The industry standard in tracking law firm mergers, Altman Weil’s Mergerline, has had this to say about activity in the wake of the Global Financial Reset (emphasis mine):

- 2011: “There were 60 law firm mergers and acquisitions announced in the United States in 2011. The annual total was up 54% from 2010 and at the highest level since 2008. … “The momentum for law firm mergers built throughout 2011 and the year ended very strongly,” said Altman Weil principal Ward Bower. “We think the trend toward larger deals will continue and the pace of mergers could accelerate in 2012.”

- 2012: “After a year largely characterized by small strategic acquisitions, the fourth quarter of 2012 saw four large, international law firm combinations announced. … “There were 19 new law firm combinations announced in the fourth quarter, including the four major cross-border deals” said Altman Weil principal Ward Bower. “We’ve now seen nine straight quarters of steady deal-making since the legal industry shook off the worst effects of the recession.”

- 2013: “There were 88 law firm mergers and acquisitions announced in the United States in 2013. The total is up 47% from 2012, and is the highest number of law firm combinations recorded in the seven years that Altman Weil MergerLine has been compiling data.”

- 2014: “There were 82 law firm combinations announced in the United States in 2014. Although down 7% from last year’s record-setting mark of 88, this is the second highest annual total recorded in the eight years MergerLine has been compiling data.”

- Q1 of 2015: There were 29 law firm mergers and acquisitions announced in the United States in the first quarter of 2015. [This is an annualized pace of 116 mergers, which would be a 32% increase over the all-time record—Bruce.] The quarter’s announcements included the largest-ever law firm combination.”

Let’s look at this through the eyes of Wall Street, shall we?

Understandably, your reaction might be, “Bull rampage! What a strong market!”

Not so fast. Let us turn to the redoubtable Andrew Ross Sorkin, founder of the New York Times’ “DealBook” column, who wrote the other day in Mergers Might not Signal Optimism:

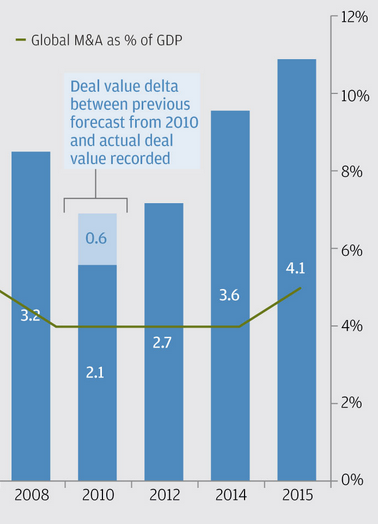

A boom in mergers and acquisitions usually signals confidence in the economy, and recent headline-grabbing deals evoke images of chief executives and directors cheering about their business prospects and overall growth.

So far this year, deal-making activity in the United States has topped $775.8 billion, up nearly 50 percent compared with figures in the period last year, just behind deal volume in 2007, according to Thomson Reuters. A steady parade of multibillion-dollar deals have been announced…

But in contrast to previous merger booms, this recent spate of deals shouldn’t necessarily be considered a barometer of a healthy economy. If anything, it might be an indicator of the troubles that lie beneath …. In many cases, companies are pursuing takeovers not because they are excited about a growing economy, but because their own growth prospects have waned.

The numbers tell the story: Revenue growth at United States companies has declined every year for the last five years, to about 5 percent now from 11.2 percent in 2010, according to a report by Citigroup. The bank put the problem bluntly: “Many companies will therefore require a source of inorganic growth to meet analyst revenue projections.”

If you can’t build it, then maybe you can buy it.

There’s more.

He observes that given this revenue-constrained environment, the best—in some cases the only—way to grow profits has been to cut costs. As he puts it, “synergy” is now back, only it’s called “savings.”

There’s another way to look at mergers acquisitions: Those that are driven by “financial” buyers vs. those that are driven by “strategic” buyers.

As you might surmise, analysts (and markets) rightly take a dim view of financial-engineering driven buyers. They’re generally in it to cut costs, consolidate operations, eliminate overlaps and duplicative activities, real estate, and people, and try to generate economies of scale. (We’ve often pointed out that there are no “economies of scale” in the classic, hard-core microeconomic sense, in Law Land, although we would be the first to observe that there can be real advantages to scale.) Once the costs and redundancies are wrung out, what’s next? You can’t cut your way to ever-increasing profitability, as they say.

Financial buyers tend to be of two kinds: First are the pure investors, who are (not to be oblique about it) pools of money looking for places to deploy it—hedge funds, private equity, turnaround shops—and they can require the existing and/or new management of the target to dance to exceedingly tight and unforgiving metrics. R&D and capital investment are usually the first to go, and then it’s advertising, talent recruitment, employee perks and benefits, pensions and 401k matches, and so it goes.

The second type of financial buyers are operating companies in the same sector/vertical as the target with cash on their hands or a rich stock price. The point is that operating companies who go looking for acquisitions without a driving strategic purpose are usually looking for the “inorganic” growth Citigroup cited in the Dealbook column. 2 + 2 = 4, assuming you can keep the combined firms intact after the deal.

Strategic buyers are cut of different cloth. They don’t start with cash burning a hole in their pocket (although they may be cash-rich); they start by asking what gaps in their capabilities an acquisition could address. Not “what’s in it for our balance sheet?” but “what’s in it for our customers?”

Accordingly, they tend:

- to understand the acquired business more thoroughly;

- to have a much longer-term perspective on the combination;

- to be willing to invest and reinvest after the initial purchase/combination; and

- to devote top-notch talent to making the integration take hold and work.

Now, three guesses as to which type of buyer tends to have greater long-run success.

Bringing us back to Law Land.

If you’re thinking of merging with another firm because lately (a) revenue growth has been anemic, and/or (b) your only tool for driving profits seems to be cutting costs, or (c)—bonus points for this one—it makes the partners think management is busy and doing stuff!, then be prepared for 2 + 2 < 4. (Witness the ranks of McKenna partners decamping from Dentons practically before the ink is dry.)

But if you’re focused on what key capabilities your clients need from your firm that you can’t provide, or can’t provide at the level you’d like, and you see a potential partner that would supply those capabilities like a key in a lock, then and only then can you claim to be strategically motivated.

Of course, keeping the Good Firm Ship afloat for another few years is a worthy cause in itself.

Just don’t confuse it with having a plan.

Bruce,

Understandably, your focus is on the firm that is considering the acquisition, their motivations and considerations. It would be interesting to have some exploration of the view-points that might be important for the firm that is being acquired.

Mark

Mark:

Aaaah, yes, the “other side” of the market! (Markets always have two sides, at a minimum.) Let me mention the two extreme ends of the spectrum, from the perspective of the acquiree, as it were: