Two of the Big Three Annual Reports on the state of Law Land are now out and it’s time for a survey of the horizon and some perspective. (The Big Three are the Altman-Weil “Law Firms in Transition” report [not yet released], the Citi/Hildebrandt annual client advisory, and the Thomson-Reuters/Georgetown “Report on the State of the Legal Market.”)

Methodological note: Each report covers its own quasi-proprietary universe of law firms, and no specific firms are identified. So although you can surmise, and I do, that there’s some meaningful Venn diagram overlap among the three reports in the sample sets, no one knows how extensive it might be. (And none of the three is coterminous with the AmLaw 100 or 200, for the record.)

Citi first: As we’ve written in the past, to our taste this report can stray a bit into cheerleading, or at least glass-three-quarters-full mode, but this year’s edition seems more balanced, if only because some of the underlying data is actually strong, taken at face value:

- Revenue up by 6.3% during the first nine months of 2018;

- Billing rates up 4.3%

- Demand growth +2.5%

Many of these figures are the strongest the industry has seen since the Great Meltdown.

On the other hand, as Citi almost immediately adds, dispersion among firms’ results continues to grow. They (as Thomson Reuters) employ the familiar AmLaw rankings as a segmentation/categorization tool, and describe the dispersion in terms of bigger vs. smaller: Specifically,

For several years, we have seen the lion’s share of Am Law 200 revenue and profit growth concentrated among the Am Law 50 firms—largely at the expense of the Am Law Second Hundred. This trend of the market favoring the Am Law 50 was particularly pronounced during 2018. Overall, average demand across the Am Law 50 rose by 3.3 percent during the first nine months of 2018—a noticeably higher rate than any of their smaller peers. In fact, 76 percent of Am Law 50 firms recorded some level of demand growth during the first nine months of 2018. By contrast, the Am Law Second Hundred saw a demand decline of 0.2 percent during this same period.

Familiar as AmLaw sizing is, we think for purposes of market segmentation it has long since outlived its usefulness and that “categories” such as AmLaw 1-25/50/100/200 have become devoid of descriptive or analytic validity.

Nevertheless, here’s their nifty chart showing the growth/shrinkage in revenue among the AmLaw 1-50, 51-100, and Second Hundred:

You can see that almost exactly three-quarters of AmLaw 1-50 firms saw revenue growth, whereas fewer than half of Second Hundred firms were so lucky, and the percentage of the latter group seeing revenue drop >5% was more than three times the experience of the first group.

In short, demand for law firm services may be growing again in real, inflation-adjusted dollars for the first time in nearly a decade, but which firms are getting their slice of that larger pie is more up for grabs than ever.

Other distant early warning signs of headwinds are in the Citi report. A few:

- Equity partner headcount continues its nearly decade long decline, down 0.3%. This may be a way to juice PPP, but it’s no way to build a sustainable future for firms in an industry whose primary service-for-sale consists of human talent.

- More laterals now ascend to the equity than homegrown promotions from within, which you can read as an insult to morale, yet more grease applied to the pole of smooth succession planning, or an increasingly desperate, zero-sum, race among firms to buy or rent revenue (take your pick).

- Speaking of succession planning, Citi projects that 61% of partners will be at or nearing retirement in eight years. I suppose you could view this as an unprecedented opportunity to promote from within, but we just saw those jaw-dropping lateral statistics, and have you asked a random group of associates lately how many aspire to the equity?

On a wholly different note, which speaks to the durability of some firms’ businesses, Citi presents a fascinating sidebar/box on “Price Elasticity of Demand” (yes, they actually call it that), which attempts to wrestle with the question of whether firms’ apparently uncontrollable urge to raise rates is self-defeating in the face of price-sensitive clients, or whether it might actually have hidden power to support and grow revenue.

The answer, as is increasingly the case in Law Land, is “Who wants to know?”

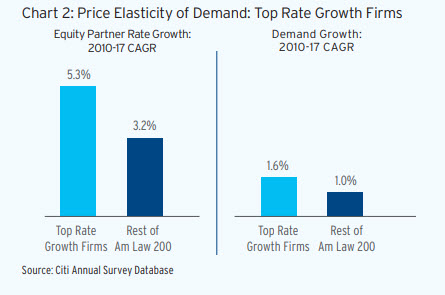

In other words, does your firm have pricing power or not? Most firms don’t, but a few do. To separate these two cohorts, Citi did an ingenious retrospective analysis. Looking at 2010—2017, they created one group of “top rate growth” firms—those in the top quartile during that time for increasing equity partner rates.

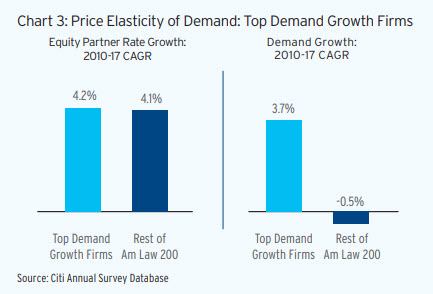

The second group was the “top demand growth” firms, and was the top quartile on that metric during the same timeframe.

Here are the results for the “rate growth” set:

And for the “demand growth” crowd:

In other words:

- The “rate growth” group outpaced everyone else by over two percentage points/year over the entire seven year period and still grew demand faster than everyone else; clients were evidently not buying from these firms based on price.

- Meanwhile, the “demand growth” crowd beat the daylights out of everyone else in, what, demand (up over 4 percentage points/year for the entire period) while essentially meeting the market dead on in terms of rate growth. They were not “buying” market share with discounts.

In Citi’s apt summary of these findings (emphasis mine):

In our view, brand strength and product focus are among the most highly rewarded traits of a law firm in today’s market. In recent years, much of the demand growth has come from high value work—work that is typically undertaken by firms who enjoy a strong brand, and can command high rates. Firms who have established themselves as the go-to practice in a market—whether that be by industry, practice or region—have been able to increase demand for their services while also charging higher rates.

Next we’ll publish our analysis of the Thomson-Reuters report.