At year end it seems fitting to take a look at economic conditions overall, and what better source than the McKinsey Global Survey Economic Conditions Snapshot/December 2012? It’s a compilation of 1,575 responses from executives “representing the full range of regions, industries, company sizes, tenures, and functional specialties,” and is weighted by the contribution of each respondent’s nation to global GDP in order to correct for diffrent response rates.

As might be expected from such a broad sample, views span the spectrum from optimistic to pessimistic, but on the whole executives are more positive than negative, albeit with regional differences. Developed Asia, for instance, finds more people saying current conditions have deteriorated while in the traditional developed world a consensus that government isn’t doing what it can to support growth is widespread.

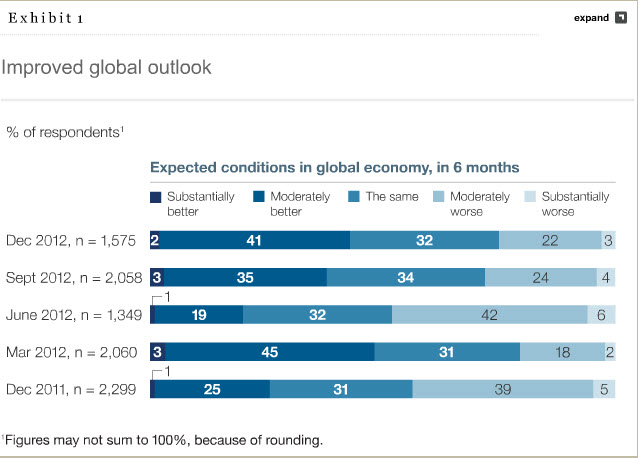

Amusingly, and in true Lake Woebegon fashion, respondents “broadly believe that demand for their companies’ products or services—as well as their companies’ profits—will increase in the next six months, despite their concern about sluggish global and domestic demand.” Nevertheless, it seems clear that pessimism is waning and optimism rising as we pull farther and farther away from the 2008 meltdown:

Turning to more specific threats or sources of unwelcome shocks, over 90% identify geopolitical risks in the Middle East and North Africa (Egypt, Libya) as worrisome while 70% (82% in the US) say US economic growth will suffer if the country goes over the fiscal cliff. More alarmingly, fewer than 1 in 5 respondents believe the US will avoid that trajectory.