I was at a conference of “Canadian Law Firm Leaders” outside Toronto earlier this week, and one of the highlights of the event, to my mind, was a talk by a representative of PeerMonitor, ThomsonReuters’ data analytics arm, which compared the recent performance of AmLaw first hundred, AmLaw second hundred, and so-called “mid-size” firms (their nomenclature, but essentially all the firms in their member database which don’t qualify for the AmLaw 200. (The conference was held under the Chatham House Rules, but I view this report as faithful to their precepts since I am not identifying anyone in attendance by name and the PeerMonitor data is publicly available online and outside the confines of the conference.)

What I saw confirmed an instinct I’ve been feeling with increasing force over the past few years, but now we have data evidently in support of my hunch.

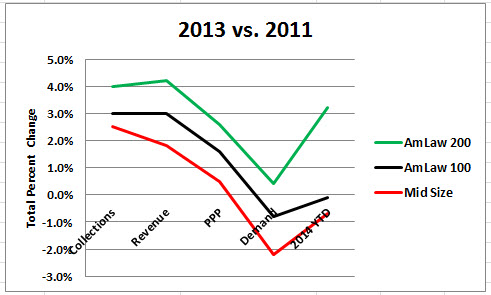

My hunch is simple: Mid-size firms are finding it tough going. They’re facing even stronger headwinds than the rest of the industry. (Yes, all the usual caveats apply, primarily that the experience of any given firm will always belie averages and generalizations, but I don’t talk indiscreetly about individual firms, as readers surely must know by now, so we will go with the PeerMonitor average data points.)

The heart of the presentation on this topic displayed information about the relative performance of these three groups of firms in the timeframe 2011—2013 on the following metrics:

- Cash collections

- Revenue growth

- Growth in profits per partner

- Growth in demand; and lastly

- A snapshot of 2014 YTD revenue

In tabular and graphic format, here is that data:

And this:

Recall that PeerMonitor data is real data taken straight from client firms’ financial reporting systems and not, ahem, marketing-driven data submitted to popular legal journals without even an affirmation of accuracy behind it, much less a certain future audit. A further methodology note: Their participant base consists of 58 AmLaw 100 firms, 50 AmLaw second hundred, and 51 mid-size, which are represented in the numbers above.

Enough with the data. “To anyone who cares to see,” in the famous phrase, it delivers a stark point about relative performance of these segments, with the AmLaw second hundred seemingly the place to be and mid-size firms bringing up the rear.

But what does it really mean?

Does the problem of midsize firms that you describe translate into “Not big enough to be noticed, and not small enough to be nimble”?