Should the Managing Partner or Executive Committee of this firm focus on how its RPL stacks up industry-wide? Well, of course they could, but suppose they did just that and chose to try to raise their standing in the averages? Their choices would be (1) to fundamentally change their office footprint, a project which could absorb a decade with no guarantee of a superior outcome on the other side; (2) try to move up-rate in their practice area mix, which could also absorb a decade, etc., while drastically disrupting the lawyer ranks in the process; or (3) deleverage when they have, by hypothesis, found a leverage ratio that’s close to optimal for their client list.

But there is one reason they might feel embarrassed or defensive about their RPL quotient, encapsulated in the doubts potential laterals might express about the low RPL figure. Why might a lateral raise that and why might the firm take it as a serious and substantive question?

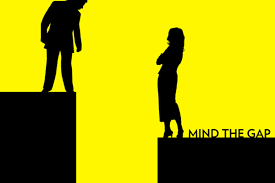

Because we’re always and everywhere comparing ourselves to others. What we’ve achieved, the path we’ve chosen, is never sufficient; we seem to have a preternatural compulsion to always be looking over our shoulders at others. If you doubt this, I invite you to conduct this experiment on your own: Suggest a slightly new, different, and better way of doing things to a colleague and ask their reaction. I’ll lay odds the first words out of their mouth will be, “Who else is doing this?”

Among the rest of the population, the “non-lawyers,” I bet much of the time the reaction would be the reverse: “I hope no one else is doing this!”

True story: The COO of a firm with a large Boston office told us how the decision whether or not to close the office during a heavy snowstorm was arrived at. “Did we see whether the courts were closing? Whether clients were shutting their offices or cancelling meetings? If the mass transit authorities were warning that people ought to get home? No! None of that. What made the decision for us was simple: ‘Is Ropes & Gray closing?'”

Back to RPL: Do not look over your shoulder at “yours” vs. “theirs.” Spot yourself your own business model and strategy. If you’re an elite firm dealing with high stakes matters, then by all means a higher RPL is probably an index of health for you. If you’re like our hypothetical firm above, pay your RPL zero heed. If you’re moving from a general practice, full service, destination-for-nothing-in-particular “Hollow Middle” firm into one focused on a particular niche (a “Category Killer”), and if that niche comes with intrinsically lower rates, celebrate a declining RPL.

It all depends on who you are. Not who the other guys are.

As you say Bruce … Among the rest of the population, the “non-lawyers,” I bet much of the time the reaction would be the reverse: “I hope no one else is doing this!”

Exhibit 1 – Jim Collins Good to Great, Chapter 5, Simplicity Within 3 circles.

The third circle is “What Drives Your Economic Engine”. Often paraphrased as “what you can make money at”, but what Collins actually described was how all of the Good to Great businesses had found a strategically important metric, which no-one else in their industry had uncovered.

By focusing on this new metric they went on to sustained success, and in some cases upset the established order in their industry. Of course some have since lost their edge, but Collins qualification criteria meant that they all had at least 15 years of outperformance.

What would we give for a metric which would allow us to dominate till 2030??

Bruce,

Thanks for all your insight. One shared insight and one query (which you may address later):

1.) A sign of a mature company or organization is that they can look at talented and marketable individual and say “Yes, person Z is great. But Z isn’t who we are and what we do here.”

2.) The third post is likely to cover PPP. I know you’ve mentioned in the past that you would like to see retained earnings as another metric that law firms should disclose. Any others? (Debt or liability obligations, Free cash flow, historical and future revenue growth, share dilution, etc.) I know I’m “borrowing” terminology from publically traded companies. I would welcome your thoughts on this has application to big law and their financial performances.

Bruce, how about a metric that’s in between revenue per lawyer and profits per partner, which is income per lawyer? Add partner profits to associate salaries, divide by the number of lawyers, and out comes IPL. This struck me as a potential metric some years ago when I was at a large (for here) firm, the management of which was complaining that its profit per partner was not as high as most of the competition. I suggested that the firm de-equitize all but the two highest-paid partners and pay the de-equitized partners what they’d been making before. The firm’s PPP would have jumped from $300,000 to $750,000 overnight, yet it would still have been the same business, and its IPL would have stayed unchanged.

In order to derive metrics that would be useful (which obviously are the ones we want), one has to determine and be clear about what is important to the law firm. Only then could one begin to characterize the issue in a way that could be measured. Bruce has written a book, A New Taxonomy: The seven law firm business models [Adam Smith, Esq., New York 2014]. It seems that these models (and I suppose there could be others) are sufficiently different that no simple metric could hope to be equally important to each type, much less accounting for the preferences and values of the partners in each. Then, one might consider what happens when Firm A in one of Bruce’s models decides that it wishes to act as and become more of a new type. What characteristics would need to change, and how would one measure change of those characteristics? If a current, published “metric” would suffice as a measurement of something that is important to one’s firm, then the firm – which supposes that the term “firm” has functional meaning – is justified in adopting that metric as useful. “Horses for courses.” So what is the course for your firm?