Nearly 20 years ago Robert Hughes published The Fatal Shore: The Epic of Australia’s Founding, still perhaps the definitive historical treatise on Australia’s founding from the continent’s discovery by the West to Britain’s decision to transport incorrigible convicts there to, ultimately, the creation of a new society. My column today is not only several orders of magnitude less epic, it’s a lot more upbeat about human nature. That said, I shall rehearse how Big Law “discovered” Australia.

Timing, they say, is everything.

And just as I noted recently that the ever-upward trajectory of globalization has plateau’d and even by some measures begun a perceptible decline, so too with mining and commodity booms.

Not to be oblique about what we’re talking about here: We’re talking primarily about Australia.

From dateline “Sydney,” The Wall Street Journal reports (emphasis supplied) that:

Global mining companies face an urgent dilemma in the grip of a prolonged commodities downturn: whether to bet heavily on new projects absent firm signs of an upturn—or wait until a recovery in prices gathers pace.

At the heart of each company’s decision is whether China is finished as an engine of torrid resources demand, or about to ramp up spending, this time on consumer goods such as air conditioners and refrigerators. If the latter, it will require commodities not at the forefront of China’s industrialization so far.

Corporate mining behemoths can basically place their bets one of two ways: As Rio Tinto has by going long and investing about $7.5-billion on expanding its existing capacity in copper and bauxite, or by going short as BHP Billiton has done in scaling down a planned expansion of its main copper mine. (BHP is also hedging a bit by experimenting with new ways to extract more usable minerals from the same raw material, but it will take nearly five years to learn whether that pans out, as they say.) The two approaches in the words of their executives:

- “We might be a little bit late to the party,” said Jacqui McGill, BHP’s executive responsible for Olympic Dam [the copper mine I mentioned].

- “The growth strategy of Rio going forward will be: Build and buy smart,” said Jean-Sébastien Jacques, who became Rio Tinto’s chief executive in July.

While their bets are clear, others admit flatfootedly that it’s tough to make a call: “It is very hard to get your timing right,” says Graham Kerr, CEO of South32 (a company assembled from BHP divestitures): “Picking when the steel market is going to be at its peak, or picking when copper will be in oversupply or deficit, the industry hasn’t been particularly good at it.”

Sure, commodities’ prices tend to move in cycles, but they weren’t ever predictable enough to really base long-term investment decisions on with any degree of confidence, and what were thought to be established cycles are harder and harder to discern of late. A standard cycle was thought to be four years boom to bust, but supercycles can last a few decades, and close observers say what we’ve been going through lately doesn’t resemble anything in the historical records going back 100 years.

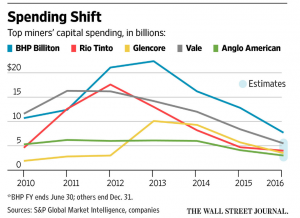

Nevertheless, it’s clear that all the Big Mining Firms have been dialing back their capital expenditures for the last five years or so:

And what was Big Law up to right around the time those CapEx lines peaked? Well, merging with Australian law firms, of course, in the expectation, among other things, that China’s appetite for raw materials would continue its insatiable trajectory. Ooops.

To be a bit more charitable here: The moral of this story, as experienced by Law Land, is two-fold.

First, as much as we might like to think of ourselves as captains of our ships and deft maneuverers around the landscapes of what practices and geographies are hot, we are all subject to macroeconomic forces. As one of my favorite Managing Partners likes to remind his troops, “In the long run, we can’t do better than our clients.” A little humility, and perhaps a little portfolio diversification, might seem in order.

Second, if the only information you had available when you were contemplating a merger with an Australian firm looked like this:

Or, the world as we knew it in 2012 when these bets were being placed, it looked like the most obvious play in the world. All lines heading up and to the right!

So again, humility to be sure, but one other thing: How about some scenario planning? Surely had that exercise been undertaken in a serious and thoughtful way ca. 2012 one of the scenarios would have looked recognizably like what actually did unfold, we now know with benefit of hindsight.

Lest you assume this train of thought only applies to the historic one-off event of UK/Aussie law firm tieups right around the peak of the commodity boom, far from it. It applies to every decision by law firms to enter new markets–be they new metropolitan areas or new practice areas–in serious and substantial ways. It applies to single-city firms in (say) the US Midwest thinking of opening a second office and to firms “known for” XYZ thinking of expanding into UVW. Yes, we can stipulate that “the most likely forecast of the weather for tomorrow is the same as the weather today”–the linear extrapolation, in other words–but you need to think seriously and hard about other ways events might play out.

Not that you should make no bets: I will be the last voice you will ever hear advancing that counsel of cowardice and despair.

But that you might have at least thought about a Plan B when the linear extrapolation that produced Plan A dissolves in tears.

The only commodities to which I can speak from experience are metals, but what we have seen in the last 40+ years in metals is that when a rising price regime reaches 3-4 years (as you point out, the “normal” cycle), people in mining start to talk to each other in the phrase, “This time is different.” The longer the up-side, the more this is said, until it becomes conventional wisdom. And that’s just about as analytical as it really is.

Analytical tools now exist that would allow serious risk assessments to be completed, taking into account uncertainties on the supply and demand side, including political risk in its several forms, and allowing for differential risk-aversion cross firms. I would think that offering this level of expertise was something that companies like Rio, BHP, and others like Glencore with very different portfolios and histories, would expect from Big Law. If not available there, they will obtain those analyses elsewhere (e.g., Axiom etc.)

And, as you point out, it wouldn’t do the law firms a bit of harm to work though such analyses themselves with respect to their own business arrangements.

In January 2016 The Economist looked at the accuracy of the IMF’s economic forecasting and concluded that “[f]orecasts of all sorts are especially bad at predicting downturns”. Given that the IMF’s economic forecasting resources and expertise most likely to exceeds that of the average law firm I agree that it would not have been obvious to firms in 2012 that the China-driven commodities super-cycle in Australia was potentially coming to an end.

I also fully agree with the central thrust of the article that scenario planning ought to be applied to “every decision by law firms to enter new markets” but I think I’d go further and say that instead of just preparing Plan A and Plan B, how about prepping a Plan C, Plan D etc… in case things don’t pan out as expected. Moreover, it’s not enough to merely have prepared a backup plan. The firms also need to be ready to execute the plan (and execute it hard) as soon as it becomes clear that circumstances have changed and Plan A is no longer the best strategy for the business to follow.

Hoping that things work out or that ‘something will come up’ is not a business strategy, it’s wishful thinking.

IU