Chart 2 goes to the heart of the matter. It shows a positive but weak relationship between average profit yield to equity partners and firm size measured by gross revenue. Note though that most of the largest firms (those over $1.5 billion revenues) yield below-predicted profit for their partners. Of these largest firms, several are multinationals and vereins in which very wide geographic differences in profitability may explain their relatively low profit yield relative to firm size. A large fraction of the smallest of the top 200 also are less profitable per partner than the overall average (see the concentration of firms of less than $500 million in revenues whose per-partner profits are less than $1 million).

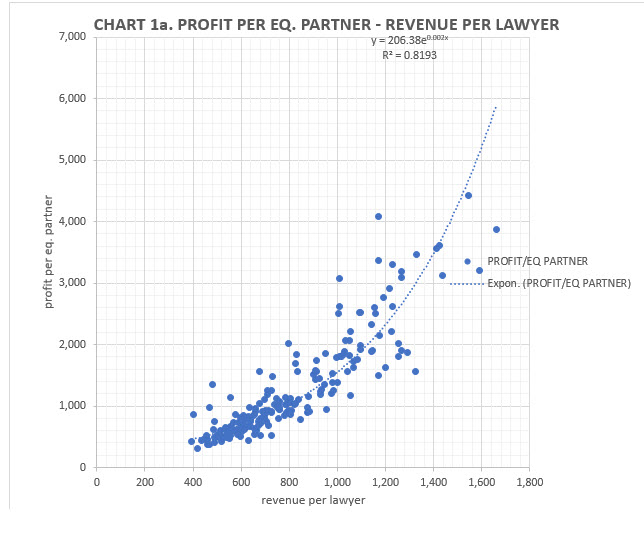

The third chart tells us that there is almost no connection at all between profit per partner and firm size measured by the number of lawyers. The scatter of observations is very wide and the very biggest firms exhibit lower-than-average profit per partner.

Conclusion

There are several reasons why already-large law firms’ partners and managers might wish to see their firms grow. But when an incumbent partner contemplates an investment in growth and asks “Will this put more money in my pocket?” the answer cannot be supported by any broad statement about firm size among the American Lawyer Top 200. Indeed, the very wide distribution of profit per partner at all levels of firm size among the Top 200 is a caution against generalization.

Two factors connect firm-wide growth to incumbent partner pay outcomes. The first is whether expansion makes a firm more excellent in the eyes of clients and recruits. Excellence, however hard to define, generates demand, creates competitive advantage, justifies higher billing rates and attracts better candidates in the market for legal talent. Second, the payoff to incumbent partners for investment in growth depends importantly upon the way partner profits are distributed.

“Shared fate” pay programs in which partner compensation is determined less by individual partner accomplishment and more by “the size of the pie” will yield benefits to incumbents as long as new partners do not claim a highly disproportionate share of their incremental contribution to the firm’s profit. By contrast, incumbent partners in firms whose pay plan predominantly rewards individual contribution cannot expect much spillover into their pockets from firm growth not directly connected to them.

Two points are worth reiterating:

- There are reasons why growth is healthy for a firm even when it does not put more money in incumbent partners’ pockets.

- Among the top 200, the statistics show that when it comes to equity partner income, firm size matters hardly at all.

The original version of this article can be found on the Veltro website.

Bruce

Update: 27 March

What follows had its genesis in a private email sent to me by a loyal and exceedingly thoughtful reader (not that you all aren’t!). On reflection, and with the consent of the reader and Dr. Rapp, your editor in chief decided what it adds to the conversation is worth sharing publicly, albeit edited for concision and clarity (I am the editor, remember). I hope to encourage, not discourage, the intrepid among you to read on with the caveat that you will see the word “heteroscedasticity” in action, and used properly to boot.

I have a question about Dr. Rapp’s graphs. I didn’t want to take up space on the web site on a technicality or two. If you think this is worthwhile, you might wish to answer at your convenience, or perhaps even forward it to Dr. Rapp.

My immediate response to Fig 1 is that there is a distinct outlier, and I wonder if it affects what one thinks of the rest of the data. Just imagine taking that out (and it is clearly an outlier in all three graphs), it looks to me like a case could be made that the relationship is not linear, but rather a concave upward power function. It would pretty surely change the slope and drop the R2 if it were removed and still modeled as linear.

Removing that datum would make little difference to Figures 2 and 3, but for them I wondered if Dr. Rapp has looked at the empirical distribution and tried to see whether there are possibly two or more populations, and that if this were so, might there be information available in looking at the behaviors of those subpopulations? (Granting the loss of power by reducing the sample sizes, of course). It is pretty easy to see, especially in Figures 2 and 3, that the outlier in Figure 1 is a small firm with a bucket full of revenue (and very low costs, based on Fig 3) in the model year.

And here is Richard Rapp’s reply:

Smart questions. The outlier is, of course, Wachtell, Lipton whose numbers are:

Lawyers: 261

Partners: 84

Revenue: $832,000,000

R/L: $3,188,000

Profit per Partner: $6,600,000

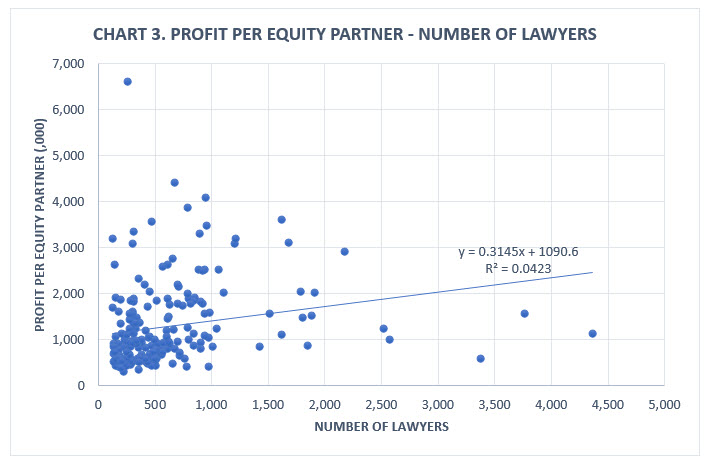

Remove this observation and you get this (chart 1):

The R² and slope aren’t much changed. Visual inspection of the Wachtell point tells us it isn’t wildly out of line and so not as influential as it might otherwise be. I think the more telling point you raise comes later.

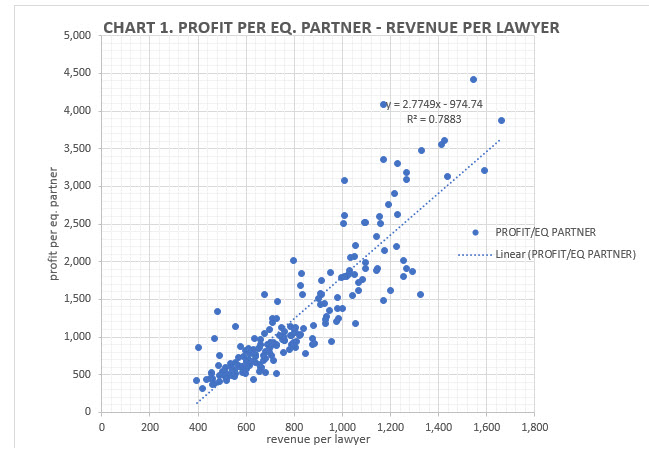

As to alternate models, you are right — it looks better as a power function or an exponential (the latter below, chart 1a). In any case, all I’m trying to do with this chart –the only reason it’s there at all — is to present the reader with an example of reasonably good fit to contrast with the two charts that follow in the piece.

More important is the question of two populations, given the heteroskedasticity that we see (but don’t bother to test for). So why didn’t I test for a structural break? Because having had a look at the lack of trend in margins with firm size (see below, chart 2 which doesn’t appear in the “think-piece”) and given the constant-cost nature of the law business, I couldn’t think of a handy, plausible two-population hypothesis. If this were my doctoral dissertation I would construct a real model including variables like ‘fraction of lawyers outside the U.S.’, or ‘U.K.-managed firm’ –two factors likely to reduce profitability. But if we were to see significant differences across those dividing lines, for example, the finding isn’t at odds with the proposition that firm size alone is a poor predictor of per-partner income.

You are right to raise the points you do. My only counter – I can’t visualize how my conclusion is threatened by them — isn’t much of a defense.

Now, at pains of it not being obvious, I exposed you all to this discussion (heteroscedasticity included) not to have played statistical sophistication as a trump card, but for precisely the opposite reason, to offer you all an opportunity to reflect on how intellectual tools–most assuredly in the world of Adam Smith, Esq. including data–invite the exercise of human judgment, experience, and understanding. But within a disciplined framework and bounded context.

So why doesn’t firm size matter at all with respect to profits per equity partner? Is it because any advantages of a large firm, such as economies of scale, diversification, access to resources, etc. are negated by other factors? If so, what “other factors” are there? Could it be opponents, knowing who they’re up against, bring their “A” game? Or maybe a large firm’s ability to boost profits per equity partner is tempered by increased bureaucracy, sluggishness and more difficulty in maintaining a unified organization?

Out of curiosity, why are most BigLaw firms largely devoted to hourly billing? And why don’t we see many large firms focused on personal injury? Seems like the personal injury practice of law would benefit greatly from having large firms.

Richard Rapp and I briefly corresponded about these questions and his reply, in which I thoroughly concur, follows: