In fact Fiorina was exactly what the board appears to have wanted: A charistmatic, visionary leader who would bring the magnetic star power and passion for change needed to revolutionize the company. By that standard, Fiorina can be judged a success, indeed, the perfect choice. The descent into Stage 4 didn’t begin with HP’s slow response to the dotcom bubble, but in how the board reacted to fallling behind.

Stage 4 begins, in other words, when organizations in a downturn look for a silver bullet to part the clouds. It could be any number of things:

- Betting big on an unproven technology;

- Doing the same with an untested strategy;

- A splashy new product or service offering;

- The always-popular “game changing” acquisition;

- An image makeover;

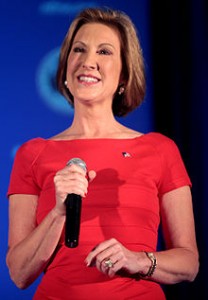

- A savior CEO;

- Or of course, as the endgame approaches, a financial rescue or acquisition.

Collins is merciful enough to outline some of the warning signs, and their counterparts:

| Markers of Stage 4 | Ways to reverse the spiral |

|---|---|

| Pin hopes on the unproven with much hype and fanfare | Formulate strategy based on empirical evidence and analysis |

| Go for the game changing acquisition | Recognize that combining two struggling firms won’t create one great one |

| React in panicky, desperate fashion | Do your research, think hard, and then and only then act-or not |

| Embark on radical change and transformation firmwide, abandoning core strengths | Be clear about what’s core, building on what’s proven |

| Proselytize about a brighter future to make up for poor results | Focus on performance; tangible results will clarify which direction to head in |

| Keep people confused by embarking on continuous restructuring or at the least, make big decisions inconsistently | Create positive momentum through sound choices executed with ongoing rigor; try to make them build on each other |

| Seek the leader as savior | Seek a leader as disciplined and steady performer |

You might start to wonder why companies in drastic decline shouldn’t attempt drastic solutions? Collins’s rebuttal is that engaging in desperate behavior worsens the firm’s prospects. Take another look at the table above: I don’t believe any choices from the left column or the right are foreordained, and firms at the start of Stage 4 can, through the choices they make, help determine whether they truly descend into a vortex or pull out and recover.

Yes, history and circumstances have consequences. So too does individual choice.

|

|

|---|

Although it probably is neither wise nor good to stretch an analogy between business and warfare, a wise (and good) NCO once tried to teach us that, when the crisis comes, we do not often rise to our expectations, but rather fall to our training. And so we trained.

Which reads quite a bit as does Column 2.