Imagine a firm that allocates its talent, investment, and management focus consistently every year, making incremental changes but following the same “steady as she goes” broad pattern year after year. Imagine another firm that consistently evaluates the performance of practice areas and offices over time and adjusts the allocation of lawyers and other resources based on relative market opportunities (be they expanding or shrinking).

Which would you guess is going to perform better over some suitably extended timeframe?

And which model do you think most law firms actually resemble?

Yes, and yes. That is to say, if your guesses mirror those of most folks I’ve actually asked this of—and if you’ve conducted this thought experiment with colleagues in your mind—you will guess Firm 2 exhibits superior long-term performance but that Firm 1’s investment pattern is the dominant one by far in our industry.

Not only would you be right on both counts, but McKinsey has discovered as much in Corporate Land, and reports on it in How to put your money where your strategy is.

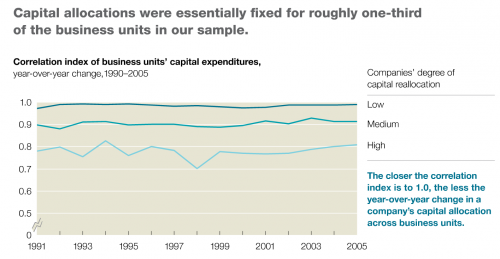

Their sample was more than 1,600 US companies over the timeframe 1990—2005. Amazingly, for fully one-third of the companies in their sample, the correlation of capital allocations from one year to the next was 0.99. 1.00, of course, would represent absolutely identical investment allocations. (They report that across the economy as a whole the year to year correlation is 0.92.)

A bit of background: Annually for the past quarter century, US capital markets have issued on average somewhere north of half a trillion dollars of corporate debt and about $85-billion of equity. Meanwhile, the amount of capital allocated or reallocated internally within large companies was approximately $640-billion per year. Here’s how the year to year correlation looks for companies in the study:

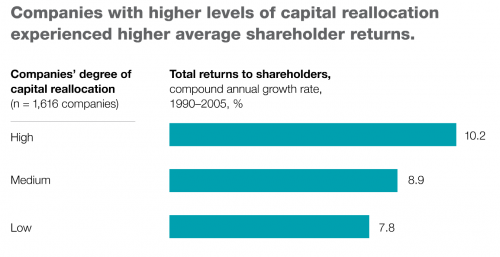

And here’s how the growth rates (CAGR of total returns to shareholders over the 15-year period 1990—2005) of those companies looks compared to their degree of capital reallocation:

McKinsey sums up the results this way:

- Companies that reallocated more resources—the top third of our sample, shifting an average of 56 percent of capital across business units over the entire 15-year period—earned, on average, 30 percent higher total returns to shareholders (TRS) annually than companies in the bottom third of the sample. This result was surprisingly consistent across all sectors of the economy. It seems that when companies disproportionately invest in value-creating businesses, they generate a mutually reinforcing cycle of growth and further investment options.

- Consistent and incremental reallocation levels diminished the variance of returns over the long term.

- A company in the top third of reallocators was, on average, 13 percent more likely to avoid acquisition or bankruptcy than low reallocators.

- Over an average six-year tenure, chief executives who reallocated less than their peers did in the first three years on the job were significantly more likely than their more active peers to be removed in years four through six.

In other words, not only did “high capital reallocators” generate superior growth and returns, they did so (a) with lower volatility and risk, including lower risk of bankruptcy or acquisition; and (b) with less managerial turnover.

This confronts us with the obvious, and I submit pressing, question: Why don’t more firms do this?

If you’re forming a straw man in your mind, you’re out of luck. The companies with high capital reallocation levels did not do so capriciously or wearing short term bifocals:

“The goal isn’t to make dramatic changes every year but to reallocate resources consistently over the medium to long term in service of a clear corporate strategy. That provides the time necessary for new investments to flourish, for established businesses to maximize their potential, and for capital from declining investments to be redeployed effectively.”

So I repeat: Why don’t more firms do this? Why, in fact, do so many firms actually undermine their strategic direction by re- and re- and re-allocating essentialy the same resources to each business unit year upon year upon underperforming year?

Reasons can range from the indefensible (they don’t think purposefully about resource allocation; they’re afraid of upsetting entrenched interests; any change whatsoever would require the dreaded partner “consensus”) to the arguably sane (every single asset is performing flat-out and any change would diminish, not enhance, results). But far more common, as McKinsey diagnoses it, is “organizational inertia with multiple causes,” centering primarily in intra-firm politics and cognitive biases. Randy Komisar, a partner in the celebrate VC firm Kleiner Perkins Caulfield & Byer, put it thus: “If corporations don’t approach rebalancing as fiduciaries for long-term corporate value, their life span will decline as creative destruction gets the better of them.”

This is where lawyers lose sight of the larger picture. “Creative destruction,” a phrase coined by the Austrian/American economist Joseph Schumpeter (1883-1950), the brilliant energizing force of capitalism, is inherent in competitive markets. It stands for the proposition that if someone discovers a better/cheaper/faster/more appealing way to do something-or provides something new altogether-the result will be the immediately perceived obsolescence and sooner-or-later “destruction” of inferior alternatives and, by extension, the firms providing those outmoded offerings.

The only thing you need to remember about creative destruction is that it has no opt-out mechanism. It’s impersonal and implacable. In this it resembles evolution; the fittest survive and as for the less fit, well, they don’t actually get a vote.

Back to why firms resist adapting and find it far more comfortable and preferable to stick to what we’ve always done or what’s familiar and comfortable. McKinsey identifies the dynamics (emphasis mine):

Within a company, last year’s budget allocation often serves as a ready, salient, and justifiable anchor during the planning process. We know this to be true in practice, and it’s been reinforced for us recently as we’ve played a business game with several groups of senior executives. The game asked participants to allocate a capital budget across a fictitious company’s businesses and provided players with identical growth and return projections for the relevant markets. Half of the group also received details of the previous year’s capital allocation. Those without last year’s capital budget all allocated resources in a range that optimized for the expected outlook in market growth and returns. The other half aligned capital far more closely with last year’s pattern, which had little to do with the potential for future returns. And this was a game where the company was fictitious and no one’s career was at risk!

In reality, anchoring is reinforced by loss aversion: losses typically hurt us at least twice as much as equivalent gains give us pleasure. That reduces the appetite for taking risks and makes it painful for managers to give up resources.

Corporate politics

A second major source of inertia is political. There’s often a tight alignment between the interests of senior executives and those of their divisions or business units, whose ability to attract capital can significantly influence the personal credibility of a leader. Indeed, because executives are competing for resources, anyone who wins less than he or she did last year is invariably seen as weak. At the extreme, leaders of business units and divisions see themselves as playing for their own “teams” rather than for the corporation as a whole, making it challenging to reallocate resources significantly. Even if a reduction in resources to their division benefits the company as a whole, ambitious leaders are unlikely to agree without a fight. As one CEO told us: “If you’re asking me to play Robin Hood, that’s not going to work.”

Sound familiar? Dispirited by now?

Actually, several approaches can help.

Know where you’re going

Obvious as this may sound, if you don’t know where you’re going and you keep doing what you’ve been doing, you’re likely to wind up in the same place. Be specific about your goals. not “expand in China,” but who’s going to be where when and what they’re going to be pursuing.

Be rigorous about evaluating alternatives. Famously, Google has quarterly reviews of each core area against the last and projected next 90 days’ performance and its strategic important. And get this: Google has no business units. Why not? They create an opportunity for corporate politics, which must be suppressed at all costs.

Use all your tools

Don’t limit yourself to talking in broad terms about where you want to allocate resources. Concentrate on each of the following, and be specific:

- seeding

- nurturing

- pruning

- harvesting

Seeding and harvesting may be the most readily understandable, and easiest to do: Entering and exiting new areas. But nurturing and pruning are harder, because they require judgments about practice areas and geographies where you have a presence and you want to build or slowly withdraw: You have to take resources from one area in order to invest them in another.

Use rules to slay the assumptive of the status quo

Larry Page at Google (yes, them again) has recently focused on pruning peripheral projects. Lee Raymond, former CEO of Exxon Mobil, required the corporate planning team to dispose of 3-5% of compay assets annually. Don’t bother doing this if you won’t do it with discipline and rigor: No special pleading, no “hardship” cases, no “this time only” exceptions.

Finally, put some processes in place to kill inertia

Such as? How about this: Periodically examine whether you would choose to invest in a practice area if you didn’t already have it. And if not? Then it’s time to talk about how to gracefully exit. Or, consider “re-anchoring,” which means evaluating practice areas by an objective measure independent of last year’s resource allocation and the (always optimistic) projections of the group’s leaders. ‘

The bottom line

This is what it comes down to: The interests of the firm may not be completely aligned with the interests of each partner.

If you profess shock, don’t bother. This is human nature, and it’s as true in Law Land as in Corporate Land.

Much of our advice for overcoming inertia within multibusiness companies assumes that a corporation’s interests are not the same as the cumulative resource demands of the underlying divisions and businesses. As they say, turkeys do not vote for Christmas. Putting in place some combination of the targets, rules, and processes proposed here may require rethinking the role and inner workings of a company’s strategic- and financial-planning teams. Although we recognize that this is not a trivial endeavor, the rewards make the effort worthwhile. A primary performance imperative for corporate-level executives should be to escape the tyranny of inertia and create more dynamic portfolios.

Are you up to it?

And if not, are you prepared to explain long-term underperformance vis-a-vis your peers?