“Follow the money?”

Well, we can try.

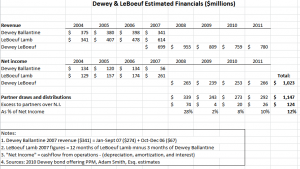

Using a combination of now-public material—the 2010 bond offering PPM being a godsend in that regard—and my own carefully constructed estimates based on other published reports including interviews with people in a position to know, I have done my level best to reconstruct the:

- Revenue

- Net Income, and

- Partner draws and distributions

of Dewey & LeBoeuf.

Here’s what I’ve come up with.

Permit me to reproduce the “Notes” here verbatim in case they’re difficult to read above:

Notes:

1. Dewey Ballantine 2007 revenue ($341) = Jan-Sept 07 ($274) + Oct-Dec 06 ($67)

2. LeBoeuf Lamb 2007 figures = 12 months of LeBoeuf Lamb minus 3 months of Dewey Ballantine

3. “Net Income” = cash provided by operating activities

4. Sources: 2010 Dewey bond offering PPM, Adam Smith, Esq. estimates

To me, this tells several stories:

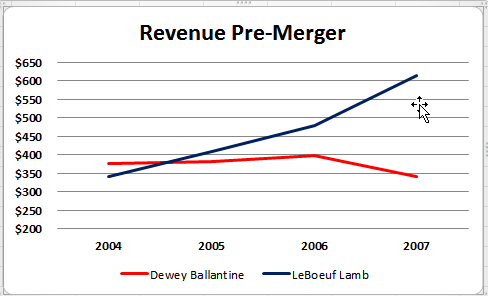

- Legacy Dewey Ballantine’s performance from 2004—2007, boom years by all accounts, was (to be charitable) flat:

- Revenue went from $375-million (2004) to $341-million (2007), or down 9.1%

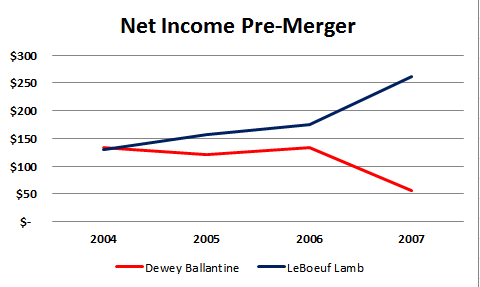

- Net income dropped even more drastically, from $134M to $56M, or down 58.2%

- Legacy LeBoeuf Lamb’s performance during those same years was little short of spectacular:

- Revenue rose from $341-million (2004) to $614-million (2007), or 80.1%

- Net income went up even faster in percentage terms, from $129M to $261M, or up 102.3%

Here we see it in graphical form. First, revenue:

Next, net income:

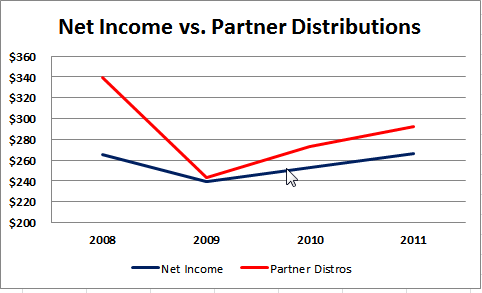

Finally, let me draw your attention to what may be the core financial issue: The fact that the post-merger Dewey & LeBoeuf was, for four years, paying out more in partner draws and distributions than its net income. The figures appear at the bottom of the spreadsheet displayed above, but here it is in graphical, and dare I say quite vivid, format:

If I could add a comment or observation more shocking than the story told by that simple graph, I would—but that’s an impossibility. For four years running since the merger, the firm has consistently and without fail paid out more to partners than it earned—and significantly more. You almost have to admire the audacity.

For the record, as I calculate the amounts, the firm earned about $1.157-billion in net income over those four years but paid out $124-million more than that, or 12%, to partners.

Where did the money come from? An enormous clue lies in the firm’s reported book equity, which dropped 32% between 2007 and 2008 from $173-million to $117-million, and fell another 17% from 2008 to 2009, $117-million down to $97-million. I understand this number was barely above $30-million by year-end 2011.

“Follow the money”?

I always worried that was a bit too glib as a catch-phrase—better suited to screenwriters than hard cold reality—but lo these many years after Watergate, it may yet contain wisdom.

Nice buildup and cliffhangers so far. May us readers guess the plot turn, i.e. payload of the next article?

My half dime goes on capita selecta from US bankruptcy law. In my jurisdiction scenario’s such as this leave a receiver with no choice but to reverse payments (as legal acts) – leaving the original recipient only with a burden of proof of his/her acting in good faith instead of the apparent callous or at least negligent lack of care/respect for the firm’s interests.

Bruce: Thanks for this post, one that many of us have been waiting to read. The PPM is a goldmine and, predictably, you have struck a rich vein right off the bat. Your additional sources extending the analysis into 2010 and 2011 are particularly valuable. I offer one extension and a couple quibbles that soften slightly your point but don’t change the ultimate conclusion.

The extension is to look at Book Equity as reported in Exhibits 1.9-1.11 of the PPM. That look provides the comment that you declined to make after comparing net income vs partner distributions. You will see that book equity for the combined firm fell 32% between 2007 and 2008 from $173 million to $117 million, and then fell another 17% between 2008 and 2009 from $117 million to $97 million. Follow the money?

The major quibbles relate to your “net income” line. What it appears you did was subtract “interest expense” from “cash flow” as reported in the PPM. Doesn’t that give you net cash flow rather than net income? Why don’t you use reported “net income” from the PPM (which is operating cash flow less depreciation and amortization)? Also, for LeBoeuf in 2007, you need to back out 25% of Dewey’s stated 2007 net income, as you did for revenue. That would get you to $264 million on your approach, $261 million on mine.

The minor quibble is that reported draws and distirbutions in 2009 were $243 million, not $253 million. See Exhibit 6.5.

Looking forward to additonal posts as you dig further.

Peter: I incorporated most of your suggestions; thanks.

My question is how well known or realized was this fact (distributions more than income)? Was it on their minds constantly or just lost in the mix? Should other partnerships learn that this should never be done and is a dangerous practice? Senior partners may feel they should be entitled to “cash out” some from parnership reserves after years of contribution.

It seems as if the culture/policy shift at Dewey to reward high paid partners with guaranteed payments happenend in 2007 What happened at Dewey to cause that shift?

I’m not a psychiatrist so I’m not qualified to say. Chronologically, however, it coincides with the immediate aftermath of the collapsed merger negotiations with Orrick. Correlation or causation? Who knows?

From an email I received this morning:

Having been a partner at Dewey for more than 4 years, I consider this experience a real “failure” and it has been a loss for the majority of the partners.

This under all the possible angles:

> no partnership culture

> no information shared among partners

> full powers on the hands of very few people (in my country, the local managing partner had full and exclusive control) and then we discover that they were completely conflicted!

> dramatic drop of income

> now the bankruptcy

I was shocked hearing that diCarmine and Sanders were paid over 2 million each: this is outrageous I believe

The funny thing is that my MP was commenting that “this is an outstanding management: we will do big things under their directorship!” and when people commented that it doesn’t seem a good thing to issue a bond, we were treated as the poor conservative guys from the countryside …

I hope that the bankruptcy will deserve to the management hard time as they brought hard time to many partners over the last 3 years

Let’s see how the matter will evolve and congratulations for your comments

i

Interesting numbers. What’s more interesting is that it is the case of the merger between Dewey Ballantine and LeBoeuf Lamb. I’ve never read the specifics until now. Gave me a clearer picture of what really happened.