I thought this would prove to be a tempest in an academic teapot—”where the politics are so vicious and bitter because the stakes are so small”—but the mainstream media has proven me wrong.

I refer of course to the bar brawl that has broken out challenging a key finding of Harvard professors Carmen Reinhart and Ken Rogoff’s 2010 paper (separate from their 2009 book, “This Time Is Different”) that public debt levels above about 90% of GDP impede economic growth. The challenge has been taken up with unrestrained glee by all who object to austerity measures. (E.g., “Perils of placing faith in a thin theory,” Wolfgang Munchau in the Financial Times, or “The Excel Depression,” and, for good measure, “The Jobless Trap,” both from Paul Krugman in The New York Times, invariably a safe bet for hyperbole in service to ideology).

I won’t belabor the details (the WSJ has a full response from Reinhart and Rogoff here), but it all began with the recent publication of a paper by University of Massachusetts Amherst economics doctoral student Thomas Herndon and professors Michael Ash and Robert Pollin saying that Reinhart and Rogoff were wrong in concluding in their 2010 study that a high level of public debt dooms an economy to protracted slow growth.

Why bring this to the attention of Adam Smith, Esq. readers, many of whom are presumably fortunate enough to have been spared the outcry? After all, and you won’t find me taking sides here, much less presuming to resolve anything,

Well, I bring it up because I feel a professional, intellectual, and publisher’s responsibillity to point you back to my January 2011 column, “We are not alone,” where (so you have told me) I introduced many of you to the Reinhart/Rogoff book, This Time Is Different. So I felt an obligation to point out neither that column nor any other here on Adam Smith, Esq. has ever mentioned the “90% debt rule.” Ideology simply isn’t our thing.

But the January 2011 column—and today’s for good measure, since it’s still clearly true—did cite Reinhart and Rogoff for their proposition that recovery from financial-crisis-driven recession takes far longer than recovery from garden-variety inflation-busting or inventory glut recessions.

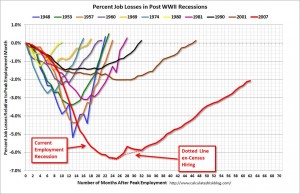

I refer you to two charts that, I submit, suffice to tell the story (these are updated, of course, from the earlier column).

First, from the invaluable Calculated Risk blog, the chart of net job losses as a percentage of pre-recession employment for every post-World War II recession in the US:

And second, the “long term” (over 26 weeks) unemployment ratio (this time series goes back to 1969, or nearly 45 years).

As a wise managing partner trying to put some perspective on the meltdown put it to his colleagues in the depths of 2009, “We can’t really grow all that much faster than our clients—not for long, anyway.”

That’s why Reinhart and Rogoff’s learning is still germane. And, as far as Law Land is concerned, still true.

Regardless of the shootout at the Economics Department Faculty Lounge.

So, R&R were wrong, but so what because they were right? Okay, maybe they cooked the books–or were sloppy to the point of failing Eco 101, but so what because they are RIGHT? Okay they cherry-picked their data–possibly because they are incompetent–and their equations are wrong, but so what because they are RIGHT? In short, everything they did is wrong and still they came up with the right conclusion?

Wow, talk about intellectual rigor! That seems to be the extent of your interests. TALKING about intellectual rigor.

I’m saying the debate between the ideologues is on an aspect of R&R’s findings that I did not address and never will. If parsing that distinction fails to qualify as intellectual rigor, I guess I plead guilty.