Not long ago, in their Soho offices, I had a chance to sit down with Mark Harris, CEO and Founder of Axiom, and a JD/BA grad of the University of Texas and former Ninth Circuit clerk and Davis Polk associate.

To say that Mark has “views” on the state of the legal industry today would be to call Hank Aaron an OK batter. Mark has spent the last 10-12 years quite evidently thinking hard, and continuously, about where we are and where we may be going, and is having no small hand in influencing that future.

I started by asking him how he would describe what we’re going through today? To paraphrase: “It’s a very unusual time in the market, but so few lawyers grasp the depth of what that means.” This echoes his basic founding premise for Axiom: Both clients and lawyers were frustrated—palpably so at the value disconnect. But, and this is the first of several “I wish I’d said that” insights, “neither party thought they were getting away with anything.” Lawyers in firms felt under extreme pressure, overworked, under-appreciated, and clients felt they were paying through the nose for advice of marginal value delivered by people who didn’t really understand their business.

He follows with an observation about markets in general: If one party to an exchange is satisfied and one is miserable, somebody struck a terrific bargain. But if both parties are miserable, the exchange needs to be reconceived from the ground up. The law firm/client relationship was, he felt, firmly in the latter camp. (This may have been confirmed by his realization that while at Davis Polk he once billed out the entire cost to the firm of his annual salary in a single month.)

Try this thought experiment: Imagine putting a law firm in a wind-tunnel, where engineers examine its design for every element that creates unnecessary drag and friction. Now, you are those engineers. Start eliminating drag.

To do so, look at the major components of expense in a typical firm:

- People, that is to say lawyers and paralegals, who actually do the work;

- Real estate, including reception areas in Class AAA space around the world suitable for half-court pickup games; and

- The Pyramid, which siphons extraordinary sums of money to fund the partners’ annual profit pool.

Start taking out unnecessary expense, just as Strunk & White would advise you take out unnecessary words; only in this case it’s not stylistic advice, it’s bedrock substance.

As founder of Adam Smith, Esq., and now of JD Match, I have a soft spot in my heart and an insatiably curious and analytic lobe in my head for entrepreneurs, so I couldn’t resist asking Mark how the early days of Axiom were, immediately after leaving Davis Polk: “It was hard. We had no network, no referenceable clients. I’ll never forget the GC of one Fortune 50 company opening our meeting by saying, ‘Who the h*** are you and how did you get on my calendar?'” (I will readily admit I’ve never had such a harsh start to a meeting, and I’m happy to cede that title to Mark in perpetuity.) But eventually, “the phone started to ring,” and soon after Axiom’s revenue had doubled year over year.

Today? It’s on track to be 100 times what it was 10 years ago. (Mark didn’t say that exactly but I can.) Another relevant number: Axiom has over 900 employees at this point, most of them lawyers, which would put them somewhere in the 40’s in the NLJ 250.

How did Axiom navigate the post-Lehman meltdown? One can imagine it could either freeze incumbent market relationships in place, or open new doors.

Answer B: For the first time, corporate America across the board embraced real willingness to look at innovative approaches, and Axiom came into its own in a second phase that continues today.

The American Lawyer ran a feature story on Axiom a couple of weeks ago (“Disruptive Innovation”), which you may have seen, but my own view after reading it was that it prompted more questions than it supplied answers, particularly in laying out odd contrasts between such observations as:

- 2011 revenues increased 62% over the prior year; and

- Axiom’s newest division grew 300+% in the past year; but

- “For much of its 12-year history, [Axiom] has been little more than a long-term legal temp placement agency.”

I asked Mark about the temp tag, pointedly, and he shared some thoughts on that “obvious mischaracterization,” which we’ll get to momentarily. More broadly, however, I wondered whether “labor market arbitrage” was, in general, an intrinsically interesting business model:

“If you think about it, everything the legal industry has done to date, in terms of innovation, has been labor market arbitrage, including the first phase of Axiom! It all started with Ben Heinemann [the legendary General Electric GC], who took essentially the same caliber of people toiling away in law firms, and put them inhouse doing pretty much the same thing, but at drastically reduced expense—to the point where 20 to 30 years later some of the largest ‘firms’ in the world are captive inhouse departments.

“Or think about moving people from places like Sixth Avenue in Manhattan or California Street in San Francisco to the Sunbelt or the Rust Belt; you enjoy a one-time, cost-of-living-driven, savings, but it’s incremental, not continuous, and not fundamentally transformative. It’s not a model change; it’s an approach that fails to address how the work gets done—instead, you’re just doing the same thing with people who cost less, pure and simple.”

I noted that the global march of the outsourcing phenomenon suggested that on some level it had to be an attractive business model—or else so many firms across so many industries wouldn’t be pursuing it—and Mark readily agreed: “Our insourcing business itself actually can and will be a very big business.”

A digression on terminology: Axiom calls it “insourcing” on purpose, to distinguish it from “outsourcing,” because its preference where possible is that Axiom lawyers working for clients do so on-site from the clients’ offices—what Brits originally, and now everyone, might think of as “secondments.”

Sticking with terminology for a moment, what Axiom calls “outsourcing” is when clients want to engage with Axiom for complete soup-to-nuts management and delivery of complex processes such as review and oversight of all commercial contracts, derivatives agreements, or patent procurement. For these engagements, Axiom lawyers and managers work offsite from the client’s premises in Axiom centers.

Insourcing and outsourcing are two of Axiom’s service offerings; the third is Managed Services, or what we might think of as highly complex projects. We’ll get to Managed Services—the newest and most intriguing part of the business—anon. But back to insourcing:

“Currently we have 11 insourcing offices, 9 of them up and running and two in launch, and we could actually go into many many more markets; it’s very capital-efficient. But we’d rather go deep in the markets we’re already in, with clients we can do more for. As exciting as geographic expansion can be, we’re not going to transform the industry simply by collecting more addresses.”

This implies Axiom’s goal is precisely to “transform the industry.” Indeed: Its “reason for being” had always been to change the way clients and attorneys work together, then the evolutionary milestones are:

- Doing more complex work, but in somewhat traditional ways, followed by

- Moving into more complex delivery of work—with more people, more moving parts, more areas of functional expertise beyond the merely legal.

Mark puts it this way: “Phase 1 was the client’s problem and the client’s solution, but using Axiom resources. Phase 2 is the client’s problem but with Axiom’s solution and Axiom’s resources. When Axiom owns the solution, then we lead the solutions design, working with our clients to apply process innovation, technology, and tools to improve both risk mitigation and cost. Throughout, the intent is for Axiom to assume the burden of creating efficiencies, because we have the benefit of scale and the ability to apply best practices codified across experience with multiple client engagements.”

If you’re serious about this—and Mark is as thoughtful, disciplined, and determined as I’ve found—you have to analyze in a deep and unconventional way what pieces of each matter can be segmented into being handled by different levels of talent: Talent from the paralegals in India to full-time US paralegals to junior associates, all the way up to the equivalents of senior client relationship partners.

This is the exciting and growing new part of Axiom which goes by the name “Managed Services.” Don’t let the somewhat MBA-speak name distract you; this is the fast-growing portion of the company. But bringing to bear technology, business analysis, solutions design, and top legal talent, and then delivering that across multiple centers and time-zones is no easy task.

Which brings our conversation to the topic of talent. Axiom has assembled and is continuing to build a team of top executive talent in business process analysis and technology, coming with pedigrees such as partners from McKinsey and Boston Consulting Group, heads of strategy and operating executives at place like Amex and Accenture. Others throughout the ranks come with similar qualifications and credentials.

I ask Mark, “Where does this talent come from? Why do they go to Axiom?”

He becomes more animated than ever:

“As a design principle, Axiom has always worshiped talent; this is the most important thing to us. We love having really smart, challenging, passionate people around; we’ve always swooned for really smart people and have always hired for that.

“Paul Carr, our COO, is a good example. He was only 39 when he joined us four years ago, but before Axiom he’d risen through the ranks at BCG, served as a Partner there, then moved to American Express where he worked for Ken Chenault as his Global Head of Strategy and then went on to run a division of Amex. Paul’s operational, he’s strategic, and he’s a great people manager, but it just starts with him. I’m humbled by the depth and intensity of talent inside Axiom.

“If you’re engaged in category creation, no matter how much talent you have you always feel constrained and stretched at the same time. So we’re always on the lookout for extraordinary talent. If we come across somebody who’s at the intersection of things that can make a difference at Axiom, we will find a place for them, whether a position is open or not.”

Is it working?

“Somehow in the past few years we’ve just found ourselves in a purple patch in terms of recruiting.”

(Parenthetically, is your firm’s C-suite equally well-qualified? No? And precisely why not?)

Mark describes the heart of the problem this way: “Clients go to law firms because they believe law firms can handle matters that are too complicated for them to manage inhouse. But the problem is that law firms aren’t actually oriented towards managing the effective delivery of complex processes.”

And there’s another problem: Lawyers (in firms and in-house) instinctively believe that “reducing costs equates to reducing quality and/or increasing risk; we take a multidisciplinary view so don’t always see it that way.”

Finally, I ask about the drumbeat surrounding alternative fees, project fees, caps, collars, etc. “Won’t this keep clients with their traditional law firms for a long time?”

Mark: “We absolutely encourage clients to do that; all of that. They should negotiate discounts, project fees, blended rates, whatever they like. But at best they’ll be getting 5-15% off rates that are going to keep going up. We propose a different model.”

To wit?

“We believe the demand for ‘law’ can be grouped in three pyramidal slices, from ‘exceptional events’ at the top, where you’re willing to pay, say, $400-$1,000/hour to ‘experience required’ in the middle, at something like $175-350/hour, to ‘efficiency required’ at the bottom, at rates of $25-$100/hour.

“If we can migrate some work down from one tier to the next lower one, that would achieve savings more on the order of 40-50%, and you’ve permanently changed the cost structure as well; it’s not a one-time discount or special deal that you’re going to have to renegotiate with every new matter.”

But firms all will tell you they’re called on for the high-end, price-insensitive work, I observe. “They do all say that, and some of them belong up there, will always be up there, and provide services very few organizations in the world can provide.” My worry, I tell Mark, is about the firms who don’t belong up there. I fear there are also a lot of wannabe’s who need to realize who they really before the market has to show them. (But that’s a topic for another day and a different column.) In any event, Mark believes that “so much of the work that goes to so many law firms can be done a better way.”

Paul Carr puts it this way:

“There is a lot of legal work which is semi repetitive, where if you apply a process lens, technology tools, and work flow management [to it], you can deliver much better performance.”

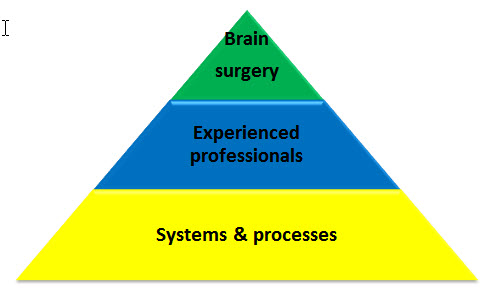

If you’re at all like me, you’ve heard many people talk about slicing our industry into roughly three segments of the conceptual value pyramid, with the truly bespoke engagements at the top—which every self-respecting law firm claims to be pursuing, as Mark notes—with a foundation of commodity work at the bottom and an interim segment of regular, evergreen work that every worthwhile client needs done capably, intelligently, and efficiently. The universal assumption is:

- Our firm wants to focus, almost exclusively, on the high-end bet-the-company work. That’s why we went to law school and work where we do.

- We’ll do some of the stuff in the middle if valued clients insist but it’s fundamentally not interesting and not what we want to be known for.

- The commodity garbage work at the base? Bottom feeders are welcome to it.

Because our embedded mental image of pyramids is, well, pyramidal, we almost unconsciously assume the middle segment is smaller than the commodity base:

I don’t think this portrays the world as it is.

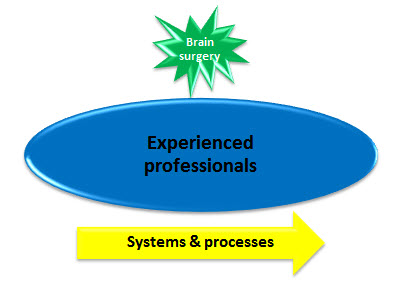

More accurate would be something like this, where the size of the segments reflects revenue.

In order to position itself to attack this middle segment, Axiom does many things other sophisticated professional services firms do and does not do many things that “temp” or “staffing agency” firms do.

- They do no work whatsoever for law firms.

- They treat their lawyers as the valued and carefully curated professionals they are—not as cogs. They expressly try to screen out lawyers who might see Axiom as a transitional way-station.

- They treat their lawyers as important professionals in other ways, as well. For example:

- Aside from a full suite of benefits, they pay for bar dues, memberships in PLI and PLC, Westlaw, conference attendance, “Axiom University” webinars, etc.; and

- They engage in one-on-one 360 performance reviews annually.

In order to gauge the caliber and complexity of work Axiom lawyers undertake, I asked for a list of examples of recent engagements, and here’s what I got back:

“M&A, joint ventures, technology licensing, patent process re-engineering, compliance overhauls, ’40 Act counseling, hedge fund advisory and formation work, enterprise sales transactions, channel distribution deals, managing giant class actions, and regulatory response work.”

Judge for yourself.

So this is how Axiom—and they’re far from alone—envisions the market: As they and a few sophisticated players in LPO Land move upmarket, many law firms that aspired to and/or established a toehold in the “exceptional events” arena are going to come face to face with reality and discover that’s not their territory after all.

The question remains: Whose vision is correct?

Ultimately, the market will cast the only vote that counts, and it will do so blindfolded, as it were, to the consequences for incumbents and aspirants alike.

The verdict is of course still out on all this, but permit me to predict one asymmetry between the way law firms will tend to respond to this profile of Mark and of Axiom as opposed to how Mark and Axiom are responding to law firms: Firms (not all, but the vast majority) will point out that their model has worked brilliantly for a century and will be comfortable dismissing the threat; analysis will stop right there.

By contrast, Mark, and many others, have built Axiom by thinking long and hard about the legal marketplace. Their analysis and reaction has no end; it is continuous—and realistic.

Perhaps there’s an analogy to be found in what Peter Mullen, whose death came last year, accomplished as the great builder (with Joe Flom) of Skadden. Here’s what the Times had to say in its obit:

Under Mr. Mullen, who died at 83 in New Preston, Conn., Skadden Arps spotted the potential of mergers and acquisitions early on and then captured that business when New York’s more genteel corporate law firms were mostly shunning it.

The white-shoe firms “said that takeovers were a one-time blip,” recalled John C. Coffee Jr., a law professor at Columbia, who in the mid-1970s practiced at one of those firms, Cravath, Swaine & Moore. “They said that Skadden was riding a short-term wave, and that it would be caught in a terrible crunch when it crashed and disappeared.”

They misjudged. Advising on corporate takeovers proved to be a lasting and highly profitable business, attracting big corporate clients instead of scaring them off. Mr. Mullen and his colleagues plowed the earnings into Skadden Arps’s expansion and diversification into other areas of the law.

One was looking at the market as it was; and others were looking at the market as they wished it to be.