A brief follow-on to the earlier column on Amazon, GE, and Whole Foods.

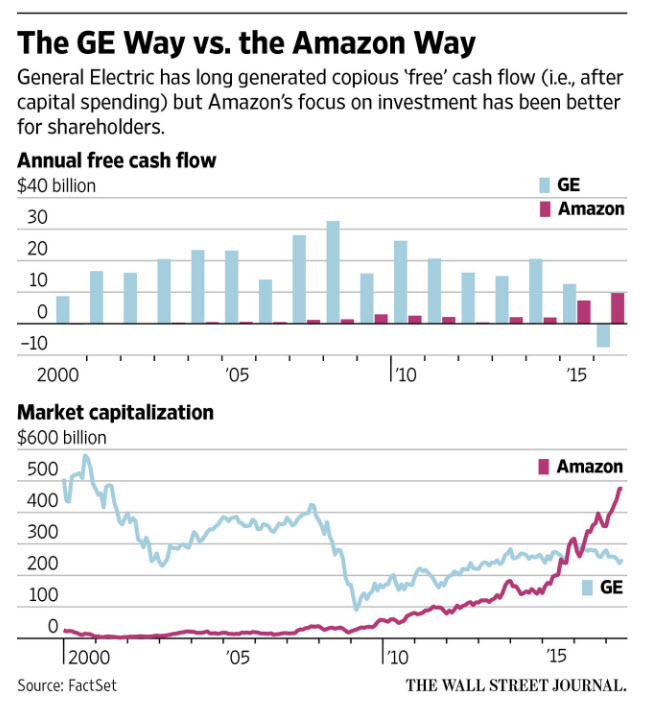

The typically worthwhile Greg Ip, writing in The Wall Street Journal on “The Economy Needs Amazons, but it Mostly Has GEs“, gives us the following chart:

The point?

- For 20+ years, Bezos has famously put innovation and expansion ahead of profit. He thinks like a venture capitalist; a bunch of flops (the Fire phone) will be more than offset by a few home runs (Amazon Web Services, Amazon Prime).

- GE is in an important sense at the other extreme; according to Ip summarizing its last quarterly earnings call (who knew!?), it “meticulously laid out profit growth by product and business segment, the sources of margin improvement, cost savings anticipated from specific restructuring moves—even how five uncollected aviation accounts were affecting profit.” In other words, GE is into cash flow and Amazon into R&D and investment.

The bottom line is the ironic one: While GE obsessively focuses on preserving cash flow and returns to shareholders, both are shrinking; and Amazon’s willingness (profligacy, some have always said) to spend cash has produced spectacular shareholder returns. Ip’s conclusion is this:

[T]he country as a whole badly needs some rules-defying risk-taking. For business, that means a bit more Amazon in the boardroom and a bit less GE.

What does this have to do with law firms?

A forward-thinking Managing Partner recently floated the notion of modeling the firm on Amazon, not GE: focussing on investments for the future and wide experimentation rather than maximizing cash flow (read: PPP) at all costs. His partners greeted the notion like turkeys might greet Thanksgiving: And the quote that captured it all was one partner who said (I paraphrase): “Your investments won’t help me buy my summer house.” I do not know how long this partner remained with the firm.

The immense and overwhelming gravitational pull of the partnership organizational form towards a short-term, this quarter/this year orientation seems to me to pose a greater and greater threat to our ability as an industry to respond to new challenges. Like the imaginary “tractor beam” deployed in Star Wars to grab enemy spacecraft and reel them in to their fate in the clutches of the opposing force’s mother ship, the pull of the short-term seems to me irresistible and terrible if unopposed.

This does not constitute a recommendation to buy AMZN and short GE.