The conventional wisdom has quickly coalesced around how all right-thinking folks ought to view Facebook’s IPO: It was a disaster. Some reasons for this view (NASDAQ’s humiliating meltdown, three shareholder class actions are already pending against FB) are indisputable, others (hedge fund managers and other impoverished Morgan Stanley super-insiders didn’t get their customary 10—20% instant “pop”) are dubious in the extreme, but formed the conventional wisdom has, not to be questioned: One of the most widely hyped and eagerly awaited IPOs since Google turned into a “launchpad explosion,” as one cheeky commenter labeled it.

Less remarked is another distinctive characteristic: Facebook’s dual-class stock structure. Not to be oblique: Mark Zuckerberg’s shares have way more votes than the shares offered to the public. Post-IPO he owns 18% of the company but he also has 57% of the voting shares, a/k/a total control.

The always reliable and engaging James Surowiecki, in The New Yorker, provides this brief history of dual-class share structures:

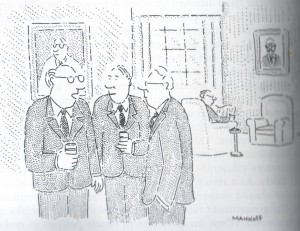

Dual-class share structures used to be rare and confined largely to family-run enterprises or media companies, such as the New York Times, where they could be justified as protecting the company’s public mission. The received wisdom was that active investors are good for companies and for the market as a whole, and that companies need to put shareholders first. But Google bucked convention when, in 2004, it adopted the dual-class structure for its I.P.O., and the arrangement has become popular among technology companies. All the big tech I.P.O.s of the past year—LinkedIn, Groupon, Yelp, Zynga—featured it, and Google’s recent stock split took things to a new level and sold shares with no voting rights at all. Whereas the C.E.O.s of most public companies have to spend time kowtowing to investors, Zuckerberg and his peers are insisting on the right to say, “Thanks for your money. Now shut up.”

In defense of the patently undemocratic, stiff-armed nature of dual share structures is the belief that today’s hair-trigger investors are obsessed with short term results and put untoward and corrosive pressure on companies accordingly (the average mutual fund portfolio turns over 100% in a year and the average hedge fund 300%).

Maybe so.

And yet few are those who would claim one of the key challenges for American capitalism is CEO’s with too little power. A benevolent—and enlightened, far-seeing, wise, and generous—despot can be a great leader, but more often don’t we seem to encounter the Rupert Murdochs of the world whose “monarchical” reign leads to trouble? Hoarding control, in short, is great in the right hands; but I leave it to you, Dear Reader, to judge the proportion of long-lived and pre-eminent institutions that have been able to count on—more, owe their success to—a consistent run of such leaders. And the only alternative involves introducing the convoluted and occasionally infuriating machinery of democracy.

Around about here you may be wondering what this has to do with law firms. One hint: It begins with “D.”

Elsewhere this week the bubbling, boiling commentariat served up What Adam Smith Knew About Inequality, courtesy of John Paul Rollert, a professor at the University of Chicago Booth School of Business, writing in Boston Review. It opens with the brilliant, lacerating, and utterly self-deprecating experience of Michael Lewis, writing near the end of Liar’s Poker, on receiving his first year-end bonus:

Together with his salary, he’s earned $90,000, more than any 26-year old he knows, more than his father at his age, and as much as any other first-year banker at the firm. Lewis is ecstatic—“Ha! I was rich”—until the carousel clicks into gear. He begins thinking about all the money he’s made for Salomon and how much more others around him are taking home. Before long his bonus seems more like a poke in the eye than a pat on the back. “By the standards of our monopoly money business, ninety grand was like being on welfare,” he says. “I felt cheated, genuinely indignant. How else could I feel?”

This of course turns the klieg lights on one of the inherent contradictions of wealth and income: It’s all relative.

It’s at least lore, if not yet established as much as such things can be as psychological fact, that no matter what they’re earning, people tend to think an additional 15—20% in income would be enough to satisfy all their needs. Until, that is, they actually achieve it, at which point an additional 15—20% is called for, etc., etc. Daniel Kahneman, and doubtless others at this point, have studied the phenomenon that a shocking percentage of people report, cold sober and in clinical surroundings, that they’d rather earn (say) $75,000/year when all around them are earning $50,000 than $150,000, surrounded by a large crowd earning $250,000.

And yes, Adam Smith figured this out a long time ago.

Smith believed that whether we are busy trading gossip or exchanging goods, we are constantly sizing up the world around us in order to guarantee our safety and improve our place. Our measurements, as such, are not made according to some universal set of standards. We are each other’s yardsticks, and we hate it when we don’t come out ahead.

This is to say that we long to get the better of inequality, no matter our present state. For Smith, this helps to explain the phenomenon—perplexing to some, enraging to others, but familiar to us all—of people who already have a lot and still desperately want more. “The homely and vulgar proverb, that the eye is larger than the belly, never was more fully verified than with regard to him,” Smith says of the wealthy landlord. “The capacity of his stomach bears no proportion to the immensity of his desires.” The eye, here, is synonymous with the imagination, which, unlike the belly, is always unbounded. This is where our dreams reside, and Smith knew that even the wildest among them has an alarming tendency to grow, especially when it is on the cusp of being satisfied.

Make no mistake: We have inextinguishable ambition largely to thank for the fact that we’re not still sitting cross-legged in caves around fires, but the key distinction that separates laudable and enlightened progress from oppression and “monarchism” is channeling our desire that we don’t merely keep up with the Joneses but that we surpass them once and for all into lawful trade and commerce and out of despotism and theft. We would err to imagine bad behavior confined to the dark alleyway or the tyrant’s court.

Self-referential advantage-seeking can, these days, be conducted in flatteringly lit airconditioned rooms by people wearing beautiful clothes and speaking in well-modulated tones—the consequences are just removed in space and time. Kind of like unmanned drone strikes vs. infantry combat.

Here’s the dilemma in brief: Competition good, envy bad.

People are an intensely competitive lot, and while Smith was not so cynical as to predict Gore Vidal’s famous quip, “Whenever a friend succeeds, a little something in me dies,” he was not so far behind. For Smith, the virtue of a thriving society is the defect of a common vice: envy. We see what others have, and we want it for ourselves.

Going back a bit further in time, there’s also this: “It is in the character of very few men to honor without envy a friend who has prospered.” (Aeschylus)

Is there a principled, but still motivating, way around this?

Well, there’s a reason the book is called The Wealth of Nations, and not The Wealth of People. Individuals in advanced societies would be well-advised not to compare themselves to their immediately adjacent betters but to people in ages past or to those less fortunate today.

In an unforgettable, if non-PC, passage near the conclusion of the first chapter of The Wealth of Nations, he writes that the complex commercial web that had evolved even back then (the 1770’s) supplies the needs of “the very meanest person” richly:

Compared, indeed, with the more extravagant luxury of the great, his accommodation must no doubt appear extremely simple and easy; and yet it may be true, perhaps, that the accommodation of an European prince does not always so much exceed that of an industrious and frugal peasant, as the accommodation of the latter exceeds that of many an African king, the absolute master of the lives and liberties of ten thousand naked savages.

Prof. Rollert elaborates:

In contemporary terms, we might say it’s better to be poor in Mississippi than rich in Mogadishu. […] Smith never contends that either the total wealth of a nation or even its median income is the last word on the moral status of economic arrangements. True, capitalism may best ensure that all people have food, shelter, and clothing, but it also exposes us to the afflictions of affluence, those, as Michael Lewis discovered, that wound our pride more than our person.

Some may argue that such distress is unworthy of being taken seriously, but “get over it” is a response more obtuse than enlightened, willfully indifferent to the role of personal pride in driving an economy and shaping our identity. We have to be honest in confronting the essential paradox of economic development, namely, that the wealthier a society becomes, the poorer many of us may end up feeling. Or, as a fellow trader replies when Lewis tells him of his own frustration, “You don’t get rich in this business. You only attain new levels of relative poverty.”

Is this phenomenon what drives irrational-in-hindsight behavior within organizations: That no matter how much B makes, if A makes what feels like substantially more, B is dissatisfied? Not to wimp out so near to the finish line, but It Depends. Few would question that Derek Jeter deserves to earn a high multiple of a Triple A Yankees farm club shortstop, but when objective statistics on performance lie less readily to hand, debate can ensue. The over-arching goal is simple to state, if devilish in details: When all is said and done, people have to admit the division of the pie was fair.

What then is to be done?

- Keep the books as open as possible without sticking anything gratuitously inflammatory in anyone’s eye;

- Ensure civility through a rigorously and unfailingly pursued tone of respect;

- Refer insofar as humanly possible to objective criteria;

- Make sure you have nothing to hide; and

- Don’t be afraid to make an occasional high-profile example of serial offenders.

The first four you need to observe continuously; the fifth only episodically. But if you take it seriously, and people know you do, the frequency with which you need to invoke it will asymptotically approach zero.

Readers here may wish also to look at the thoughts on closely related matters by Uwe Reinhart, particularly the entries for 07 July 2011 and 22 July 2011 at http://economix.blogs.nytimes.com (follow the last slash with/201.07/08 or 07/22). The first is titled “Bristol Palin and How Society Establishes Value”; the second is “Is There Hope for the Unemployed?”

Professor Reinhart also summons Adam Smith, but includes his own versons of what “value-added people” may be. You and your readers might comment on where the legal profession, as you see it, lies in the distinction he presents in the second essay between “tradable” and “Nontradable” portions of the economy, and what, if anything that means for law-firm economics

Mark

The Bristol Palin piece is here:

http://economix.blogs.nytimes.com/2011/07/08/bristol-palin-and-how-society-establishes-value/

and “Hope for the Unemployed” is here:

http://economix.blogs.nytimes.com/2011/07/22/is-there-hope-for-the-unemployed/

Prof. Reinhardt (economics department at Princeton) was one of my most favorite professors in the department when I was a lowly undergrad there, and I’ve admired his work ever since.