From the redoubtable David Warsh of Economic Principals:

When the Nobel Prizes were established, in 1901, the Nobel Foundation for perhaps a decade sought to spirit laureates into Stockholm in order that they should be available when their recognition was announced. The world was smaller then. The Swedes gave up, in favor of telegrams, after reporters began staking out the railroad stations.

This year’s economics Nobelists are Oliver Hart and Bengt Holmstrom. Techically, the economics Nobel is the “Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel,” since it was not one of the original 1901 set of Chemistry, Physics, Literature, Peace, and Medicine; the Economics sibling is the baby of the family, dating only to 1969.

Prof. Hart was born in London, earned a bachelor’s in math from King’s College Cambridge and a masters in economics from the University of Warwick. His Ph.D. came from Princeton in 1974, and he joined the Harvard economics department in 1993, chairing it from 2000—2003. He’s also a visiting professor at the London School of Economics.

Prof. Holmstrom was born in Helsinki, got his bachelors in math and physics from the University of Helsinki, a masters in operations research from Stanford and a doctorate in business from Stanford. He joined the MIT economics department in 1994 and chaired it from 2003—2006. (Studious readers will note that I can celebrate a two-fer here, as Hart’s and Holmstrom’s doctoral degrees came from my two alma maters.)

They won for their work in contract theory, which has influenced many fields ranging from executive compensation and broader issues of corporate goernance to privatization to constitutional law and beyond. As the Royal Swedish Academy put it, because of Hart and Holmström “we now have the tools to analyze not only contracts’ financial terms, but also the contractual allocation of control rights, property rights, and decision rights between parties.”

An important part of contract theory recognizes that contracts can never exhaustively detail all possible outcomes—news flash, lawyers!—and that the optimal way to deal with unforeseeable future eventualities is to make sure that the contract gives the right person the right to decide when the parties can’t reach consensus.

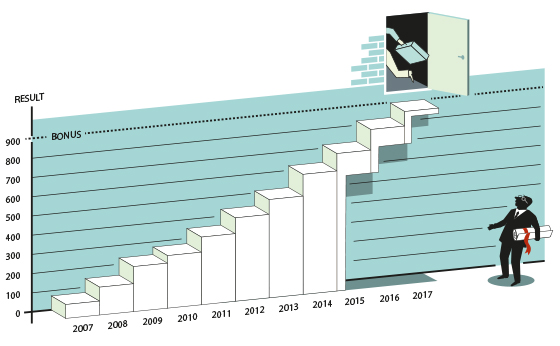

Another concrete implication would recommend that executive compensation not be tied to luck, and therefore that if stock performance is a component of deferred future comp, it be adjusted for an index of stock performance of companies in the same industry. (If an entire sector booms obviously that doesn’t mean any given executive was a genius, but conversely and to be fair, if an industry craters but your company doesn’t fall as far or as fast, you deserve some credit even if shareholders suffered losses overall.)

As with all complex and subtle theories, the recommendation it produces in many cases is “it depends.” For example, if an electric utility needs to renegotiate its deal with a coal mine, the question presents itself whether the utility would be well advised simply to acquire the mine and vertically integrate. There’s no black/white yes/no answer. In the area of privatization, this has relatively clear contours. While their work strongly suggests that privatizing prisons is optimal—subject to common sense regulation about standards for treating inmates, etc.—no one would dream that outsourcing, say, foreign policy is anything other than preposterous. (Contract theory at least specifies why it would be preposterous: It’s insanely difficult to specify in advance how to carry it out.)

At the highest level of generalization, Hart and Holmstrom’s work addresses the thorny “principal/agent” issue, which Adam Smith himself explained in Wealth of Nations:

The directors of such [joint-stock] companies, however, being the managers rather of other people’s money than of their own, it cannot well be expected, that they should watch over it with the same anxious vigilance with which the partners in a private co-partnery frequently watch over their own. Like the stewards of a rich man, they are apt to consider attention to small matters as not for their master’s honor, and very easily give themselves a dispensation from having it. Negligence and profusion, therefore, must always prevail, more or less, in the management of the affairs of such a company.

A concluding note about the trend of economics Nobel’s lately: They have strongly concentrated in micro-, not macro-. Microeconomics deals with the ins and outs and nitty-gritty of markets, production, substitutes and disaggregation, and so on. Macroeconomics is what tends to be covered in the popular media: Fiscal and monetary policy, interest rates, trade balances, taxation and surpluses and deficits.

If you ask me, the Nobel committee hasn’t awarded many macro-centric prizes lately because the field is in a funk of profound confusion. Keynes and Friedman are dead. Long live Keynes and Friedman. At some point we’ll do better on this front.