomson Reuters whether there are any vereins in their dataset. Stay tuned.

In response to the comment from BigLaw Lit, the last chart states that it is tracking total hours, not share of firm revenue, measured year-over-year. I read the chart to say that from mid-2012, the number of litigation hours in all segments is down about 4.5% (Y/o/Y declines of about -1.5%, 0%, -1%, and -2%, measured midyear), which the market has accommodated in some mix of (a) working fewer hours per lawyer, so that people who used to bill 2000 hours/year are now billing about 1900 hours, and (b) having fewer lawyers employed in litigation, so that about 1 of 20 litigation lawyers from 2012 is now out of work. If the largest of the firms are doing more foreign litigation, then the decline in American litigation is even sharper.

A long-time reader writes:

This would seem to validate “MidRange Guy”‘s deduction that 5% of 2012 litigators are now doing something else.

We have also seen an ongoing erosion in utilization, supporting his other point. Data to follow in this series.