I’m often asked—on a panel last month in Europe and on a panel later this month right here in New York at the Law Firm COO & CFO Forum, for example—what I think about “disruption” in the legal industry.

Bypassing the obversation that it’s a large and amorphous question, it immediately seems to summon forth two camps of people, whom we can call the Believers and the Deniers for the moment. And that is usually pretty much where the dialogue begins and ends. This tiresomely predictable result generally leaves me in an awkward spot if I care to take my responsibilities seriously, both on the panel and as an analyst of and participant in the industry. My problem is that I’m neither a believer or a denier; I happen to think it’s more complicated than that.

Believers generally start from the premise that Law is a big industry—something north of half a trillion US$/year in revenue worldwide—followed by the inarguable observations that it hasn’t fundamentally changed in a very long time (although we have “automated the quill pen,” as a friend jokes), and that lurking on the sidelines, and increasingly impatient to get sent onto the field, are any number of sophisticated, well-funded, and ambitious startups. In other words: “Just you wait!” (This is typically pronounced with a high degree of self-satisfaction, bordering on glee.)

Deniers start from the equally inarguable premise that, well, that Law Land hasn’t fundamentally changed in a very long time. So why should we expect this time to be any different?

I have heard recently, and in person, that we could have spent the last 20 years worrying about the accountants coming, but they never actually did. So are we supposed to start now? Q.E.D. Delivered, I might add, with a virtual slap on the back and an equally virtual, “Good old chap….”

Deniers can also find juicy targets in the sometimes overheated rhetoric of the reformist camp. Alex Novarese of LegalBusiness (a friend) recently noted in a column whose headline included the phrase “cutting edge New Law twaddle” that some ventures seem to have “been set up for ill-defined reasons by the people who have been bringing you jargon-laden, proselytizing conferences laden with Palo Alto-style utopian geek speak,” and that:

It gets worse. And funnier. It should be possible to believe and discuss the very real likelihood of dramatic tech-supported change in the delivery of legal services without descending to Google-inflected guff but it just goes to show that New Law is even better than Old Law at making inane marketing proclamations. That’s progress for you.

Entertaining fun is had all around, but back to the question: Is there or is there not some coming disruption in Law Land?

Let’s try a distinction and see if it helps:

There’s business model disruption—presumably at the hands of new entrants into the marketplace for providers of or substitutes for legal services—and then there’s technology disruption. I think this distinction falls down as soon as you state it, however, since if a “technology disruption” is to have any economic or financial impact, it will have to entail a disruption in the (business) marketplace. That said, you can still, I suppose, enter the maze of speculation about disruption through the business-model door or the technology door, understanding it’s all one maze. Today I want to enter through the technology door.

Now, if there’s really going to be “disruption” in terms of what lawyers do, it won’t be predictive coding in e-discovery, assembling wills and deeds of sale through spiffy software on LegalZoom, or conducting labor market arbitrage between the Northeastern US and the subcontinent of India. Those are akin to giving an auto mechanic an air wrench instead of a manual wrench; it will speed things up (greatly!), but the mechanic is still deciding what has to be done, initiating the process, and evaluating the results.

I don’t know if my standard of what “disruption” would look like is typical, but for disruption to qualify as the real thing, I think it has to begin to perform some of the actual legal reasoning reserved to flesh and blood lawyers today.

Perhaps it’s too easy to slide from that into the quagmire of “artificial intelligence,” which has been, to borrow a phrase from another domain, the technology of the next decade since World War II or thereabouts. Rather than go down that boulevard of broken dreams, I will refer you to the pithy observation attributed to many fathers and now part of Silicon Valley lore that “it’s only AI so long as you don’t know how it works; once it works, it’s just software.”

Now, if there’s one thing that the American public had surprisingly and memorably drilled into them about computers performing human-type feats of deduction and analysis, it was the famous triumph in 2011 of IBM’s “Watson” over two human champions at Jeopardy.

Within months, IBM set up a Watson business unit. The original Jeopardy-winning Watson machine was the size of a large bedroom; IBM quickly reduced it to the size of the vegetable drawer in your refrigerator. And their target? “Any information-intensive industry was fair game, anywhere where there were huge volumes of unstructured and semi-structured data that Watson could ingest, understand and process quicker than its human counterparts. Healthcare might be a starting point, but banking, insurance, and telecoms were all in the firing line.”

And within months of IBM setting up the new business unit, Watson was installed and working away at New York’s Memorial Sloan Kettering Cancer Center helping doctors make better treatment choices. (There’s a three-minute video here.)

As part of IBM’s $1-billion investment in the development and commercialization of Watson technology, this week they are celebrating the opening of their development center right here in SoHo. And now Watson has come to Law Land.

The first entry point that I’m personally aware of is an implementation being run by Legal OnRamp helping “too big to fail” banks comply with their Dodd-Frank imposed mandate to go through “resolution and recovery planning” (“RRP,” more colloquially known as living wills), which merely requires them to draw up plans as to how they would go forward, or gracefully liquidate, under virtually any conceivable future scenario. (I wrote previously about OnRamp’s “bridge to practice.”)

Needless to say, this is “stress testing” of an entirely different order, and it requires among other things capturing and putting into a structured database the tens and tens of thousands of contracts any mega-bank will have—and updating it continually. In terms of massive jobs in legal analysis, this approaches the fabled “boiling the ocean” thought challenge.

And note one highly distinctive and salient characteristic of this type of quasi-legal, quasi-compliance assignment: Neither corporate inhouse law departments nor Big Law is remotely cut out to do it. It takes, or it will take, some kind of third approach.

Not only a “third approach,” but think about how the “living will” issue combines several characteristics which, I believe, are going to become increasingly common as regulatory and cross-border complexity grow:

- Whatever tools are used to address the problem will need to “scale” powerfully and smoothly;

- Young lawyers can and are going to provide a large component of the workforce addressing these issues;

- And compliance with these kinds of mandates is not discretionary.

Watson is going to step up to the plate.

Is this, then, disruption at last?

I remain agnostic, or perhaps more accurately, at the moment I subscribe to the “Scottish verdict” of “not proven.”

Big Law has an opportunity here, should you choose to seize it. It’s simple: Your firm can begin actively exploring what Watson’s capabilities–which will inexorably grow over time–might be able to provide your clients. Yes, this will require people, time, and money, albeit small dashes of each at this point. It may go down easier with your partners if you explain that deciding to get to know Watson better, as it were, doesn’t require you to be either a Believer or a Denier. Watson is here and now. What it will become in future is anyone’s guess: Not even IBM could tell you.

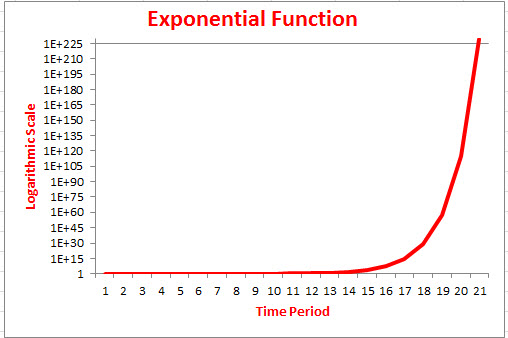

But for those of you who haven’t taken a look at an exponential curve lately, here is one: This is a simple series starting with the value 1.001 and raising it to the 1.01 power in each consecutive time period:

The story here is very simple, and it’s one I subscribe to: Disruption is invisible, invisible, invisible, until it suddenly becomes overwhelming and undeniable.

My working hypothesis—for that’s the best any of us can, honestly, do at the moment—is that both the Believers and the Deniers are premature. In the end, we shall see.

“Think”

Great post, Bruce. I’d be pleasantly surprised, bordering on shocked, if more than a tiny fraction of the AmLaw 100 had approached IBM to talk about Watson’s legal applications. I’d be equally shocked if any of the Big 4 accounting firms had not.