The first thing you learn in your antitrust law course is to ask, “What’s the market?”

In other words, define the market you’re talking about, because the definition you select, I promise you, will make all the difference. Antitrust analysis aside, choosing the span of the market on which you plan to compete is such a critical part of organizational strategy that coming up with the wrong answer can be a life or death decision. Consider just one legendary misapprehension of one’s market: Western Union passed on Alexander Graham Bell’s offer to sell them his US patent rights to the telephone because…they thought they were in the telegraph business, not the communications business. And “the telegraph is all our customers need.” Well, I suppose if you put it that way, then QED.

Believe me, I don’t mean to imply that defining a market is child’s play—or that we’re so remarkably superior to and more enlightened than the unfortunate naifs at Western Union over a century ago. Consider (this is just a thought experiment) what market HBO is in. The market for original movies and TV series? The premium/subscription cable market? The TV market? The entertainment market?

Or, here’s a thornier one currently playing out before our eyes: What market are Comcast and Time Warner Cable in, for purposes of their proposed merger? Cable TV? (If so, they share access to not a single subscriber.) Broadband? “Bundled” cable, broadband, and phone? The market of “intermediaries” between consumers and content providers? Not obvious.

But enough of the dilemma.

Today I write because I fear far too many of us are making a mistake in blithely assuming we know what the “market” is for newly minted law school graduates. It’s not one market. Thoughtful observers of this precinct of Law Land have long known this, of course, but for those of you who may not have given it much thought, or for the cognoscenti who might be interested in a little data-driven dimensionalization of this reality, read on.

At the recent annual NALP conference in Seattle, Jim Leipold, the executive director, summarized the post-Great-Reset market this way:

- fewer entry-level private practice jobs

- lower average starting salaries

- higher unemployment and under-employment

- fewer JD’s working as lawyers

- (and as a corollary) more working in business, “law-related” fields, or seeking entirely different careers

- new grads competing with displaced lawyers

- and overall a job market that is “tough across all sectors.”

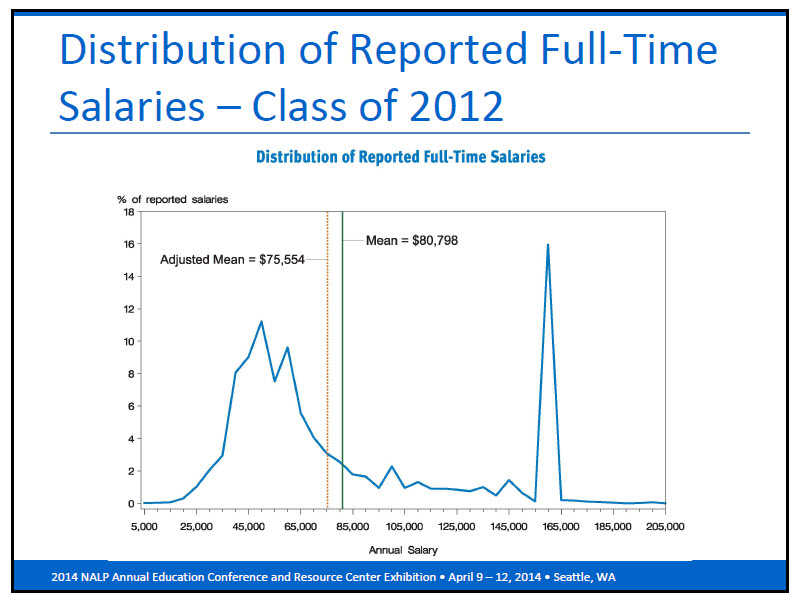

That’s from the 30,000 feet perspective. But Jim also updated what he called “my favorite slide of all time,” the bimodal salary distribution of new graduates. (NALP also gets credit for discovering this bizarre distribution when it first emerged, starting ca. 2000, and they’ve faithfully updated it ever since.)

By the way, you can click on any chart in this column to see it larger, in a new window.