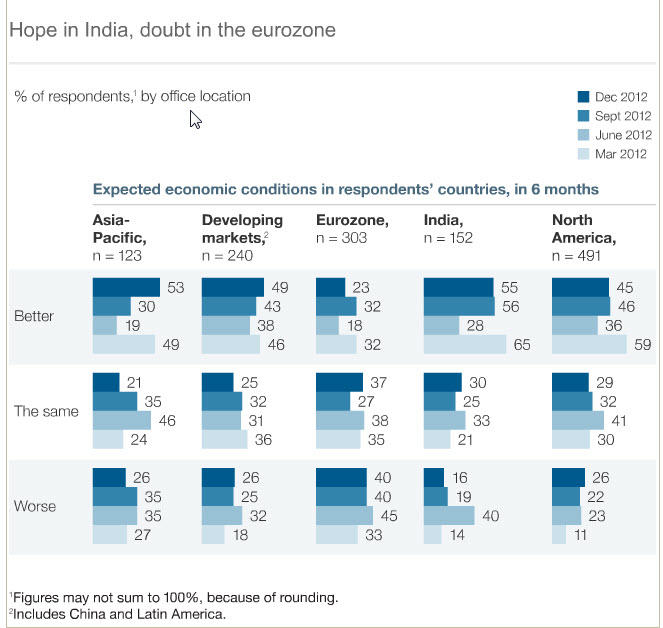

This chart has a great deal of data on it (which I actually admire as an armchair student of the visual display of quantitative information), but to simplify comprehension I invite you to focus only the darkest blue, top—and current reading—bars. The story it tells becomes rather simple:

- Asia-Pacific (which does not include China or India) seems to be suffering schizophrenia, going from optimistic a year ago to pessimistic since then and back to optimistic again in the most recent reading;

- Developing markets, including China and Latin America, seem reasonably stable in outlook with about half thinking things are looking up and the other half foreseeing no change or a deterioration;

- The Eurozone is getting more and more pessimistic;

- India is the reverse, becoming more hopeful;

- And as for North America, it’s hard to discern a meaningful trend, with consensus bumping along much as it is in the developing markets, with roughly half hopeful and the other half split fairly evenly between status quo and deterioration.

Next up is prioritizing what’s impeding growth. What’s of interest here to me is not what the risks are (the usual suspects) but the wide divergence in their weighting from one region to another. For example:

- In the Eurozone, low consumer demand is seen as a problem by 2 out of 3 respondents, but in India only 1 in 5 feel the same;

- 47% of Indian respondents see “transitions of political leadership” as problematic, but only 14% in North America;

- “Lack of access to credit” is seen as a problem by 50% in the Eurozone, but just 14% in Asia-Pacific.

But draw your own conclusions:

Now, let’s turn to the US and the looming “fiscal cliff.” With less than four days to go at press-time here it’s looking all but certain no deal will be reached. and our political incumbent protection society leadership appears to be slouching towards impasse.

I don’t know about you, but I think the fundamental premise of Congress’ imposing the potential fiscal cliff on itself was psychologically flawed. The working assumption surely was that it would be such an appalling event that no one could possibly permit it to come to pass. Now we know that was mistaken, as the powers that be in Washington, who presumably have their hands on the wheel if anyone does, appear to be aiming straight for it. What happened?

I think it was a Psychology 101 mistake: The closer an event comes to reality, the more accustomed we are to the possibility/probability it will actually occur. We know this occurs even when facing our own imminent death (given enough time to come to terms with it, at least, and to work through the stages of grief). The awful and unthinkable slowly morphs into the expected and manageable. And so here we are.

Now, how bad might it really be?

All that can be said is this is an experiment we’ve never run before, so no one really knows.

In lieu of sheer speculation—if you’re in the market for that you know where to find it—let’s close out the year with a few deeply informative charts putting large economic trends in perspective.